Capital Southwest Stock: 10.20%-Yielder for Steady Income

CSWC Stock’s Dividend Streak at 42 Years

Small dividend stocks with a long history of paying regular dividends are not all that abundant. In fact, they are rare, usually existing in the realm of much bigger companies.

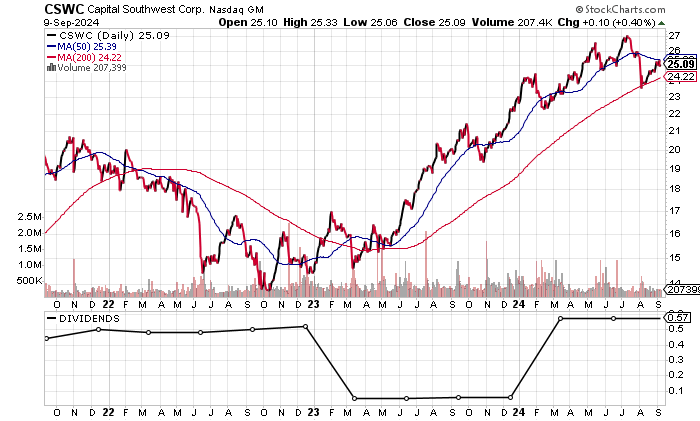

But I have discovered one opportunity: Capital Southwest Corporation (NASDAQ:CSWC). The stock has rallied 242% since the pandemic low. At the same time. Capital Southwest stock has paid a regular dividend along the way, dishing out dividends in 42 consecutive years.

Capital Southwest is a financial firm that pursues credit and private equity and venture capital investments in middle market companies, buyouts, recapitalizations, and mezzanine, later-stage, mature, late-venture, emerging-growth, and growth-capital investments.

The company targets areas of investment such as industrial manufacturing and services, value-added distribution, health-care products and services, business services, specialty chemicals, food and beverage products and services, tech-enabled services, and software-as-a-service models. (Source: “Southwest Corporation; Profile,” Yahoo! Finance, last accessed September 10, 2024.)

The company raised its quarterly dividend to $0.64 per share effective the September payment, up from the previous $0.63 per share. Not a big increase, but Capital Southwest stock is all about paying consistent dividend income over time.

Capital Southwest stock traded at a 52-week high of $27.23 on July 17, now just below its record $28.41 reached in October 2021

Moreover, CSWC stock has moved into a golden cross, a bullish technical crossover where the 50-day moving average (MA) of $25.40 is above the 200-day MA of $24.80. Holding this formation could see the stock move towards its record high.

Chart courtesy of StockCharts.com

Strong Revenue Growth Continues into First Quarter

Capital Southwest reports in a fiscal year ending March 30. The last report was for fiscal 2024.

The five-year revenue picture shows growth in the last four consecutive years to the record $178.1 million in fiscal 2024. Moreover, Capital Southwest has grown revenues in eight straight years dating back to fiscal 2017.

| Fiscal Year | Revenues (Millions) | Growth |

| 2020 | $62.0 | N/A |

| 2021 | $68.1 | 9.8% |

| 2022 | $82.2 | 20.7% |

| 2023 | $119.3 | 45.1% |

| 2024 | $178.1 | 49.3% |

(Source: “Capital Southwest Corporation,” Seeking Alpha, last accessed September 10, 2024.)

Analysts estimate that Capital Southwest will report higher revenues of $201.5 million in fiscal 2025, followed by $206.4 million to as high as $223.6 million in fiscal 2026. In the fiscal first quarter ended June 29, its revenues came in at $51.4 million, up 27.2% year over year. (Source: Yahoo! Finance, op. cit.)

On the bottom line, the company has generated generally accepted accounting principles (GAAP) profits in five straight years, with growth in the last four years. In my view, this is impressive given the nature of the business that tends to be uncertain, depending on the economy and interest rates.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2020 | $1.57 | N/A |

| 2021 | $1.66 | 5.7% |

| 2022 | $1.87 | 12.7% |

| 2023 | $2.29 | 22.5% |

| 2024 | $2.70 | 17.9% |

(Source: Seeking Alpha, op. cit.)

Looking ahead, analysts estimate that Capital Southwest will report $2.59 per diluted share in fiscal 2025 and $2.47 per diluted share in fiscal 2026. (Source: Yahoo! Finance, op. cit.)

The working capital is extremely strong, but the risk with Capital Southwest is the total debt of $738.6 million on the balance sheet at the end of June. This is usual for these types of loan businesses that are all about moving capital to clients. (Source: Yahoo! Finance, op. cit.)

The steady revenue and profit growth should support the company’s ability to deal with the debt, and this should improve as interest rates begin to ratchet lower over the next few years.

Capital Southwest Stock: Dividends Up 574% Since 2016

Dividend growth has been strong. Capital Southwest paid $0.38 per share in dividends in fiscal 2016, and it’s targeted to dish out $2.56 per share in fiscal 2025.

The forward yield of 10.2% is attractive and just above the five-year average dividend yield of 9.38%. (Source: Yahoo! Finance, op. cit.)

The Lowdown on Capital Southwest Stock

In my view, Capital Southwest stock is suitable for income investors seeking regular income and moderate price appreciation over time. The high yield is attractive, but it could decline if the stock can gain any traction. In this case, the yield would drop, but the share price would rise.

Be aware of the risk given the nature of the company’s investment business. So far, over the last five years, Capital Southwest Corporation has provided steady results.