Colgate Stock: This Company Has Paid a Dividend Since 1895

1 Dividend Stock to Own Forever

Around our research office here at Income Investors, we just call them “forever assets.”

Everyone knows exactly what we’re talking about. We bring them up so often, the shorthand just makes things easier.

Forever assets describe stocks you can literally buy today and own for the rest of your life. These firms have rewarded owners for generations. Their entrenched market positions have allowed them to crank out dividends year after year, decade after decade.

In the past, most folks just wanted to strike it rich on hot tech stocks. That approach, however, is changing. People have started dumping riskier names in favor of true forever assets like Clorox Co (NYSE:CLX), Norfolk Southern Corp. (NYSE:NSC), and WD-40 Company (NYSE:WDFC).

Finally! As I’ve said for years, these businesses represent some of the best stocks around. They stand head and shoulders above the rest.

For investors, learning how to spot a forever asset is a great skill. No, they won’t impress your brother-in-law at the next family barbecue. Understanding the traits of these wonderful businesses, however, makes for the best way to build real wealth in the stock market.

Let’s use Colgate-Palmolive Company (NYSE:CL) as a case study. First, we want a timeless service. Can you picture your grandchildren enjoying this product decades from now?

You don’t need an MBA to wrap your head around Colgate. It doesn’t deal in “swaptions” or credit default swaps. Unlike Fitbit Inc (NYSE:FIT) or GoPro Inc (NASDAQ:GPRO), Colgate doesn’t have to invent the next hot gadget every few months.

I don’t know what social network tweens will dig in 50 years, but I’m pretty sure people will still need to brush their teeth. Colgate just makes the same trademarked product everyday. That will likely continue for the next 50 years, regardless of where the stock market goes or who controls the White House.

Second, we want to see spotless financials. Forever assets earn big profit margins and generate strong free cash flows, putting them in a better position to return money to shareholders.

You can’t find a better business than toothpaste. A tube costs only a few cents to make, you sell it for a dollar, and you need a new tube every few weeks.

And as you can imagine, toothpaste hasn’t changed much over the years. That means you don’t have to spend billions on things like research or new factories, leaving lots of money on hand for owners.

This has turned the company into a cash cow. Colgate generates $0.60 in gross profits on every dollar generated in sales. And because people are cautious about what they put in their mouths, it’s tough for rivals to encroach on their margins.

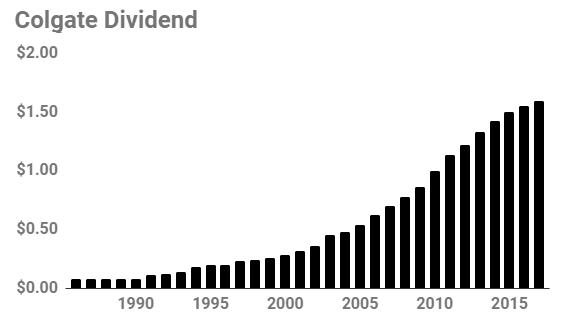

Finally, we want a long history of rewarding shareholders. Here, too, the company stands out. Colgate has mailed out checks to shareholders for 122 years, one of the longest dividend histories around.

Every year. Since 1895. Think about everything that happened over that time: the San Francisco earthquake, two World Wars, the Great Depression, the baby boom, Vietnam, Watergate, inflation, Ronald Reagan, Black Monday, the dot-com bubble, 9/11, the financial crisis, and more. Yet through all of these tough times, Colgate went about its business and paid out distributions to shareholders.

The last time Colgate did not pay a dividend, President Grover Cleveland sat in the White House and William Morgan had just invented volleyball in Holyoke, Massachusetts.

Sure, Colgate’s modest 2.2% yield might not get yield hogs out of bed. But that said, the company has passed on lucrative dividend hikes for decades. Given enough time, even this income trickle can become a raging river of cash flow.

Source: “Colgate-Palmolive Company,” Yahoo! Finance, last accessed July 14, 2017.

The Bottom Line

These points are just common sense: timeless businesses with big profit margins and that take care of their owners should do well over the long-haul. It doesn’t take a Ph.D to figure that out.

Of course, you have no sure things in investing. Even the best companies can falter from time to time. But when you invest in wonderful businesses like Colgate, you give yourself the best chance of compounding wealth over the long haul.