Brookfield Renewable Partners LP: This Income Stream Now Yields 7%

This Stock Pays Out 7%

Brookfield Renewable Partners LP (NYSE:BEP) wants to do a lot of good, both for nature and for investors.

The limited partnership is one of the largest renewable power companies in the world. It aims to reduce greenhouse gas emissions by producing wind, solar, and hydroelectricity for customers.

It’s a nice goal. But is the partnership’s distribution (which currently yields almost seven percent) nice, too? Let’s dig into this payout.

Clean energy production can be quite the cash cow business. Sure, it costs a lot of money up front, but once you have a project up and running, it just sits there delivering electricity to customers.

And these cash flows are quite reliable. As long as the wind blows and the sun shines, you’re making money. Power generation can vary substantially from month to month, but over the course of a year, electricity production is quite reliable.

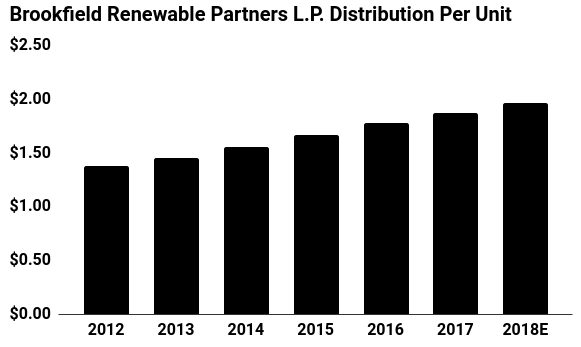

This has resulted in a reliable income stream for shareholders. Since going public in 2005, BEP stock has paid a distribution to investors every single year. Last year, the partnership mailed out over $340.0 million in payments.

Looking forward, that income stream will likely continue to grow. Brookfield’s contracts come with built-in price hikes that should boost overall cash flows by one to two percent each year. And as legacy contracts come up for renewal, management expects to secure significantly higher power rates.

But the big growth driver will be new projects. Executives aim to invest $600.0 million and $700.0 million annually in new green energy projects. With more countries looking to cut emissions, Brookfield has a large universe of potential expansion projects to choose from. (Source: “Investor Day,” Brookfield Renewable Partners LP, September 27, 2017.)

Brookfield could boost its growth rate even faster through acquisitions, assuming management doesn’t overpay. Last year, it invested $203.0 million to buy a partial stake in wind and solar company TerraForm Power Inc (NASDAQ:TERP). Executives followed that move with a $230.0-million investment in TerraForm Global, Inc. (Source: “Brookfield Renewable Completes Acquisition of TerraForm Global,” Brookfield Renewable Partners LP, December 28, 2017.)

(Source: “Distribution History,” Brookfield Renewable Partners LP, last accessed August 13, 2018.)

The big risk here? Interest rates.

Because Brookfield’s business works like a kind of “equity bond,” it competes directly with fixed-income securities for capital. If interest rates rise, traders will likely dump their relatively risky units for safer returns elsewhere.

Higher interest rates could also slow the company’s growth rate because Brookfield funds most of its new projects through debt. Management would likely take on fewer projects if rates rise, resulting in a slower pace of distribution growth.

That said, I would see any sell-off as a chance to scoop up units at bargain prices. Brookfield offers a rare opportunity for investors: the chance to do good for the planet (and for their portfolios).