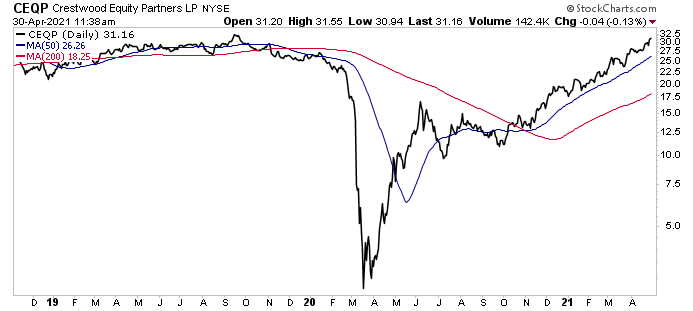

Crestwood Equity Partners LP Up 70% in 2021 & Still Provides 8.1% Dividend

CEQP Stock Up 240% Year-Over-Year; Company Increases 2021 Guidance

What’s not to like about Crestwood Equity Partners LP (NYSE:CEQP)?

The company has done everything you’d expect a high-yield stock to do during the worst economic crisis in 100 years. Crestwood Equity Partners stock has provided substantial, reliable passive income during times of volatility and underlying strength when the markets have turned bullish.

Before the COVID-19-related stock market crash in February/March 2020, CEQP stock provided investors with an annual dividend of $2.50 per share, which in early February 2020 worked out to a 10.7% dividend yield.

On March 18, 2020, Crestwood Equity Partners stock bottomed at $2.25, which translated to an annual dividend yield of 111.1%. As of this writing, its yield is around 8.1%

Everyone knew the markets would turn around; it was just a matter of when. As it turned out, stocks experienced their quickest turnaround on record. And patient CEQP stock holders were some of the biggest winners.

Since the market bottomed, Crestwood Equity Partners stock has soared by 240%. Over the same period, the company has maintained its quarterly dividend payout at $0.625 per unit, or $2.50 on an annual basis. (Source: “Distributions,” Crestwood Equity Partners LP, last accessed May 4, 2021.)

During one of the most turbulent times on Wall Street, particularly within the energy sector, CEQP stock’s high dividend yield helped investors ride out the storm. During the recovery, investors have been able to take advantage of a rising share price. It has been a win-win situation.

The outlook remains bullish for this dividend stock. Crestwood Equity Partners stock has essentially erased all of its losses associated with the coronavirus-fueled stock market crash, and the economy hasn’t even fully recovered yet. If anything, we’re still in the very early stages of the rebound.

This bodes well for both Crestwood Equity Partners and its investors. It’s especially true when you consider that the company reported strong first-quarter financial results, which led it to raise its full-year 2021 guidance.

Chart courtesy of StockCharts.com

Crestwood Equity Partners LP is a master limited partnership (MLP) that develops, acquires, owns, or controls and operates assets and operations within the midstream energy sector. (Source: “Investor Presentation: March 2021,” Crestwood Equity Partners LP, last accessed May 4, 2021.)

The company owns and operates midstream assets located primarily in the Bakken Shale, Delaware Basin, Powder River Basin, Marcellus Shale, and Barnett Shale.

Crestwood Equity Partners has three operating segments:

- Gathering & Processing, which includes natural gas, crude oil, and produced water gathering and processing operations

- Storage & Transportation, which includes natural gas and crude oil storage and transportation operations

- Marketing, Supply & Logistics, which includes natural gas liquid, crude oil, and natural gas supply and logistics; contract storage and pipeline capacity

Across these segments, Crestwood Equity Partners LP provides infrastructure solutions to service natural gas and crude oil shale plays across the U.S.

The company’s long-term contract customers are a who’s who of the oil and gas industry: Royal Dutch Shell plc (NYSE:RDS.A, NYSE:RDS.B), Exxon Mobil Corporation (NYSE:XOM), ConocoPhillips (NYSE:COP), and Chesapeake Energy (NASDAQ:CHK).

Strong Q1 Results Topped the Estimates

For the first quarter of 2021, ended March 31, Crestwood Equity Partners announced record adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $165.4 million, a nine-percent increase over the $23.4 million in the first quarter of 2020. (Source: “Crestwood Announces First Quarter 2021 Financial and Operating Results,” Crestwood Equity Partners LP, April 27, 2021.)

The company reported first-quarter distributable cash flow (DCF) to common unitholders of $108.4 million, a year-over-year increase of 15%.

The first-quarter 2021 dividend coverage ratio was 2.8. This ratio represents the number of times a company can pay its current dividend. A healthy dividend coverage ratio above 2.0 is ideal. Anything under 1.5 might make investors nervous.

At 2.8, it’s safe to say that Crestwood Equity Partners LP’s dividend payout is reliable. In fact, thanks to the company’s strong cash position, it’s quite possible that Crestwood will raise its quarterly payout this year after holding it at $0.625 for the last six quarters.

Crestwood Equity Partners’ first-quarter 2021 free cash flow after distributions was $63.3 million.

“I am pleased to announce record first quarter 2021 results with Adjusted EBITDA of $165.4 million and distributable cash flow of $108.4 million, increases of 9% and 15%, respectively, over the first quarter of 2020, leading to free cash flow after distributions of $63.6 million,” commented Robert G. Phillips, chairman, president, and CEO. (Source: Ibid.)

Management Raises 2021 Guidance

A strong first-quarter outperformance driven by improving commodity prices, coupled with a favorable outlook for 2021, gave Crestwood Equity Partners LP’s management team the confidence to increase its full-year guidance.

For fiscal 2021, Crestwood Equity Partners expects to report:

- Adjusted EBITDA in the range of $575.0 to $625.0 million, up from a previous guidance range of $550.0 to $610.0 million

- Distributable cash flow of $335.0 to $385.0 million, up from $320.0 to $380.0 million

- Free cash flow after distributions of $130.0 to $180.0 million, up from $90.0 to $160.0 million

- A dividend coverage ratio greater than 2.0, up from a previous range of 1.7 to 2.0

The Lowdown on Crestwood Equity Partners LP

Despite historic commodity price volatility throughout 2020, Crestwood Equity Partners LP reported record fourth-quarter results. The company has also outperformed in the first quarter of 2021.

Thanks to the company’s solid balance sheet, strategic transactions, and favorable outlook, management has raised its full-year guidance. This is great news for Crestwood Equity Partners stock investors.