Crown Castle International Corp: 1 Top Dividend Stock for the Next 10 Years

“5G Gold Rush” Boom for Crown Castle International Corp.

Imagine putting on a set of virtual reality goggles and watching a live football game as if you’re actually standing on the field. Or the balcony to your house being converted into a landing platform for your own personal delivery drone. Or construction crews controlling heavy equipment like cranes and excavators remotely, making worksite injuries a thing of the past.

These ideas might sound like science fiction, but they’re coming a lot sooner than you might think.

It’s all part of the incoming mobile network called “5G.” Short for “fifth generation,” this technology, according to industry analysts, promises to boost mobile download speeds on your cellphone a hundredfold. It will also cut latency times (the delay between when your phone sends and receives a signal) by more than 90%.

But the opportunity here goes well beyond cell phones. Analysts believe that 5G will serve as the foundation for a host of new advances in artificial intelligence, autonomous vehicles, and the Internet of Things.

Early estimates put the size of this opportunity at nearly $12.0 trillion over the next decade, creating fortunes for well-positioned investors. And one company—which pays a lucrative, growing dividend—owns most of the infrastructure to make this technology possible: Crown Castle International Corp. (NYSE:CCI).

Quiet Business Cranks Out Dividends

If you own a mobile carrier like Sprint Corp (NYSE:S), T-Mobile US Inc (NASDAQ:TMUS), or Verizon Communications Inc. (NYSE:VZ), then you face a big problem. With your customers chugging down more data on their devices, you need more cellphone towers to send all of that data to those devices.

Finding locations to put this infrastructure, however, isn’t easy. Rivals have already bought the best locations. And most people, as you can probably imagine, don’t want a cell tower in their backyard.

The solution? Carriers have started partnering with real estate companies that specialize in owning and operating cell towers. And that’s where Crown Castle fits in. The company is one of the biggest players in this industry, with 105,000 towers worldwide, in addition to 65,000 miles of fiber optic cable across the U.S. (Source: “Investors,” Crown Castle International Corp., last accessed April 8, 2019.)

These deals present a win-win for everyone. For carriers, they can quickly expand their mobile networks at a fraction of the cost of building towers themselves. Crown Castle International, on the other hand, locks in a steady stream of rental income that will roll in for years to come.

Crown Castle doesn’t provide an exact breakdown of its operations, but in an investor presentation, close competitor American Tower Corp (NYSE:AMT) detailed the economics of running a tower business. That serves as a close approximation for the returns that Crown Castle earns on its own investments.

On average, a new tower costs $275,000 to construct. A single tenant will pay $20,00 a year in rent. From this income, American Tower—and presumably Crown Castle—spends about $12,000 in operating expenses (maintenance, property taxes, payments to landowners, etc.). This leaves an approximate $8,000 annual gross profit, which comes out to a three-percent return on investment. (Source: “American Tower Corporation: An Overview,” American Tower Corp, last accessed April 14, 2019.)

The real beauty of owning a cell phone tower, though, is scalability—or, as analysts call it in business lingo, “operating leverage.” Each unit can accommodate up to six tenants, and each addition renter only adds $1,000 per year in operating costs. With two tenants on a tower, the cash return on investment for businesses like American Tower and Crown Castle jumps to 13%. With three tenants on a tower, this figure jumps to 24%. Compare those returns to renting out, say, an apartment building or a house. (Source: Ibid.)

Landlords in these businesses jump for joy when they can earn cash returns of six or seven percent per year. On average, these businesses have 2.6 tenants per tower and that number will likely increase in the years ahead. So if you can do the back-of-the-envelope math, you start to appreciate how profitable this industry can be.

|

One Tenant |

Two Tenants |

Three Tenants |

|

| Construction Costs |

$275,000 |

– |

– |

| Tenant Revenue |

$20,000 |

$50,000 |

$80,000 |

| Operating Expenses |

$12,000 |

$13,000 |

$14,000 |

| Gross Margin |

$8,000 |

$37,000 |

$66,000 |

| Return on Investment |

3% |

13% |

24% |

(Source: “Introduction to the Tower Industry and American Tower,” American Tower Corp, last accessed April 14, 2019.)

Moreover, Crown Castle has no problem raising rents year after year due to the high cost of switching tower sites. If you have a bank account, then you’ve probably experienced this yourself. Most of us will stomach higher fees and poorer service because it’s too much of a hassle to switch branches.

