Crown Castle Stock: Telecom Infrastructure REIT Yields 6.2%

Contrarian Income Investors: Take Note of CCI Stock

The U.S. is in the process of rapidly building up its advanced communications infrastructure, especially since there’s high demand for 5G technology. Cell towers and the associated infrastructure are expensive to construct, but they’re needed for the country to stand above the global competition.

A leading player in the communications infrastructure space is Crown Castle Inc (NYSE:CCI), a real estate investment trust (REIT) with a market valuation of about $45.0 billion.

The company’s real estate portfolio comprises more than 40,000 cell towers, about 90,000 route miles of fiber, and about 115,000 small cells. Crown Castle says it has offices in every major U.S. market. (Source: “About Us,” Crown Castle Inc, last accessed May 16, 2024.)

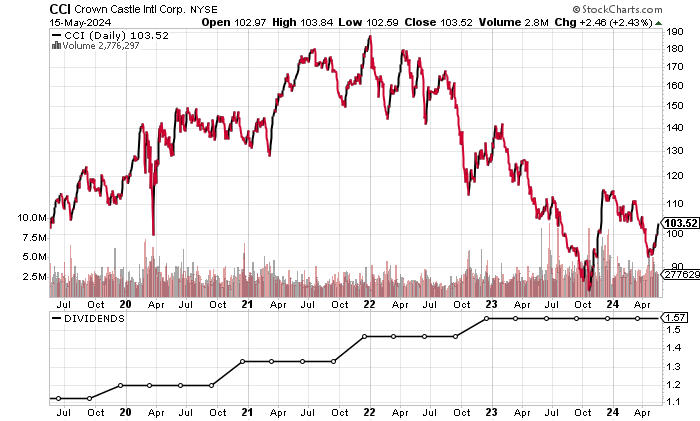

It might be an opportune time for investors to look at Crown Castle stock, given that it’s more than 50% below its peak price of $209.87 in December 2021. Trading at $103.52 on May 15, CCI stock’s 50-day moving average (MA) is $100.99 and its 200-day MA is $102.94.

If the stock’s 50-day MA moves above its 200-day MA, a bullish golden cross pattern could emerge on its chart.

Chart courtesy of StockCharts.com

Crown Castle Inc Reports Profitability & Rising Free Cash Flow

Crown Castle grew its revenues for four consecutive years, from $5.76 billion in 2019 to a record high of $6.99 billion in 2022, prior to experiencing a small contraction in 2023. That was the REIT’s first revenue drop in 10 years.

Analysts expect the company’s revenue contractions to continue. They estimate that Crown Castle will report a 5.5% decline in revenues to $6.6 billion in 2024, followed by a decline of 0.8% to $6.55 billion in 2025. (Source: “Crown Castle Inc (CCI),” Yahoo! Finance, last accessed May 16, 2024.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $5.76 | N/A |

| 2020 | $5.84 | 1.3% |

| 2021 | $6.34 | 8.6% |

| 2022 | $6.99 | 10.2% |

| 2023 | $6.98 | -0.1% |

(Source: “Crown Castle Inc.” MarketWatch, last accessed May 16, 2024.)

Crown Castle has consistently generated gross margins around the 60%–70% range, including a record-high 71.6% in 2023.

| Fiscal Year | Gross Margins |

| 2019 | 65.5% |

| 2020 | 66.6% |

| 2021 | 68.6% |

| 2022 | 70.4% |

| 2023 | 71.6% |

On the bottom line, Crown Castle Inc has never lost money. The REIT has consistently reported generally accepted accounting principles (GAAP) profitability, with GAAP-diluted earnings-per-share (EPS) growth in three of the last four years. In 2022 and 2023, the company earned its highest profits in the last 10 years.

Analysts expect Crown Castle to report lower earnings of $2.88 per diluted share in 2024 and $2.58 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

I think the softer earnings expectations account for Crown Castle stock’s share-price deterioration. An earnings surprise to the upside could boost CCI stock.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.79 | N/A |

| 2020 | $2.48 | 39.0% |

| 2021 | $2.67 | 7.4% |

| 2022 | $3.86 | 44.6% |

| 2023 | $3.46 | -10.3% |

(Source: MarketWatch, op. cit.)

Crown Castle Inc’s funds statement shows that the REIT has been a free cash flow (FCF) machine. This is highlighted by four straight years of FCF growth, to a record-high $1.7 billion in 2023. That’s nearly three times the company’s 2019 FCF.

The jump in FCF should allow the REIT to continue paying dividends and work on paring down its high debt load.

| Fiscal Year | FCF | Growth |

| 2019 | $641.0 Million | N/A |

| 2020 | $1.4 Billion | 123.1% |

| 2021 | $1.6 Billion | 9.1% |

| 2022 | $1.6 Billion | 0.6% |

| 2023 | $1.7 Billion | 8.3% |

(Source: MarketWatch, op. cit.)

Crown Castle Inc’s high capital expenditures are typical of REITs. At the end of March, the company’s balance sheet held $29.1 billion in total debt. (Source: Yahoo! Finance, op. cit.)

I expect that the REIT will need to reduce this debt. The lower interest rates on the horizon should help.

So far, the company has easily covered its annual interest expenses with higher earnings before interest and taxes (EBIT). The REIT’s interest coverage ratio in 2023 was a reasonable 2.9 times.

| Fiscal Year | EBIT (Billions) | Interest Expense (Millions) |

| 2020 | $1.7 | $666.0 |

| 2021 | $1.8 | $632.0 |

| 2022 | $2.4 | $673.0 |

| 2023 | $2.3 | $821.0 |

(Source: Yahoo! Finance, op. cit.)

Crown Castle Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a soft 4.0. This is just below the midpoint of the Piotroski score’s range of 1.0 to 9.0. From 2019 through 2023, the REIT’s Piotroski score averaged a far better 6.0.

Crown Castle Stock’s Dividend Looks Safe

In March, CCI stock paid a quarterly dividend of $1.565 per share. (Source: “Stock Information,” Crown Castle Inc, last accessed May 16, 2024.)

As of this writing, that translates to a forward dividend yield of 6.19%. (Source: Yahoo! Finance, op. cit.)

My view is that Crown Castle stock’s dividend is safe, but I expect that the company will look at paring down its debt before thinking of raising its dividends.

| Metric | Value |

| Dividend Streak | 11 Years |

| 7-Year Dividend Compound Annual Growth Rate | 7.4% |

| 10-Year Average Dividend Yield | 4.4% |

| Dividend Coverage Ratio | 1.1 |

The Lowdown on Crown Castle Inc

Crown Castle has some work ahead to improve its revenue growth and halt its expected earnings erosion. While the company’s shareholders wait for that to happen, they get to collect regular dividends.

A positive sign is that institutional ownership of CCI stock is extremely broad, with 1,631 institutions holding 92.7% of Crown Castle Inc’s outstanding shares (as of this writing). The top two institutional investors are The Vanguard Group, Inc., with a 13.0% stake, and BlackRock Inc (NYSE:BLK), with an 8.4% stake. (Source: Yahoo! Finance, op. cit.)

In addition, we’ve been seeing insider buying of Crown Castle stock, with company insiders purchasing a net 63,963 shares over the last six months.