Cracker Barrel Stock: 7.1%-Yielder for Contrarian Investors

CBRL Stock’s Dividend Streak at 42 Years

More than three years have passed since the COVID-19 pandemic crushed the restaurant industry.

A common view during the height of the pandemic was that the government-mandated closures of restaurants would devastate the industry with massive losses and bankruptcies. While many small restaurant businesses did fold, the majority of big restaurant chains held on and staged generational rallies.

That’s the case with Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL), a restaurant company with an American heritage theme.

At the end of 2022, the company’s business network comprised 665 company-owned “Cracker Barrel” locations in 45 states and 51 “Maple Street Biscuit Company” restaurants. (Source: “Investor Presentation: January 2023,” Cracker Barrel Old Country Store, Inc., last accessed December 18, 2023.)

While the economy and spending have been ramping up in the U.S., inflation continues to have a negative impact on companies’ margins and bottom lines. The situation, however, should keep improving over the next few years.

Cracker Barrel Old Country Store, Inc. was hurt by the pandemic, but it has still managed to pay dividends for 42 straight years.

Cracker Barrel stock traded at a record-high $181.99 in November 2018, prior to tanking to $53.61 on March 19, 2020. CBRL stock subsequently rallied to $178.82 in April 2021 but failed to hold, and then it drifted lower to $62.69 in September 2023. Cracker Barrel Old Country Store, Inc.’s share price is currently sitting just above its low, and it’s worth a look for contrarian investors.

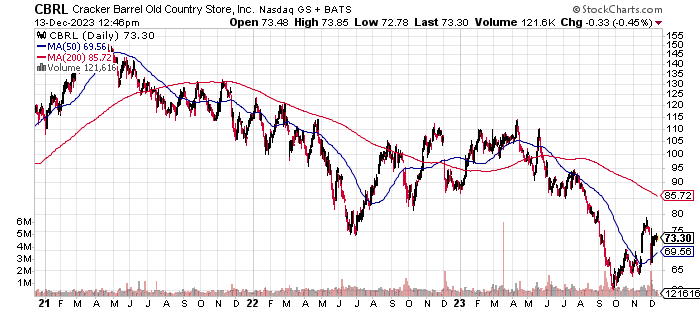

As shown in the following chart, Cracker Barrel stock’s price is relatively volatile. This is reflected by its beta of 1.41, which suggests that CBRL stock’s price will move more than the S&P 500, both in up and down markets.

Chart courtesy of StockCharts.com

Cracker Barrel Old Country Store, Inc. Faces Growth Challenges

Cracker Barrel operates in a fiscal year ending July 29, so its most recent results are for fiscal 2023.

The company’s revenues grew in four of its last five reported fiscal years. The exception was fiscal 2020, when the pandemic surfaced. In fiscal 2023, Cracker Barrel Old Country Store, Inc.’s revenues jumped by 6.4% to a record-high $3.44 billion, extending its growth streak to three years. This was above its revenues of $3.07 billion in fiscal 2019, prior to the pandemic-related shutdowns.

Analysts expect some stalling as the company faces challenges. They estimate that Cracker Barrel’s revenues will grow by a mere one percent to $3.48 billion in fiscal 2024, followed by growth of another one percent to $3.51 billion in fiscal 2025. (Source: “Cracker Barrel Old Country Store, Inc (CBRL),” Yahoo! Finance, last accessed December 18, 2023.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2019 | $3.07 | N/A |

| 2020 | $2.52 | -17.9% |

| 2021 | $2.82 | 11.8% |

| 2022 | $3.27 | 15.8% |

| 2023 | $3.44 | 5.4% |

(Source: “Cracker Barrel Old Country Store, Inc.” MarketWatch, last accessed December 18, 2023.)

A look at the cost side shows the company consistently generating steady gross margins, but it needs to improve its gross margins back to the 34% level.

| Fiscal Year | Gross Margin |

| 2019 | 34.3% |

| 2020 | 34.6% |

| 2021 | 32.4% |

| 2022 | 34.5% |

| 2023 | 32.7% |

On the bottom line, Cracker Barrel Old Country Store, Inc. has been largely profitable, based on generally accepted accounting principles (GAAP). It had a GAAP-diluted earnings-per-share (EPS) loss in fiscal 2021, though. There were some encouraging signs in fiscal 2022, but that was followed by a decline in GAAP-diluted EPS in fiscal 2023.

Adjusting for non-recurring expenses, Cracker Barrel Old Country Store, Inc. reported $5.47 per diluted share for fiscal 2022.

Analysts’ consensus estimates for the company’s earnings have been falling. They expect Cracker Barrel’s earnings to contract to $4.84 per diluted share in fiscal 2024, prior to rebounding to $5.39 per diluted share in fiscal 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $9.27 | N/A |

| 2020 | -$1.36 | -114.7% |

| 2021 | $10.71 | 886.9% |

| 2022 | $5.67 | -47.1% |

| 2023 | $4.45 | -21.6% |

(Source: MarketWatch, op. cit.)

Cracker Barrel Old Country Store, Inc.’s funds statement shows that the company has consistently produced high free cash flow (FCF)—except in fiscal 2021. The drop in FCF in fiscal 2023 is a concern, but for now, the company should have no problem extending its dividend streak.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $224.5 | N/A |

| 2020 | -$136.3 | -160.7% |

| 2021 | $230.5 | 269.1% |

| 2022 | $106.9 | -53.6% |

| 2023 | $123.5 | 15.5% |

(Source: MarketWatch, op. cit.)

Cracker Barrel Old Country Store, Inc.’s balance sheet included $1.2 billion in debt at the end of October. (Source: Yahoo! Finance, op. cit.)

Its Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a decent reading of 6.0, which is above the midpoint of the Piotroski score’s 1.0–9.0 range.

The following table shows that Cracker Barrel has managed to cover its interest expenses via higher earnings before interest and taxes (EBIT) in its last four reported fiscal years.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $103.6 | $22.3 |

| 2021 | $366.7 | $56.1 |

| 2022 | $153.0 | $9.6 |

| 2023 | $120.6 | $17.0 |

(Source: Yahoo! Finance, op. cit.)

Management Could Reduce Cracker Barrel Stock’s Dividends

Cracker Barrel Old Country Store, Inc. has maintained a quarterly dividend level of $1.30 per share since October 2019. (Source: “Dividends History,” Cracker Barrel Old Country Store, Inc., last accessed December 18, 2023.)

The company’s high payout ratio of 132.3% could lead management to reduce the dividend, depending on what happens in fiscal 2024.

CBRL stock’s dividend yield of 7.07% (as of this writing) is well above its five-year average of 3.69%. That’s largely due to its share price falling recently.

| Metric | Value |

| Dividend Growth Streak | 1 Year |

| Dividend Streak | 42 Years |

| 7-Year Dividend Compound Annual Growth Rate | -5.7% |

| 10-Year Average Dividend Yield | 4.8% |

| Dividend Coverage Ratio | 2.0 |

The Lowdown on Cracker Barrel Old Country Store, Inc.

Cracker Barrel stock is worth a look for contrarian investors, but the company will need to re-energize its financial growth and get back on track.

The expected decline in inflation should help Cracker Barrel Old Country Store, Inc. increase its fragile same-store sales. If the company is successful in turning things around, we could see a strong rally by CBRL stock.