Crestwood Equity Partners Stock: Bullish Outlook for This Reliable 8.7% Yielder

Why Crestwood Equity Partners LP Is Attractive

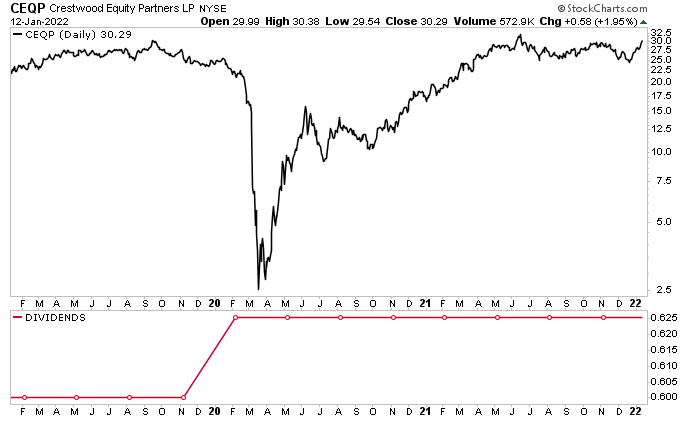

Shares of Crestwood Equity Partners LP (NYSE:CEQP) have soared by more than 1,100% since bottoming in March 2020. CEQP stock has also made significant near-term gains, up by 10% in 2022 so far and 55% year-over-year.

While those gains should be more than enough to make any growth investor happy, Crestwood Equity Partners stock isn’t finished yet. Wall Street analysts expect the stock to post gains of at least 30% over the next 12 months.

Why the enthusiasm?

First, Crestwood Equity Partners LP has reported excellent financial results, which included strong revenue growth and distributable cash flow.

This positions the company to meet or exceed the upper end of its full-year adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) guidance of $570.0 to $600.0 million. (Source: “Crestwood Announces Third Quarter 2021 Financial and Operating Results,” Crestwood Equity Partners LP, October 26, 2021.)

Second, the company has made a number of strategic acquisitions, divestitures, and other deals to strengthen its bottom line.

About CEQP Stock

Crestwood Equity Partners owns and operates midstream energy assets primarily in the Bakken Shale, Delaware Basin, Powder River Basin, Marcellus Shale, and Barnett Shale. (Source: “Q3 2021 Fact Sheet,” Crestwood Equity Partners LP, last accessed January 13, 2022.)

The company operates through three segments: Gathering & Processing; Storage & Transportation; and Marketing, Supply & Logistics.

The Gathering & Processing segment provides natural gas, crude oil, and produced water gathering, compression, treating, processing, and disposal services to producers in unconventional shale plays.

The Storage & Transportation segment provides crude oil and natural gas storage and transportation services to producers, utilities, and other customers.

The Marketing, Supply & Logistics segment provides natural gas liquid (NGL), crude oil, and natural gas marketing, storage, terminaling, and transportation services to producers, refiners, marketers, and other customers.

Chart courtesy of StockCharts.com

Acquisitions, Divestitures, & Other Agreements

In 2020, Crestwood Equity Partners LP closed on a $160.0-million acquisition of NGL assets from Plains All American Pipeline, L.P. (NYSE:PAA). The deal added approximately seven million barrels of NGL storage, a multi-year supply agreement, and additional access to transportation capacity. (Source: “Crestwood Announces First Quarter 2020 Financial and Operating Results, Provides Update on Current Market Response and Revised 2020 Outlook Based on Expected Market Conditions,” Crestwood Equity Partners LP, May 5, 2020.

In July 2021, Crestwood Equity Partners and its joint-venture partner Consolidated Edison, Inc. (NYSE:ED) sold off subsidiaries of Stagecoach Gas Services LLC to a subsidiary of Kinder Morgan, Inc (NYSE:KM) for $1.2 billion. The joint venture was split 50/50. (Source: “Crestwood and Con Edison Announces Closing of Stagecoach Gas Services Divestiture,” Crestwood Equity Partners LP, July 9, 2021.)

Also in 2021, Crestwood Equity Partners entered new long-term agreements with Continental Resources, Inc. (NYSE:CLR) in the Powder River Basin and Novo Oil & Gas in the Delaware Basin. (Source: “Crestwood Announces Third Quarter 2021 Financial and Operating Results,” Crestwood Equity Partners LP, October 26, 2021, op. cit.)

In October 2021, Crestwood Equity Partners announced that it would be expanding its core Williston and Delaware Basin footprints with its acquisition of Oasis Midstream Partners LP (NASDAQ:OMP), an ultra-high-yield dividend stock we’ve profiled on numerous occasions at Income Investors. (Source: “Crestwood to Acquire Oasis Midstream Partners in $1.8 Billion Transaction,” Crestwood Equity Partners LP, October 26, 2021.)

Crestwood Equity Partners agreed to pay $1.8 billion in equity and cash for Oasis Midstream Partners. The combined company will have an enterprise value of approximately $7.0 billion, and it’s expected to generate pro forma 2021 adjusted EBITDA of more than $820.0 million.

The acquisition of Oasis Midstream Partners LP further solidifies Crestwood Equity Partners’ position as a leading service provider in the Williston Basin, doubling the company’s inventory of tier-one drilling locations to 1,200 of them across 535,000 dedicated acres.

Robert G. Phillips, Crestwood Equity Partners LP’s chairman, president, and CEO commented, “This transaction enhances our competitive position in the Williston and Delaware Basins, enables Crestwood to capture substantial operational, commercial, and capacity synergies…and substantially expands the long-term contract acreage and inventory dedications of our gathering and processing portfolio.” (Source: Ibid.)

He added, “Importantly, we are completing this transaction during a period when macro oil and gas fundamentals are exceptionally supportive of upstream development and there is increasing demand for midstream infrastructure and services.”

In connection with the close of the Oasis Midstream Partners transaction, Crestwood Equity Partners LP expects to increase its common distribution to $2.62 per unit annually, representing an approximate five-percent year-over-year increase. In contrast, for the third quarter of 2021, the company announced a distribution of $0.625 per common unit, for a yield of 8.7%.

The Lowdown on Crestwood Equity Partners Stock

Crestwood Equity Partners LP has a history of providing investors with reliable passive income during times of volatility and showing underlying strength when the markets turn bullish. That’s evidenced by the fact that the company actually raised CEQP stock’s dividend in 2020, and the stock’s price made meteoric gains that year.

While Crestwood Equity Partners was a strong company before the COVID-19 pandemic, its acquisition of Oasis Midstream Partners LP has made it even stronger. The deal will create a midstream energy leader that’s well positioned in terms of size, scale, and customer-base diversification. The move should also help this dividend stock continue rewarding investors with ultra-high payouts.