Could Berkshire Hathaway Issue an 11% Special Dividend?

A Dividend From Warren Buffett? Maybe.

Warren Buffett loathes paying dividends, but that could be about to change.

Last Sunday, U.S. utility Sempra Energy (NYSE:SRE) agreed to buy power transmission company Oncor Electric Delivery Company LLC for $9.5 billion. The deal tops a smaller bid from Berkshire Hathaway Inc. (NYSE:BRK.A, NYSE:BRK.B) issued last month. (Source: “Sempra Energy Announces Agreement To Acquire Ownership Interest In Oncor,” Sempra Energy, August 21, 2017.)

Sempra sealed the deal over the weekend after raising an earlier offer. Buffett, whom offered to buy Oncor in June for $9.0 billion, had indicated that he wouldn’t raise his price. Berkshire analysts expressed disappointment the transaction fell through, but approved of the company’s discipline not to get into a bidding war.

The silver lining for shareholders? It could force the “Oracle of Omaha” to start paying dividends.

Berkshire Hathaway has an odd problem: too much cash. Last quarter, the insurance giant’s corporate treasury topped $99.7 billion. And each year, business operations add another $20.0 billion to that total.

Keeping so much money in the bank puts a drag on returns. Worse, rising prices start to eat into the real value of those reserves. With yields on cash being less than the rate of inflation, Buffett’s greenbacks buy less and less each day.

The Oncor acquisition would’ve put a dent in that balance. But now that the deal has fallen through, Buffett will have to go back to the drawing board. The pressure is on to find another “elephant-sized” acquisition, as he so often puts it in his shareholder letters.

Bagging new deals hasn’t been easy, either.

In March, one of Berkshire’s holdings, Kraft Heinz Co (NASDAQ:KHC), offered to buy Unilever NV (ADR) (NYSE:UN) for $143.0 billion. That acquisition, however, unwound after the press caught wind of the negotiations.

Stocks overall look expensive too. Buffett’s success comes from his ability to drive a bargain for wonderful businesses with wide competitive moats. But, given that equities now trade at price multiples comparable to the tech bubble, top names command premium valuations.

You can see this in the deal flow. Over the past year, private equity players have paid record valuations for acquisitions. And given the shortage of growth opportunities more generally, big companies have turned to consolidation in their quest to boost profits.

Buffett may have one more deal left in him. Analysts have tossed around a number of likely targets, including names like Nike Inc (NYSE:NKE), Danone SA, and Hershey Co (NYSE:HSY). But, with the stock market hitting record highs, the list of acquisition candidates keeps getting shorter.

For Buffett, a dividend could be an easy solution.

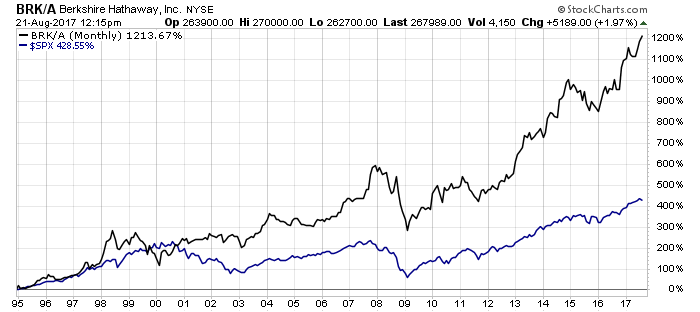

In the past, Berkshire has opposed returning funds to shareholders. Buffett believes he can do a better job managing investors’ capital than they can. Historically, that argument has held up.

Chart courtesy of StockCharts.com

Berkshire, though, might be changing its tune. The longer its cash sits idle, the bigger the pressure to pay a distribution. The Oracle of Omaha even admitted so at the company’s recent shareholder meeting, hinting that the insurance giant’s longtime dividend policy could be due for an overhaul.

“We don’t like that and we shouldn’t use your money that way for a long period of time,” he explained. “There’s no way I can come back here three years from now and tell you that we hold $150 billion or so in cash or more and we think we’re doing something brilliant by doing it.” (Source: “2017 Berkshire Hathaway Shareholders Meeting (Full Transcription),” Mine Safety Disclosures, June 1, 2017.)

A special distribution would create a big payday for shareholders. Berkshire would likely only pay out a fraction of its cash on hand, keeping some dry powder in case a good opportunity springs up. If, for example, Buffett were to pay out half of the cash balance today, it would result in an 11% one-time distribution.

Owners should watch the Oracle’s next move closely.

The billionaire investor hasn’t stopped hunting for new targets. And, given Buffett’s track record, most shareholders probably prefer keeping their money in Berkshire.

Last Sunday’s Oncor deal, however, shows that putting the money to work won’t be easy. If Berkshire Hathaway can’t bag another elephant-sized acquisition, shares may very well pay dividends one day. With a cash balance topping $100.0 billion, this could become one of the most lucrative income payers around.