Big Acquisition Expected to Bolster Chord Energy Stock’s High-Yield Dividends

Why CHRD Stock Has Been Crushing the Market

Energy stocks may not be as exciting as tech stocks, but if you’re looking for share-price gains, the energy sector is a better place to be these days. Over the last three months, the energy sector has been the stock market’s top performer. Year-to-date, energy stocks have been the No. 2 performer, second only to communication services stocks.

That momentum is expected to continue. Analysts have increased their 2024 forecast for crude oil to as high as $100.00 per barrel.

That’s because, in addition to tensions in the Middle East and oil production cuts by the Organization of the Petroleum Exporting Countries Plus (OPEC+), global oil demand hit a five-year seasonal high in February. (Source: “World Oil Demand Jumped to 5-Year Seasonal High in February,” OilPrice.com, April 17, 2024.)

This combination of events should continue to support bullish moves by shares of oil and natural gas companies like Chord Energy Corp (NASDAQ:CHRD).

Most people aren’t familiar with this company. It only got its current name in July 2022 when Oasis Petroleum Inc. joined forces with Whiting Petroleum Corporation to become Chord Energy. (Source: “Whiting and Oasis Complete Combination, Establishing Chord Energy,” Chord Energy Corp, July 1, 2022.)

The $6.0-billion merger created a scaled unconventional U.S. oil producer with a premier position in the Williston Basin.

The company is about to get a lot bigger.

In February, Chord Energy announced plans to merge with Enerplus Corp (NYSE:ERF) in an $11.0-billion stock and cash transaction. The acquisition is expected to close in the second quarter. (Source: “Chord Energy and Enerplus to Combine in $11 Billion Transaction Creating Premier Williston-Focused E&P Company With Top-Tier Shareholder Returns,” Chord Energy Corp, February 21, 2024.)

The merger is expected to generate up to $150.0 million per year in cost savings and be accretive to cash flow per share, free cash flow per share, net asset value, and return of capital.

The merged company will have a prime position in the Williston Basin of about 1.3 million net acres.

Adding the fourth-quarter 2023 production of the two companies results in a total of 287,000 barrels of oil equivalent per day (BOE/D). In the third quarter of 2023, Chord Energy produced 176,000 BOE/D.

Oil is expected to account for about 56% of the combined company’s production. Chord Energy Corp’s pro forma inventory supports about 10 years’ worth of development at the current pace of production.

Q4 Oil Volume Growth Topped High End of Guidance

For the fourth quarter of 2023, Chord Energy reported oil production of 106,200 barrels per day (B/D) and total production of 183,800 B/D. Both numbers exceeded the high end of the company’s guidance. (Source: “Chord Energy Reports Fourth Quarter and Full-Year 2023 Financial and Operating Results, Declares Base and Variable Dividends and Issues 2024 Outlook,” Chord Energy Corp, February 21, 2024.)

During the fourth quarter, the company’s net cash provided by operating activities was $543.3 million and its net income was $301.6 million, or $6.93 per diluted share.

In full-year 2023, the company’s net cash provided by operating activities was $1.8 billion and its net income was $1.02 billion, or $23.51 per diluted share. In the full year, the company’s oil production was 99,800 B/D and its total production was 173,004 BOE/D.

Commenting on the results, Danny Brown, Chord Energy Corp’s president and CEO, said, “Chord closed 2023 on sound footing by executing on its program and delivering strong volume growth in the second half of the year.” (Source: Ibid.)

Base-Plus-Variable Dividend of $3.25 Per Share

Some oil and gas companies have come up with a novel way of paying dividends that maximizes returns to shareholders when commodity prices are high but still pays sizeable dividends when the industry is facing headwinds. That’s through base-plus-variable dividends.

Each quarter, Chord Energy Corp pays solid base dividends plus variable dividends that are based on the company’s cash flow. Sometimes, when times are exceptionally good, energy companies hike their base dividends.

Chord Energy stock’s variable payout changes every quarter. For instance, in August 2023, Chord Energy Corp paid a base dividend of $1.25 per share and a variable dividend of $0.11 per share. In November 2023, CHRD stock paid a base dividend of $1.25 per share and a variable dividend of $1.25 per share.

In full-year 2023, Chord Energy returned $646.0 million to its shareholders through a mix of dividends and share repurchases.

In March 2024, Chord Energy Corp paid a cash dividend of $3.25 per share. That included a base dividend of $1.25 per share and a variable dividend of $2.00 per share. (Source: Ibid.)

As of this writing, that works out to a yield of 5.61%.

Chord Energy Stock Has 22% Upside

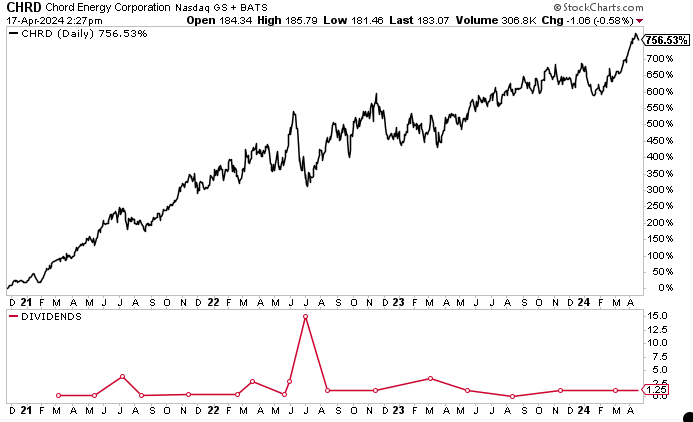

As of this writing, CHRD stock has rallied by an impressive 756% since the company went public in November 2020. Moreover, Chord Energy stock hit a new record high of $190.23 per share on April 12.

The stock continues to trade near that level. It’s up by 23% over the last three months, 12% year-to-date, and 36% year-over-year.

Those are big gains, and fresh highs are expected over the coming quarters. Analysts have provided a 12-month share-price target for Chord Energy Corp in the range of $196.00 to $224.00. That points to potential gains in the range of approximately 7.0% to 22.0%.

Chart courtesy of StockCharts.com

The Lowdown on Chord Energy Corp

Chord Energy is an oil and gas exploration and production company with the largest acreage position in the Williston Basin.

And it’s about to get a lot bigger, once its merger with Enerplus Corp closes this year. The company will have a stronger balance sheet, continue to have a resilient cash flow, and have a leading return-of-capital framework that includes base-plus-variable quarterly dividends.

Thanks to high oil and gas prices, plus record-high demand and consumption, the outlook is excellent for Chord Energy Corp’s business, as well as for CHRD stock’s share price and dividends.