Brandywine Realty Stock: Bullish 16.4%-Yielder Has 70% Upside

BDY Stock Up 17% Over Last 3 Months

The time is ripe, once again, for equity real estate investment trusts (REITs) like Brandywine Realty Trust (NYSE:BDN).

Technically, REITs should do well when interest rates are on the rise. They can pass the increases on to their tenants through rent hikes. Then, REITs pass their extra income on to investors in the form of high-yield dividends. To maintain their status as REITs, these companies legally need to return at least 90% of taxable income to their shareholders.

Not all equity REITs are the same, though. They may be able to increase their rents, but their underlying operations can be hit by economic changes differently. The COVID-19 pandemic wasn’t kind to REITs that were focused on restaurants and the retail industry. Health-care REITs, especially those with retirement homes, took a hit due to the optics regarding the spread of COVID-19.

That said, many REITs have annual rent increases built into their contracts. The increases are generally tied to the Consumer Price Index (inflation), although there are limits to how much REITs can raise their rents. This can, at times, result in inflation outpacing the built-in rent hikes.

REITs don’t put all their eggs in one basket, though. Generally, a portion of their leases are negotiated each year. Moreover, when inflation is running hot, like it has been for the last couple of years, the demand for property is higher, which leads to higher real estate values.

Unfortunately, most investors tend to see rising interest rates as bad for REITs, so REIT stocks have fallen over the last two years. But with U.S. inflation falling to about three percent (its lowest level in two years) and interest rate hikes winding down, REITs are back in favor with income investors.

The iShares Core US REIT ETF (NYSEARCA:USRT), which tracks U.S. REITs, declined to a low in early October and has been trending higher since then. As of this writing, it’s up by nine percent year-to-date and three percent year-over-year.

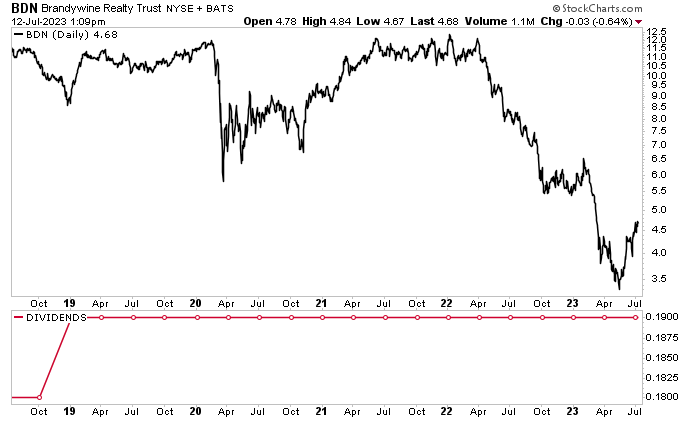

In contrast, Brandywine Realty stock may be down 15% year-to-date, but it’s up by 10% over the last month and 17.5% over the last three months. Despite the big gains, it has a price-to-earnings (P/E) ratio of just 5.7.

BDN stock should continue to trend higher when the current interest-rate-hike cycle ends, which should occur by year-end. Conservative Wall Street analysts are bullish on Brandywine Realty stock at the moment. They’ve provided a 12-month median share-price estimate of $5.00 and a high estimate of $8.00. This points to potential gains in the range of about seven percent to 71%.

Brandywine Realty Trust comes by those bullish calls honestly. The trust has been reporting solid financial results, growing its real estate portfolio, achieving high occupancy levels, and paying reliable, high-yield dividends.

Chart courtesy of StockCharts.com

About Brandywine Realty Trust

Brandywine Realty is one of the largest publicly traded REITs in the U.S. Since its founding in 1994, the company has grown from 200,000 square feet and a total market capitalization of less than $5.0 million to more than 24 million square feet and a total market capitalization of approximately $5.0 billion. It also has $2.6 billion in development. (Source: “Home Page,” Brandywine Realty Trust, last accessed July 14, 2023.)

Brandywine Realty has a core focus on urban, town center, research and lab space, and transit-oriented properties in Austin, Texas; Philadelphia, Pennsylvania; and Washington, D.C. (Source: “Supplemental Information Package: 2023 First Quarter,” Brandywine Realty Trust, last accessed July 14, 2023.)

