The Coca-Cola Company: This “Forever Asset” Has Paid Dividends Since 1893

One Asset to Own Forever

In our research meeting, we started calling them “forever assets.” The nickname just kind of stuck. We talk about them so often around the office that everyone has heard about it before.

I coined the phrase “forever assets” years ago to describe an elite group of businesses that have rewarded investors for decades. These firms sell timeless products and enjoy entrenched market positions, and thanks to this type of competitive advantage, these stocks have crushed the broader stock market.

While tech firms have to invent the next hot app every other quarter, forever assets don’t have to run on the innovation treadmill. Likewise, forever assets don’t deal in financial mumbo-jumbo or hard-to-understand investment derivatives. In some cases, many of these firms have made the same product for over 100 years. That has resulted in a reliable, growing stream of income that has lasted for decades.

One great example: The Coca-Cola Company (NYSE:KO). Most people associate the company with its trademark beverage (hint: it’s in the name), but over the years, the company has acquired a diversified portfolio of leading brands, like “Sprite,” “Fanta,” and “Dasani.”

Exciting? Not really, but selling the basics has made Coca-Cola into a cash-flow machine. The company has paid a dividend for over 125 years. Its shares have also beaten the S&P 500, delivering a total return (including dividends) of 12,500% since 1968.

For these reasons, I’ve always kept Coca-Cola on my watchlist. However, I’ve never gotten around to actually recommending the stock. “Mr. Market” always seemed to price its shares a smidge too high for my taste. Over the past year or so, though, traders have dumped old-fashioned businesses like Coca-Cola for cryptocurrencies and hot tech plays. For dividend investors, this has created a rare opportunity to scoop up these shares at a reasonable price.

The Business

Coca-Cola can trace its roots back to Dr. John Pemberton in 1885. The inventor first sold his creation as a fountain beverage at an Atlanta pharmacy, mixing syrup with carbonated water. Today, Coca-Cola grosses more than $35.0 billion in revenues with operations in more than 200 countries worldwide. The company sells more than 1.8 billion servings each day.

For investors, anyone can wrap their heads around this operation fairly easily. Coca-Cola purchases commodity inputs and then manufactures a concentrated syrup. This concentrate gets sold to bottlers across the country, which package and sell the final product to shops, supermarkets, and vending machines. Coca-Cola also provides soft drink concentrate to fountains (cinemas, convenience stores, fast food restaurants, etc.), which sell the final product in cups and glasses.

It’s a brilliant model. Bottlers have to pay for all of the plants, all of the trucks, and almost all of the capital costs. Coca-Cola, meanwhile, can kick up its feet and collect ongoing royalty income. Because it’s passed on almost all of its expenses to local partners, management has more money left over for shareholder-rewarding actions like dividends and buybacks.

Coca-Cola’s status as a forever asset comes from its brand. If you survey people at random to name the first soft drink that leaps to mind, Coke wins, hands down. I can’t count the number of times I’ve heard people order a Coke in a restaurant, only to be told apologetically by the server that they only had something else.

In blind taste tests, rival Pepsi comes out on top, but in restaurants, supermarkets, and convenience stores, people tend to reach for Coca-Cola. It’s significant that we have an enormous amount of licensed Coke paraphernalia (apparel, glassware, collectibles, artwork, toys, etc.) but relatively little licensed PepsiCo, Inc. (NYSE:PEP) merchandise. Pepsi may have won the taste-test battle, but it lost the real war: the hearts and minds of the country.

Martin Lindstrom highlighted this phenomenon in his book Buyology: Truth and Lies About Why We Buy. During a 2003 study, scientists hooked test subjects up to an MRI machine and revisited the famous “Pepsi Challenge.” In blind taste tests, the majority, in fact, preferred Pepsi, but when scientists repeated the test and disclosed which brand the test subjects were drinking, a whopping 75% chose Coke!

What did the MRI show? It revealed a tug-of-war in the brains of those who had a preference for Pepsi but knew that they were drinking Coke. Their rational thinking (the side that knew Pepsi tasted better) got overwhelmed by their deeper, emotional connections with Coke. Our positive associations with Coca-Cola—its logo, history, colors, advertising, and childhood memories—override the rational, thoughtful parts of our brains.

In other words, Coca-Cola’s business would be almost impossible for its rivals to replicate. Let’s say you and I could recreate the company’s famous syrup (though it keeps the exact combination of flavoring, carbonation, and sweetener under lock and key), and let’s say you and I could recreate the company’s worldwide distribution network (though this would cost hundreds of billions of dollars), and let’s assume you and I could match Coca-Cola’s marketing budget (which comes in at around $3.7 billion each year).

Even if the two of us could somehow overcome these hurdles, we could never match Coca-Cola’s 100-plus-year relationship with consumers.

For shareholders, this brand strength has turned the company into a reliable moneymaker. Worldwide, Coke sells one out of every two bottles of soft drink. The average person consumes eight eight-ounce beverages a day; Coke provides about four of those ounces.

You can see the strength of this brand in the company’s financial results. For decades, Coca-Cola’s gross margins have routinely topped 60%. The firm generates more than $0.20 in profit on every dollar of capital invested in the business. I can only list a handful of companies in the world that crank out numbers like these.

