China Petroleum & Chemical Stock Up 20% in 2021 & Provides 8.3% Dividend

China Petroleum & Chemical Corp’s 2020 Results Lead Global Peers

China Petroleum & Chemical Corp (NYSE:SNP), also known as Sinopec, is the listed arm of one of China’s two integrated oil majors. It’s one of Asia’s largest refiners and chemical companies.

Since it’s based in China, many North American investors won’t be all that familiar with Sinopec, which is a shame. China Petroleum & Chemical Corp is a massive oil and gas company with a strong balance sheet. And despite 2020 being a tough year economically, the company recorded industry-leading results.

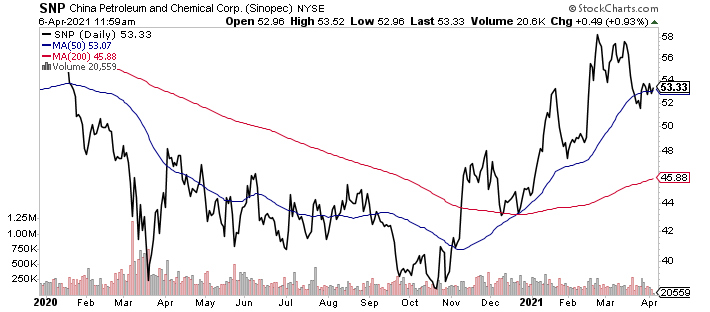

The solid results, coupled with other exciting news, have helped SNP stock advance approximately 20% in 2021. China Petroleum & Chemical stock is also up by nearly 11% year-over-year.

Chart courtesy of StockCharts.com

China Petroleum & Chemical Corp is one of Asia’s largest integrated oil companies in terms of revenue. The company’s revenues come primarily from refining and marketing oil products and from petrochemical production.

Sinopec has China’s largest fuel station network, with more than 30,000 stations, and it enjoys a significant market share in petrochemicals. Moreover, the company owns oil and gas assets in the Shandong and Sichuan provinces.

China Petroleum & Chemical Corp was established in 2000 by China Petrochemical Corporation, a state-owned enterprise and a majority shareholder of SNP stock.

The idea of investing in a state-owned oil and gas company that isn’t exactly chummy with the U.S. may not sit well with all investors, but Wall Street doesn’t seem to mind. As of this writing, 155 institutions have holdings in China Petroleum & Chemical stock.

Five of the top institutional holders of SNP stock are:

| Holder | Shares | Value |

| Renaissance Technologies, LLC | 3,055,204 | $136.3 Million |

| Dimensional Fund Advisors LP | 1,265,827 | $56.5 Million |

| Arrowstreet Capital, Limited Partnership | 816,409 | $36.4 Million |

| Northern Trust Corporation | 427,193 | $19.1 Million |

| Royal Bank of Canada | 386,663 | $17.2 Million |

Five of the top mutual fund holders of the stock are:

| Holder | Shares | Value |

| DFA Investment Dimensions-DFA Emerging Markets Value | 882,890 | $41.9 Million |

| DFA Emerging Markets Core Equity Portfolio | 196,340 | $9.3 Million |

| SPDR Portfolio Emerging Markets ETF | 146,853 | $8.1 Million |

| Fidelity Low-Priced Stock Fund | 98,164 | $4.7 Million |

| DFA Emerging Markets Series | 61,856 | $2.9 Million |

(Source: “Major Holders,” Yahoo! Finance, last accessed April 8, 2021.)

In late March, China Petroleum & Chemical Corp reported 2020 operating income of $321.2 billion, with profitability attributed to shareholders of $5.0 billion. (Source: “Sinopec’s 2020 Performance Leads Global Peers, Strives to Achieve Carbon Neutrality 10 Years Ahead of China’s Goal,” Cision, March 30, 2021.)

Thanks to ongoing profitability, the company was able to maintain a healthy dividend. Combined with a special dividend, China Petroleum & Chemical stock pays an annual dividend of $4.37 per share, for a yield of 8.3%. And it’s safe; the payout ratio is just 70.7%.

Sinopec has a history of raising its dividends and maintaining a high yield. SNP stock’s five-year average dividend yield is seven percent.

The outlook is solid for the company, too. Management said it expects to report first-quarter profitability of $2.4 to $2.7 billion. In addition to strong profitability, Sinopec stands out as one of the only oil and gas companies in Asia to boost its 2021 capital spending: 24% year-over-year to $25.5 billion.

The Lowdown on China Petroleum & Chemical Corp

China Petroleum & Chemical Corp is an excellent energy company operating in the second-largest economy in the world. By 2028, it’s expected that China will overtake the U.S. as the world’s largest economy, five years earlier than previously expected.

If opportunity is important to you, it’s certainly not a bad idea to look at one of the largest oil and gas companies operating in one of the biggest, fastest-growing economies.