Camping World Stock: Undervalued 11.6%-Yielder Has 58% Upside

Why Wall Street Is Bullish on CWH Stock

Camping World Holdings Inc (NYSE:CWH) is a consumer cyclical company whose stock is being held back by perceived economic headwinds, fears of a recession, rising interest rates, and pessimistic investor sentiment.

That said, the company has been doing everything right, and it’s only a matter of time before investors wake up to Camping World stock‘s high potential.

Wall Street analysts are already on board; they’ve provided a 12-month share-price forecast for CWH stock in the range of $28.00 to $34.00 per share. At its current price, this points to potential upside in the range of about 30% to 58%.

Why the enthusiasm?

Camping World Holdings Inc has reported strong financial results for the last number of years.

Moreover, in light of the current economic environment, the company has proactively implemented cost reductions. Starting in the fall of 2022, the company reduced its headcount (yet increased the wages and benefits of its remaining employees) and eliminated or reduced its underperforming assets, locations, and business lines.

Meanwhile, instead of waiting idly on the sidelines for the economy to improve, Camping World Holdings Inc has recently announced five big acquisitions.

All this helps explain why analysts are so bullish on the overlooked, undervalued Camping World stock.

About Camping World Holdings Inc

Camping World is the biggest retailer of recreational vehicles (RVs) and RV-related products and services in the U.S.

The Illinois-based company currently operates almost 200 retail locations in 42 states. It also operates more than 2,600 service bays, up from 2,291 in 2020. (Source: “Investor Presentation: September 2022,” Camping World Holdings Inc, last accessed April 18, 2022.)

The company operates through two business segments: Good Sam Services and Plans, and RV and Outdoor Retail.

The Good Sam Services and Plans segment provides emergency roadside assistance plans; extended vehicle service contracts; property and casualty insurance; travel assistance plans; and vehicle financing and refinancing assistance. This segment also produces consumer shows and events, as well as consumer publications and directories. It also sells Good Sam Club memberships and offers co-branded credit cards.

The company’s RV and Outdoor Retail segment sells new and used RVs, RV parts, accessories, and supplies; offers finance and insurance contracts related to the sale of RVs; provides RV servicing, collision work, and interior design; sells outdoor products, equipment, gear, and supplies; and distributes RV furniture (business to business).

The company has 5.5 million active customers and 2.1 million Good Sam Club members.

There’s a lot of room for Camping World Holdings Inc to grow; it has a 15% share of the new RV market and a five-percent share of the used RV market.

Management Announces 5 Acquisitions

At a time when many businesses have been hunkering down and taking a wait-and-see approach to the economy, Camping World has been expanding its presence in Arkansas, California, Michigan, Oregon, and Utah. (Source: “Press Releases,” Camping World Holdings Inc, last accessed April 18, 2023.)

In 2022, the company announced seven acquisitions, including Richardson’s RV Centers, the largest acquisition in Camping World’s history. Solidifying its position as the No. 1 RV dealer in California, the Richardson’s agreement includes eight locations in California and Indiana, comprising five dealerships, one future dealership, and two parts and service centers.

So far in 2023, Camping World has announced the following five acquisitions.

On March 14, the company announced it was acquiring Pan Pacific RV Center, which includes two RV dealerships in northern California. The acquisition, which is expected to close in the second quarter of this year, will increase the company’s location count in California to 20.

On March 27, Camping World Holdings Inc announced plans to become the No. 1 RV retailer in Utah (by unit volume) by acquiring Carbon Emery RV. This acquisition will include two dealerships along U.S. Route 6. The deal, which is expected to close in the second quarter, will increase Camping World’s location count in Utah to six.

On April 6, Camping World Holdings Inc announced that it would be preserving its No. 1 market position in Arkansas by acquiring Breeden RV Center in Van Buren. This acquisition, which is expected to close in the second quarter, will increase the company’s location count in Arkansas to four.

On April 11, the company announced that it would be acquiring Travel Land RV Center in Houghton Lake, Michigan. This acquisition is expected to close in the second quarter, and will increase the company’s location count in Michigan to seven.

