Broadstone Net Lease Stock a Diversified REIT Yielding 7.4%

BNL Stock Is a Good Ol’ Brick & Mortar Play

Real estate investment trusts (REITs) should form part of an income investor’s diversified investment portfolio. That’s because the mandate of REITs is to provide income to investors.

The majority of REIT stocks were sold off when interest rates began to rise a few years ago, but with the likely end to high rates, income investors have been jumping back on the REIT bandwagon. They hope to get an early start before the masses jump in and drive up share prices.

A diversified REIT that has caught my eye is Broadstone Net Lease Inc (NYSE:BNL). The $3.1-billion company is a great way to play a cross section of the economy.

The REIT focuses on acquiring single-tenant commercial properties that it leases out for long terms. (Source: “Investors,” Broadstone Net Lease Inc, last accessed May 16, 2024.)

At the end of March, Broadstone Net Lease owned 759 individual net leased commercial properties, primarily situated in 44 states. The company’s diverse property mix includes health-care, industrial, office, restaurant, and retail properties.

The REIT has been growing its revenues and generating profits and free cash flow (FCF), but its share price is down by 8.7% in 2024 (as of this writing).

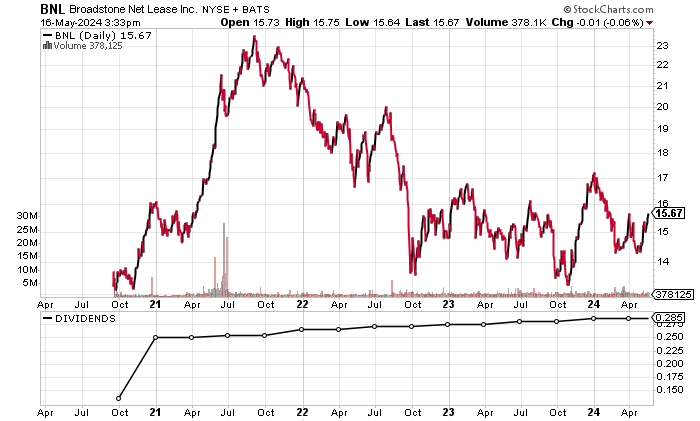

Trading around $15.70 on May 16, Broadstone Net Lease stock is down significantly from its record high of $28.00 in September 2021. I see its current price level as an opportunity.

On its chart, BNL stock is above its 50-day moving average (MA) of $14.92 and its 200-day MA of $15.55. A bullish golden cross pattern could emerge if the stock’s 50-day MA moves above its 200-day MA.

Chart courtesy of StockCharts.com

Steady Revenues, Profitability, & Free Cash Flow

Broadstone Net Lease Inc has reported four consecutive years of rising revenues, including a record-high $448.1 million in 2023.

Analysts estimate that Broadstone Net Lease will report lower revenues of $418.3 million for 2024 and follow that with a small rebound of 3.3% to $432.2 million in 2025. (Source: “Broadstone Net Lease, Inc. (BNL),” Yahoo! Finance, last accessed May 16, 2024.)

The company’s expected slowdown in revenue growth is likely due to the potential economic slowdown in the U.S. as high interest rates continue.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $298.8 | N/A |

| 2020 | $323.7 | 8.3% |

| 2021 | $383.2 | 18.4% |

| 2022 | $408.9 | 6.7% |

| 2023 | $448.1 | 9.6% |

(Source: “Broadstone Net Lease Inc.” MarketWatch, last accessed May 16, 2024.)

Broadstone Net Lease generated gross margins above 90% in the last four years.

| Fiscal Year | Gross Margin |

| 2019 | 84.6% |

| 2020 | 93.4% |

| 2021 | 95.2% |

| 2022 | 94.7% |

| 2023 | 94.9% |

On the bottom line, Broadstone Net Lease Inc has consistently produced generally accepted accounting principles (GAAP)-diluted earnings-per-share (EPS) profits, with growth in the last three straight years.

Analysts expect Broadstone Net Lease to report earnings of $0.85 per diluted share for 2024 and $0.71 per diluted share for 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2020 | $0.44 | N/A |

| 2021 | $0.67 | 52.7% |

| 2022 | $0.72 | 7.6% |

| 2023 | $0.83 | 15.8% |

(Source: MarketWatch, op. cit.)

Broadstone Net Lease Inc’s funds statement shows the company consistently delivering positive FCF. This allows for dividends, debt repayment, and share buybacks.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $142.3 | N/A |

| 2020 | $168.2 | 18.2% |

| 2021 | $243.3 | 44.7% |

| 2022 | $224.5 | -7.7% |

| 2023 | $224.8 | 0.1% |

(Source: MarketWatch, op. cit.)

At the end of March, Broadstone Net Lease Inc’s balance sheet pointed to strong working capital, total debt of $1.9 billion, and $222.8 million in cash. (Source: Yahoo! Finance, op. cit.)

A high debt load is typical of REITs because they need to spend capital to expand. I don’t see any immediate concern with Broadstone Net Lease’s debt, given its strong cash position and its ability to generate profits and positive FCF.

The REIT has been easily covering its annual interest expenses with higher earnings before interest and taxes (EBIT). Its interest coverage ratio in 2023 was reasonable at 3.0 times.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $133.4 | $76.1 |

| 2021 | $175.3 | $64.1 |

| 2022 | $209.4 | $78.7 |

| 2023 | $244.1 | $80.1 |

(Source: Yahoo! Finance, op. cit.)

Broadstone Net Lease Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is an extremely strong 8.0. This is just a notch below a perfect score of 9.0.

Broadstone Net Lease Stock’s Dividend Likely to Increase

In July, BNL stock will be paying a quarterly dividend of $0.29 per share. (Source: “Broadstone Net Lease, Inc. Common Stock (BNL) Dividend History,” Nasdaq, last accessed May 16, 2024.)

As of this writing, that works out to a forward dividend yield of 7.4%. (Source: Yahoo! Finance, op. cit.).

With the company’s high FCF, the stock’s dividends could rise for the fifth straight year.

| Metric | Value |

| Dividend Growth Streak | 4 Years |

| Dividend Streak | 5 Years |

| 10-Year Average Dividend Yield | 6.1% |

| Dividend Coverage Ratio | 1.3 |

The Lowdown on Broadstone Net Lease Inc

Income investors who seek regular dividends and the potential for above-average share-price appreciation should look at Broadstone Net Lease stock.

BNL stock has attracted strong institutional support, with 394 institutions holding 84.6% of the outstanding shares (as of this writing). The top two institutional investors are The Vanguard Group, Inc., with a 14.84% stake, and BlackRock Inc (NYSE:BLK), with a 10.05% stake. (Source: Yahoo! Finance, op. cit.)