In the case of cell phone towers, it costs carriers $35,000 to move locations. Never mind the risk of service disruptions that come with changing from site to site. Tenants, for these reasons, will almost always opt to pay higher rents over switching to a cheaper tower nearby.

But here’s the part that gets me the most excited: Crown Castle International’s tower network represents a collection of truly irreplaceable assets. Even if you and I cobbled together $10.0 billion, we would have a tough time building a viable competitor. New sites must follow a long regulatory approval process, zoning laws put heavy restrictions on developments, and community residents often oppose new towers in their neighborhoods.

Is it possible to build a viable competitor? Yes, but it wouldn’t come cheap. The large barriers to entry keep all but the most deep-pocketed rivals out of the industry. This allows incumbents like Crown Castle to earn outsized returns with little fear of rivals biting into margins.

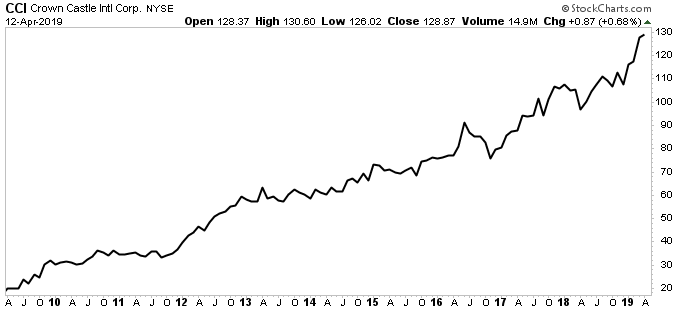

For investors, this business has developed into a profit machine in recent years. Over the past decade, rental income has grown nearly fourfold to $4.7 billion. Over that period, Crown Castle units have generated a total return, including dividends, of 550%. As a point of comparison, the broader S&P 500 delivered a gain of only 250% during that same time frame.

Chart courtesy of StockCharts.com

Furthermore, management passes on much of their profits to unitholders in the form of distributions. Since issuing its first dividend in 2014, Crown Castle International Corp. has more than doubled its payout. Today, its units pay a quarterly distribution of $1.13 apiece, which comes out to an annual yield of 3.5%. And this could just be the beginning.

5G Bonanza Could Send This Dividend Stock Soaring

Everybody loves to surf the Internet on the go. Unfortunately, carriers have struggled to build the physical infrastructure needed to pipe enough bandwidth to our phones. In order to accommodate our virtual world, we need an entirely new type of wireless signal. And that’s where 5G comes in.

The advance to 5G is akin to jumping from the telegraph to the radio. The new network will allow you to send texts, make calls, and browse the Web like today. The difference comes down to speed. As I mentioned above, 5G networks will boost download speeds to 10 gigabits per second, a 100× increase from today. That means you’ll be able to download a two-hour high-definition video in only 3.6 seconds, versus six minutes on today’s 4G LTE network.

But 5G goes far beyond mobile phones. The industry has created the new network standard specifically to keep up with the proliferation of Internet-connected devices: cars, wearables, railroad tracks, hospital equipment, home appliances, door locks, security cameras, etc.

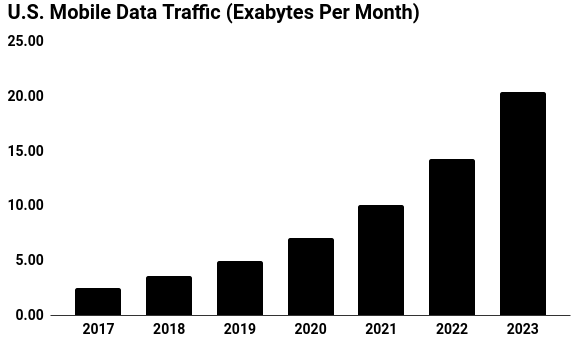

Today, we have 105 million non-traditional devices (basically excluding phones and personal computers) connected online. By 2023, it’s estimated that this figure could reach 468 million. That, according to projections by Cisco Systems, Inc. (NASDAQ:CSCO), could increase mobile data consumption in the U.S. sixfold by 2023. (Source: “American Tower Corporation: An Overview,” American Tower Corporation, op cit.)

This situation has kicked off something I’ve described as the “mobile gold rush.” To roll out this new 5G technology, carriers will need to spend billions of dollars beefing up their networks. This investment could top $275.0 billion over the next decade, according to a recent report by the Federal Communications Commission. The agency also predicts that the 5G rollout will create three million jobs nationwide and add $500.0 billion in extra economic activity. (Source: “5G rollout could create up to 3 million jobs and add $500 billion to GDP,” Consulting.us, August 21, 2018.)