Why these cities? Because they’re growing.

According to various sources presented by Brandywine Realty Trust, Austin is the fastest-growing office market, the fastest-growing metropolitan region, and the best place to start a business. It’s also the second-best job market of the top 50 metro regions and the second-hottest city for commercial real estate.

Philadelphia is the sixth-largest city in the U.S. in terms of population, and a leading global hub for research and innovation. The city gets the most National Institutes of Health (NIH) funding for cell and gene therapies, bringing in $317.1 million between 2018 and 2022. Some 80% of the pharmaceutical and biotech companies in the U.S. have offices in Greater Philadelphia. The city has had the No. 1 growth rate for highly educated population among the 25 largest metro areas since 2008. Philadelphia also ranks among the most affordable cities in the U.S.

Washington, D.C. is the nation’s capital and one of the most sought-after investment markets in the world.

Brandywine Realty Trust’s tenant mix comprises business services (16%), legal services (15%), finance (11%), manufacturing (nine percent), engineering and management services (eight percent), insurance (seven percent), banking (five percent), and transportation/public utilities (four percent).

Four of its top tenants are Comcast Corporation (NASDAQ:CMCSA), FMC Corp (NYSE:FMC), IBM (NYSE:IBM), and Spark Therapeutics, Inc.

10% Leasing Pipeline Growth in 1st Quarter

For the first quarter ended March 31, Brandywine Realty reported a net loss of $5.3 million, or $0.03 per share, compared to first-quarter 2022 net income of $5.9 million, or $0.03 per share. (Source: “Brandywine Realty Trust Announces First Quarter Results,” Brandywine Realty Trust, April 19, 2023.)

Its funds from operations (FFO) came in at $50.8 million, or $0.29 per diluted share, versus $60.3 million, or $0.35 per diluted share, in the first quarter of 2022.

During the first quarter of 2023, Brandywine Realty Trust’s core operating portfolio of 72 properties was 89.0% occupied, with 90.4% of the real estate leased out. The company signed 357,000 square feet of new and renewed leases and grew its same-store net operating income by 2.2%.

The company ended the first quarter with $2.1 billion in debt. Of that, 93.1% was fixed-rate and 6.9% was floating. The REIT also had $96.9 million of cash and cash equivalents, and no outstanding balance on its $600.0-million unsecured line of credit.

Commenting on the results, Gerard H. Sweeney, Brandywine Realty Trust’s president and CEO, said, “We continue to make solid progress on all of our active development and redevelopment projects with two developments scheduled for delivery later this year. The 10% growth in our leasing pipeline is further evidence of tenant preferences in flight to quality workplaces.” (Source: Ibid.)

Sweeney noted that Brandywine Realty Trust’s liquidity position was further strengthened by the closing of a $70.0-million unsecured term loan.

Thanks to steady progress being made on its 2023 business plan, as well as all of its operating and financial metric targets, the REIT is maintaining its FFO guidance in the range of $1.12 to $1.20 per share.

Brandywine Realty Trust Maintains Quarterly Dividend at $0.19

In May, Brandywine Realty’s board declared a quarterly cash dividend of $0.19 per share, for a current yield of 16.4%. For context, as mentioned earlier, the U.S. inflation rate is currently about three percent. The company has held its payout at $0.19 per share since the start of 2019. Before that, it raised BDN stock’s dividend over the previous four years. (Source: “Dividends,” Brandywine Realty Trust, last accessed July 14, 2023.)

While some dividend hogs might not like the fact that the REIT has held its distribution at the same level for the last four years, what’s important is that management didn’t cut or suspend Brandywine Realty stock’s payout during the pandemic. That’s because the company continued to generate high amounts of cash.

The only thing that hasn’t followed suit is its share price. But, as mentioned above, BDN stock’s price has been on the mend, and its outlook is solid.

The Lowdown on Brandywine Realty Stock

Brandywine Realty Trust was a superb REIT before the COVID-19 pandemic, and it continues to be one now. It has enviable properties in three of the most sought-after metro regions in the U.S.

The company has a solid balance sheet, a growing pipeline, and high occupancy rates. This allows it to provide BDN stockholders with reliable and (in most cases) growing, high-yield dividends.