CrossAmerica Partners LP: 10.8% Yield Is Reliable & Safe

CrossAmerica Partners Stock a Top High-Yield Dividend Stock

Google is a pretty reliable source for information. After all, every day, billions of people ask billions of questions, resulting in links from the 1.7 billion web sites out there. In less than a second, I can learn that there are 7.7 billion people on the planet or that the average price for a gallon of gas is $2.78.

But Google isn’t always right. While researching CrossAmerica Partners LP (NYSE:CAPL), I noticed a number of related questions at the bottom of the page. “Is CrossAmerica Partners’s Dividend stable?” was one of the top ones. Google’s response was, “No, CAPL’s dividend has not been stable over the last 10 years.”

Since the definition of “stable” is “firmly fixed,” Google couldn’t be more wrong. If anything, CAPL stock’s dividend is the definition of stable. Over the last 12 quarters, CrossAmerica Partners has maintained its quarterly dividend at $0.525 per share. (Source: “CAPL Dividend History,” Nasdaq, last accessed April 23, 2021).

That means, since the second quarter of 2018, investors have been able to rely on CrossAmerica Partners stock to provide a safe, stable dividend. Throughout 2020, the year that the world grappled with the worst economic crisis since the Great Depression, CrossAmerica Partners kept its dividend unchanged. That was at a time when other energy stocks were cutting their dividends.

More recently, on April 22, 2021, CrossAmerica Partners announced another quarterly distribution of $0.525 per unit, attributable to the first quarter and payable on May 11 to all unitholders of record as of May 4. (Source: “CrossAmerica Partners LP Maintains Quarterly Distribution,” CrossAmerica Partners LP, April 22, 2021.)

Annualized at $2.10 per unit. CAPL stock’s dividend yield stands at 10.8%. Again, it’s safe; the payout ratio is just 73.2%, which is far below the 90% threshold I like to see.

What happened to CrossAmerica Partners stock’s dividend prior to the second quarter of 2018? From the second quarter of 2014 to the first quarter of 2018, CrossAmerica Partners LP raised its dividend 13 times.

True, a rising dividend doesn’t necessarily suggest that CAPL stock’s payout is “stable,” but that definition misses the point—or is misleading—since anything that rises is not stable. The fact is, CrossAmerica Partners has only cut its dividend payout once since 2014. That doesn’t make it a dividend champion, but it does make it a reliable, high-yield dividend stock that investors are bullish on.

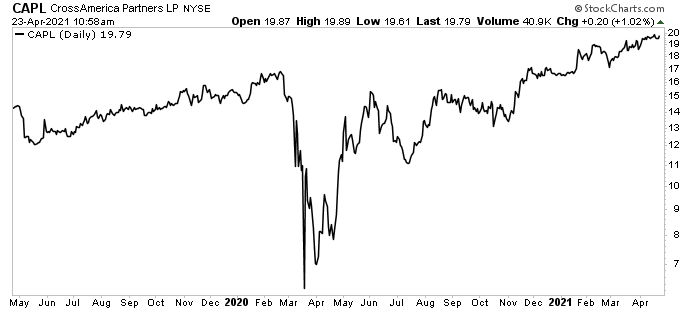

CrossAmerica Partners stock is up 75.5% year-over-year, seriously outpacing the S&P 500, which is only up 45.8%. CAPL stock has also rallied 533% since bottoming in mid-March 2020 and is already up 16.5% since the start of 2021. As of this writing, CrossAmerica Partners LP is trading at $19.79, its highest level in seven years—and near record levels.

Chart courtesy of StockCharts.com

The outlook for CrossAmerica Partners LP is solid, with the U.S. economy poised to reopen this year. As more Americans hit the road, they’ll be forking over their money at CrossAmerica-owned gas stations.

The Allentown, PA-based company is a leading wholesale distributor of motor fuels; convenience store operator and owner; and lessee of real estate used in the retail distribution of motor fuels. (Source: “Home,” CrossAmerica Partners LP, last accessed April 23, 2021.)

CrossAmerica Partners distributes branded and unbranded petroleum at approximately 1,800 gas stations and owns or leases approximately 1,100 sites across 34 states.

The partnership has well-established relationships with several major oil brands, including ExxonMobil Corporation (NYSE:XOM), BP plc (NYSE:BP), and Sunoco LP (NYSE:SUN). CrossAmerica Partners ranks as one of ExxonMobil’s largest distributors by fuel volume in the U.S., and in the top 10 for additional brands.

Strong Fourth-Quarter & Full-Year Results

In March, CrossAmerica reported fourth-quarter 2020 operating income of $8.1 million, a 14% drop from the fourth-quarter 2019 (pre-COVID-19) operating income of $9.0 million. Its fourth-quarter 2020 net income was $9.0 million, a 109% increase from the fourth-quarter 2019 net income of $4.3 million. (Source: “CrossAmerica Partners LP Reports Fourth Quarter and Year-End 2020 Results,” CrossAmerica Partners LP, March 1, 2021.)

The partnership generated fourth-quarter 2020 adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $24.4 million, versus fourth-quarter 2019 adjusted EBITDA of $25.6 million.

Its fourth-quarter 2020 distributable cash flow came in at $26.2 million, a 40% increase from the fourth-quarter 2019 distributable cash flow of $18.8 million.

CrossAmerica Partners LP’s fourth-quarter 2020 gross profit from its wholesale segment increased by 12.5% year-over-year to $36.8 million. Meanwhile, its fourth-quarter gross profit for the retail segment increased 747% year-over-year to $19.5 million.

“Increased COVID-19 mitigation efforts and rising crude prices impacted our fourth quarter results. Despite a challenging environment, the Partnership ended the year strongly,” said Charles Nifong, CEO and president. (Source: Ibid.)

The company’s full-year operating income increased 167% year-over-year to $115.6 million and its net income soared 493% to $107.5 million. CrossAmerica Partners LP’s full-year adjusted EBITDA inched up 3.5% to $107.4 million while its distributable cash flow jumped 28% to $102.5 million.

“Our newly acquired assets, particularly our retail assets, enhanced our operations and our distribution coverage and leverage both improved meaningfully during the year. Our ability to achieve these results, particularly in light of the COVID-19 Pandemic, speak to the soundness of our strategic plan, our execution, and the quality of our people,” concluded Nifong.

The Lowdown on CrossAmerica Partners LP

CrossAmerica Partners stock continues to be a great oil and gas play for income-starved investors and those who love to see their underlying investment rise. High dividend yields are great, but it’s even better when the share price rises too.

CrossAmerica Partners LP reported strong fourth-quarter results and finished 2020 in a better operational and financial position than it was at the start of the year. Things should be even brighter once the economy fully opens up and returns to normal.