But here’s the best part: 5G signals travel through the air on a higher frequency than traditional 4G LTE. While that improves performance, it significantly reduces the distance that signals can travel. Today, carriers can connect with customers up to 50 miles away from one of their towers; on 5G, this distance will drop to only a few hundred yards. That means network owners like Sprint, T-Mobile, and Verizon will need a much denser network—more base stations in more locations.

(Sources: “Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2017–2022 White Paper,” Cisco Systems, Inc., last accessed April 14, 2019; “Ericsson Mobility Report, June 2018,” Communications Today, last accessed April 14, 2019.)

Crown Castle International has found itself in the middle of this boom. With carriers scrambling to secure new towers, they’ve started to push up rents at existing sites. In 2018, we saw Crown Castle raise rents six percent. That additional rental income has padded the company’s bottom line, serving as basically “free money” for unitholders. (Source: “Supplemental Information Package and Non-GAAP Reconciliations,” Crown Castle International Corp., December 31, 2018.)

Management, however, refuses to rest on their laurels. Since 2007, the company has plowed $10.2 billion back into operations, building new towers and upgrading existing base stations. Over that period, Crown Castle has added 28,800 sites to its portfolio. And these new towers, on average, generate a great income stream for the business.

The company’s biggest bet came in 2017 with a $7.1-billion acquisition of Lightower Fiber Networks. That deal doubled the size of Crown Castle’s fiber-optic network, building out huge positions in key metro areas like Boston, New York, and Philadelphia.

By owning the cable that connects cell towers to the Internet, Crown Castle can charge extra to carriers on every megabit of data that flows through its network. It’s a savvy move, given the explosion of mobile data usage poised to develop over the next few years.

Crown Castle’s recent financial results prove that its strategy has paid off. Last quarter, site rental revenues jumped 15% year-over-year to $4.7 billion. The company reported a net profit of $213.0 million, up 117% from the same period in 2017. Executives also boosted their sales and earnings guidance for the upcoming year, signaling an enormous amount of confidence in the underlying business. (Source: “Crown Castle Reports Fourth Quarter And Full Year 2018 Results, Raises Outlook For Full Year 2019,” Crown Castle Corp, January 23, 2019.)

For unitholders, this growth should translate into respectable returns. Over the next five years, management expects to raise the distribution at a seven-to-eight percent compounded annual clip. That represents one of the fastest growth rates in the world of real estate investment trusts. And given the long expansion runways created by the rise of mobile data and the coming 5G revolution, Crown Castle will likely sustain the growth rate for at least another decade or so.

Selling “Picks and Shovels” to a Gold Rush

This is the part where you might be thinking, “Sounds great, but what are the potential downsides?” Well, Crown Castle faces three big risks: evolving technology, carrier concentration, and higher interest rates.

Anytime you invest in emerging technologies, you face a certain degree of uncertainty. It’s difficult to predict which gadget makers will come out on top in the new 5G world. But in the case of Crown Castle, the company is selling “picks and shovels” in a gold rush. Rather than betting on a specific application for the technology, management is selling an essential service to everyone. This represents a safer and potentially more profitable strategy than getting involved in making new devices or applications.

Carrier concentration, however, presents a much bigger risk. Last year, Sprint and T-Mobile announced plans to merge their operations. The deal still needs to get approval from Congress and has to pass a number of regulatory hurdles, but if the government gives the green light, a combined Sprint/T-Mobile operation would have a lot more heft at the negotiating table. That would give carriers more bargaining power to drive down rents, hurting Crown Castle’s bottom line.

Higher interest rates could also bite investors. Crown Castle competes directly with fixed-income securities for capital. If bond yields rise, income hunters will be tempted to sell their units for safer returns elsewhere.

Management, moreover, funds most of their expansion through debt. About $1.00 out of every $5.00 that the company has borrowed is a floating-rate liability, meaning the interest rate paid changes with market conditions. If yields rise, Crown Castle will have to cough up more money to lenders.

The Bottom Line on Crown Castle International Corp.

Many of us have imagined a future of “smart cities” controlling traffic, autonomous cars whisking us away to our destinations, and virtual reality delivering truly immersive experiences. Thanks to the emergence of 5G, those ideas are fast becoming reality.

Crown Castle International Corp. isn’t the only company bringing you this future, but it owns most of the essential infrastructure to make this reality possible. The coming mobile gold rush has just gotten started, and investors have a chance to get in on the ground floor.