On April 13, Camping World Holdings Inc announced plans to acquire All Seasons RV in Bend, Oregon. This acquisition, which is expected to close in the second quarter of 2023, will increase the company’s location count in Oregon to six.

Camping World Holdings Inc’s Used Vehicle Sales Hit Record High in 2022

Despite the tough economic climate, Camping World managed to report wonderful financial results for 2022.

In 2022, the company’s revenues inched up by 0.8% to $7.0 billion. Its used vehicle revenues increased by 11.3% to a record $1.9 billion, although its new vehicle revenues slipped by 2.2% to $3.2 billion. (Source: “Camping World Holdings, Inc. Reports Strong 2022 Results,” Camping World Holdings Inc, February 21, 2023.)

In 2022, the company sold a record 51,325 used vehicles, an increase of 4.9% year-over-year, and 70,429 new vehicles, a decrease of 9.4% year-over-year.

Camping World Holdings Inc’s gross profit went down in 2022 by 7.9% to $2.3 billion. Its total gross margin in 2022 was 32.5%, a decrease of 306 basis points, driven primarily by the higher cost of new vehicles. Its new vehicle gross margin was 20.2%, down from 26.5% in 2021. Its used vehicle gross margin in 2022 was 24.5%, down from 26.0% in 2021.

The company reported full-year 2022 net income of $351.0 million, or $3.22 per share, down from its 2021 net income of $642.0 million, or $6.07 per share.

Camping World Stock’s High-Yield Quarterly Dividend Maintained at $0.625/Share

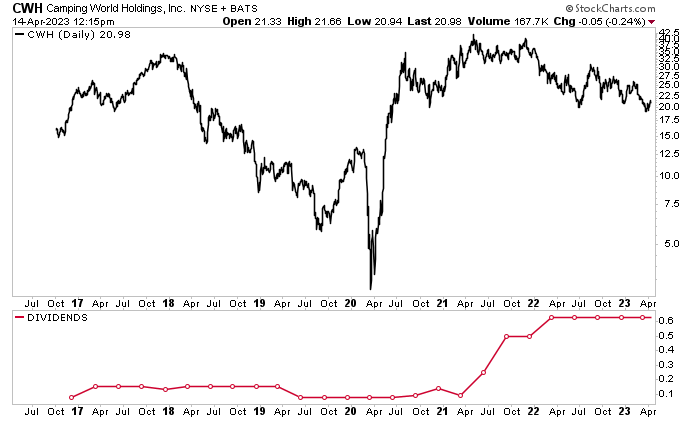

CWH stock’s price might not be performing all that well right now, down by 2.6% year-to-date and 20.7% year-over-year (as of this writing), but patient investors can ride out the volatility with the company’s high-yield dividends.

In February, Camping World Holdings Inc’s board declared a regular cash dividend of $0.625 per share, for an inflation-crushing current yield of 11.6%. That dividend yield doesn’t just kick inflation to the curb; it’s also better than anything Camping World stock’s peers are throwing up.

For instance, Harley-Davidson Inc‘s (NYSE:HOG) current dividend yield is just 1.8%. Another big difference is that Harley-Davidson cut its dividend during the COVID-19 pandemic, from $0.38 to $0.02 per share. HOG stock’s dividend has increased since then, to $0.165 per share, but that’s still way below its pre-pandemic level.

Camping World Holdings Inc, on the other hand, has increased its payout a number of times since the stock market crashed in February/March 2020. Furthermore, the company can afford to raise its dividend again; CWH stock’s payout ratio is currently about 77.5%.

Chart courtesy of StockCharts.com

The Lowdown on Camping World Holdings Inc

Camping World is a great consumer cyclical company that continues to do well despite economic headwinds.

Camping World stock might not be performing well right now in terms of share price, but the company has been doing everything necessary to protect its status as the leading RV retailer in the U.S.

In addition to reporting tremendous financial results, Camping World Holdings Inc has continued to announce strategic acquisitions, open new locations, and take steps to reduce its costs. This should help juice its share price once the economy returns to normal. Until then, dividend hogs can take solace in CWH stock’s reliable, growing, ultra-high-yield dividends.