NYSE:DLR-H: Can This 7% Dividend Yield Really Be Safe?

An Interesting 7% Yield

In a world of zero-percent interest rates, few investments offer higher yields than preferred shares.

Regular readers have heard me tout these before. Preferred shares represent a kind of hybrid between stocks and bonds, allowing investors to trade distribution growth in the future for a bigger yield today.

Better still, owners get paid before common stockholders see one red cent in dividends. And in the event of a bankruptcy, preferred shareholders stand near the front of the line to get their money back. For these reasons, they tend to represent a safer, less volatile income stream.

Case in point: Digital Realty Trust, Inc. Series H Preferred (NYSE:DLR-H). The partnership leases out huge data centers to tech giants. And with a fixed, upfront yield of nearly seven percent, these shares might be worth investigating further.

We have a big margin of safety, for starters. Digital Realty is conservatively capitalized with a sturdy balance sheet. Management has only borrowed about $0.40 in debt for every dollar of assets on the books.

Moreover, the business throws off ample cash. Digital Realty generates $3.55 in cash flow for every dollar paid out in interest and preferred dividends. In other words, we have a big safety net here in the event that business takes a downturn.

That wiggle room should continue to grow.

Also Read:

How to Calculate Dividend Yield?

We have an obsession with downloading videos, checking social networks, and snapping thousands of photos. Over the past two years alone, humanity created more data than the previous 5,000 years combined.

But our virtual world requires an increasing amount of physical (and expensive) space. Tech giants have built out sprawling data centers to support their businesses, which can cost upwards of $1,000 per square foot to build. And with storage demand projected to grow at by 50% per year for the foreseeable future, vacancies will remain scarce.

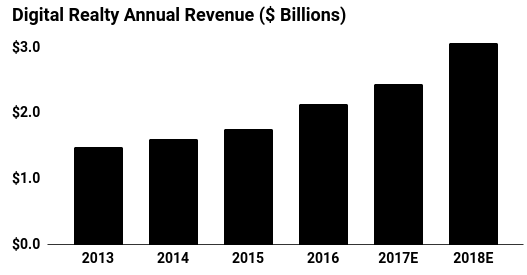

In the case of Digital Realty, analysts projects profits to grow at a high single-digit annual clip through 2022. For common shareholders, that should translate into growing dividends. For preferred stockholders, that increases the safety of our income stream.

This deal has one wrinkle, however.

Unlike common stocks, preferred shares often come with callable dates. Past a certain point, companies have the right to redeem the issue. Owners receive the par value for their shares (usually set at $25.00), regardless of what they might have paid for them.

Redemption usually follows a drop in interest rates. Companies will buy back their high-rate preferreds and sell new issues with lower yields. This can save companies a boatload of money in preferred dividends.

In the case of Digital Realty’s “Series H” preferreds, that’s a real problem. Management has the right to redeem these shares at any time after March 2019 at $25.00. And given the partnership has issued new preferreds at considerably lower yields, executives will probably exercise this privilege.

A deal breaker?

For the “buy and hold” crowd, sure. Over the next year or so, however, investors will likely continue to collect their seven-percent payout. And given preferred owners stand first in line to get paid, this issue represents one of the safest high yields around.