Could 21%-Yielding ORC Stock Soar 38%?

Orchid Island Capital Pays Monthly Dividends

Today, we’re going to take a look at ORC stock.

The early April stock market sell-off put a lot of great stocks in an even better trading range. The “Liberation Day” crash kicked a lot of overvalued stocks to the curb, too. After all, when it comes to the stock market, a rising tide lifts all boats. The key is to separate the wheat from the chaff and locate the best high-yielding income stocks.

One excellent stock that hit a record high in the weeks leading up to the April sell-off is Orchid Island Capital Inc (NYSE:ORC). The company’s share price was juiced by a fourth-quarter earnings beat, solid estimated first-quarter results, and an environment that’s friendly to mortgage real estate investment trusts (mREITs).

Interest rates haven’t come down as quickly as many had hoped, but they are still expected to trend lower in 2025 and 2026. Though, to be fair, it all depends on how the global trade war turns out.

Lower interest rates are good because mREITs borrow a lot of money to expand their portfolios, and higher borrowing costs can cut into profitability.

And the current interest rate environment means that mREITs are able to borrow capital at far lower rates than what the mortgages are actually paying. This should allow an mREIT like Orchid Island Capital to buy more debt for the same or even less than it could in a high-interest-rate environment and, eventually, lead it to increase its monthly dividends.

Orchid Island Capital invests in residential mortgage-backed securities (RMBS) on a leveraged basis. The income the mREIT generates for distribution to its shareholders comes from the difference between the yield on its mortgage assets and the costs of borrowing. (Source: “Q4 2024 Earnings Presentation,” Orchid Island Capital Inc, April 23, 2025.)

The company’s portfolio is made up entirely of highly liquid agency fixed-rate pass-through securities, interest-only securities, and principal-only securities.

2024 Profitability of $37.8 Million

For the fourth quarter ended December 31, 2024, Orchid Island reported net income of $5.6 million, or $0.07 per share, and net interest income of $8.1 million, or $0.10 per share. (Source: “Q4 2024 Earnings Supplemental Materials,” Orchid Island Capital Inc, January 31, 2025.)

During the quarter, Orchid Island increased its average agency RMBS portfolio to $5.3 billion from $5.0 billion in the third quarter. The mREIT ended the quarter in a strong liquidity position, with $353.6 million in cash and cash equivalents.

For full year 2024, Orchid reported net income of $37.8 million, or $0.57 per share, a big improvement over a 2023 loss of $39.2 million, or a loss of $0.89 per share. Its net interest income for 2024 was $5.3 million, or $0.08 per share.

Looking ahead to the first quarter, the mREIT expects to report net income of $0.18 per share. (Source: “Orchid Island Capital Announces Estimated First Quarter 2025 Results, April 2025 Monthly Dividend and March 31, 2025 RMBS Portfolio Characteristics,” Orchid Island Capital Inc, April 9, 2025.)

Monthly Dividend of $0.12/Share Declared

According to Orchid Island Capital, it will continue to make regular monthly cash distributions. This shouldn’t be a big surprise. ORC stock needs to distribute at least 90% of its taxable income to shareholders as a dividend to retain its real estate investment trust (REIT) status, which it has done since its February 2013 initial public offering (IPO). (Source: “Dividend History,” Orchid Island Capital Inc, last accessed April 23, 2025.)

In April, the mREIT declared a monthly dividend of $0.12 per share, or $1.44 per share on an annual basis, for a forward yield of 21.18%.

ORC Stock Could Pop 38%

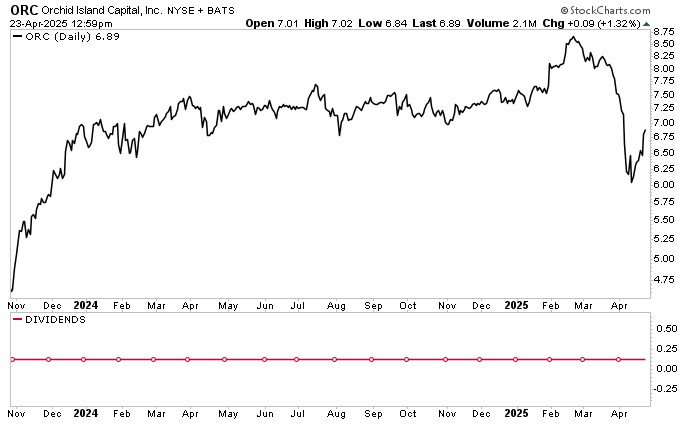

ORC stock has been on a nice run since November 2023. That’s when the Federal Reserve said it was done cutting interest rates. In December 2023, mREITs got an additional boost after the central bank announced that it would start cutting interest rates. The Fed has slashed interest rates three times since September 2024.

ORC stock had a nice run in the opening weeks of 2025 as well. In late January, ORC popped in step with a broad-based stock market rally. It continued to do well, hitting a new 52-week high of $9.01 on February 21.

The stock continued to hover near that level until April 2, when President Donald Trump unveiled his global tariffs. There are concerns about how those tariffs will impact the economy. The Federal Reserve suggested they could heat up inflation, which could result in an unexpected interest-rate hike.

Perhaps not surprisingly, ORC stock took a hit. However, as you can see in the below chart, the stock has been rebounding. This comes in large part due to President Trump hinting that he will soften tariffs with China.

The markets also took a hit after the president stated that he couldn’t wait for Fed boss Jerome Powell to be done his term next year. Trump had criticized Powell for not lowering interest rates when the Federal Reserve last met. The Fed isn’t expected to cut rates when it meets next in May either.

On April 22, President Trump backtracked, saying that he has no intention of firing Powell; this helped inject some optimism into the markets.

ORC stock has rallied 7.7% over the last trading days (to April 23). That’s the good news. Despite the decent near-term gains, the stock is still down:

- 10% over the last three months

- 7.5% year to date

- 5.0% over the last 12 months

Brighter days could be ahead. Wall Street analysts have provided a 12-month share price target of $9.50 per share. This points to potential upside of 38%.

Chart courtesy of StockCharts.com

The Lowdown on ORC Stock

Orchid Island Capital is an mREIT with a growing portfolio of RMBS. In the fourth quarter, the company swung to profitability of $37.8 million and increased its agency RMBS portfolio to $5.3 billion. It also provided solid guidance for the first quarter.

While the threat of higher interest rates is generally bad for mREITs, Orchid Island’s agency securities are mostly fixed-rate 30-year and 15-year securities. Its hedges, meanwhile, have a longer duration bias, which protects the portfolio against an unanticipated rise in longer-term rates.

Still, lower interest rates are good for Orchid Island, because it can borrow money at much better terms. All of this bodes well for ORC stock and its monthly dividend.