More importantly, the incredible brand strength has allowed Coca-Cola to raise its prices over the years. You’ve probably noticed this yourself, both in the form of smaller packages and higher price tags. Most people, though, will fork over an extra nickel or two for their favorite treat. This ability to pass on higher prices year after year constitutes the true hallmark of a wonderful business.

The Dividend

For many people, Coca-Cola comes to mind first when they think of dividend stocks—and for good reason. The firm tops the list of “Dividend Aristocrats,” pumping out 55 straight years of distribution increases. Over that period, the payout to shareholders has grown multifold.

“Let’s say you were going away for 10 years and you wanted to make one investment and you know everything you know now, and you couldn’t change it while you were gone,” billionaire Warren Buffett, the company’s largest shareholder, once explained. “What would you think about? I would certainly want, where I knew the market was going to continue to grow, where I knew the leader would continue to be the leader—I mean worldwide—and where I knew there would be big unit growth. I just don’t know anything like Coke.”

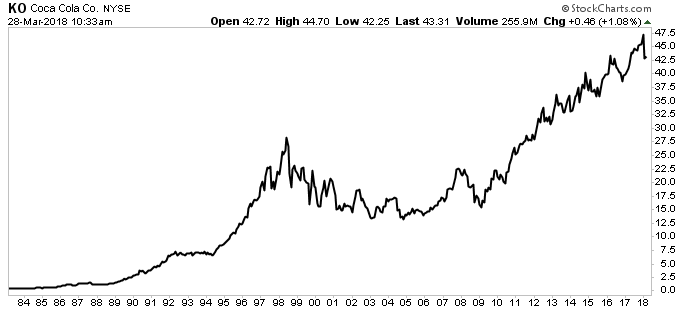

Chart courtesy of StockCharts.com

To keep growing that distribution, Coca-Cola will need to think outside of its core brand. Soda makes up about 70% of the company’s sales, which have stagnated in recent years. At a recent investor conference, new CEO James Quincey revealed a three-part plan to grow the company’s earnings going forward.

To begin, cut costs. Management wants to trim $3.8 billion in annual spending by 2019, or about 10% of 2017 sales. This will come from a combination of trimming corporate payrolls, squeezing efficiencies out of the supply chain, and getting more bang for its buck out of the marketing budget. Through these initiatives, Coca-Cola should be able to earn more profits on each bottle of soda sold.

Next, refranchise bottling operations. As mentioned, bottling comes with low margins and large upfront investments. Management wants to sell off the last of these facilities to focus on the more profitable concentrate business. This will leave a smaller, but more profitable, company. It will also free up capital for share buybacks, providing a potential catalyst for the stock price.

Finally, diversify the product line. Coca-Cola has moved into faster-growing categories with brands like “VitaminWater,” “Honest Tea,” and “Zico” coconut water. Management has also worked quickly to boost its market share in categories like dairy, energy drinks, sports drinks, bottled water, and ready-to-drink coffees. We’ve also seen the rollout of new low-sugar soft drinks, adapting to a more health-conscious marketplace.

Those efforts seem to have paid off. Last year, the company saw its organic revenues (which strips out the impact of acquisitions) increase three percent from 2016. More importantly, the company now earns more profit on each dollar of sales that come into the business. Fourth-quarter operating margins increased 315 basis points year-over-year.

“I am pleased with our accomplishments and results in 2017,” Quincey said. “We achieved or exceeded our full year guidance while driving significant change as we continued to transform into a total beverage company. While there is still much work to do, I am encouraged by our momentum as we head into 2018.”

So, let’s sum it all up. Over the next five years, I expect Coca-Cola to deliver mid-single-digit revenue growth and gross margins in the mid-60s (versus 62.6% in 2017) after 2018. That should translate into an earnings per share growth rate of between six percent and seven percent per year. Given its relatively high payout ratio of 80%, management can’t boost the distribution much faster than earnings growth. Therefore, I expect the dividend to grow more or less in line with profits.

For investors, the combination of a safe, growing dividend and a reasonable price tag looks compelling. Thanks to the hot economy and fast returns in tech, traders have rotated out of stodgy consumer-staple names. With shares yielding 3.5% and trading at a modest discount to my $50.00 fair value estimate, Coca-Cola offers the potential for above-average total returns.

The Risks

Of course, Coca-Cola is no slam dunk. Consumer preferences have changed over the past decade, with a shift to healthier, lower-calorie drinks. Beverage makers have come under scrutiny in recent years, with new soda taxes hampering unit sales. Investors also need to keep a close eye on rising input costs, like corn, sweetener, and aluminum.

That said, Coca-Cola’s entrenched market position makes it a safer bet compared to other consumer product makers. Its management has responded to changing customer tastes by moving into new businesses, executives have cut the proportion of sales that it derives from soft drinks from over 90% in 2005 to below 70% today, and given the company’s brand strength, it has historically had no problem passing on higher commodity prices to consumers.

Buying these shares at a discount to fair value leaves it with a little wiggle room. In my financial model, I assumed a modest (certainly not spectacular) growth rate, but even if management can’t hit my relatively low bar, shareholders buying here should still earn a decent return.

The Bottom Line on Coca-Cola

Coca-Cola represents a classic American forever asset, with a wide competitive moat and long dividend history. Wall Street, though, wants to chase higher returns in the tech sector, leaving some wonderful businesses by the wayside. For investors with a little more patience, this stock will likely deliver above-average returns over the long haul.