Bluerock Residential Growth REIT Inc Provides Safe, Consistent 6.1% Dividend

BRG Stock a Great Option for Income Hogs

Residential real estate investment trusts (REITs) have taken a big hit during the coronavirus pandemic. With businesses forced to shutter their doors and millions of Americans out of work, there were concerns about where rent was going to come from. REITs like Bluerock Residential Growth REIT Inc (NYSEAMERICAN:BRG) have taken a big hit.

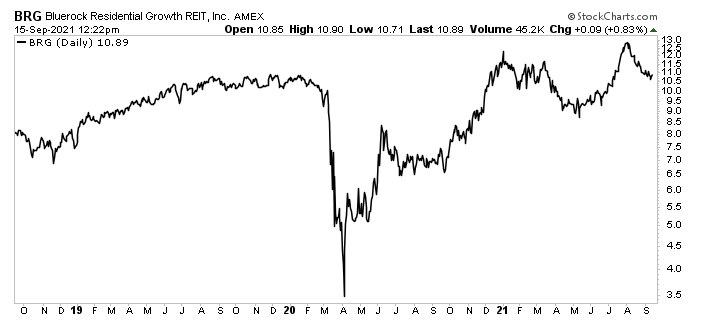

During the March 2020 stock market crash, Bluerock Residential Growth REIT stock cratered by more than 65%. BRG stock rebounded quickly though, and it has made strong strides since then, erasing all of those earlier losses.

Bluerock acquires well-located, institutional-quality apartment properties (live/work/play) in geographic areas with attractive growth. (Source: “NARIET: June 2021,” Bluerock Residential Growth REIT Inc, last accessed September 20, 2021.)

In addition to reaffirming its 2021 cash funds from operations (CFFO) in the range of $0.65 to $0.75 per share, the company’s investment pace has been increasing, including its first investment in single-family homes.

Moreover, Bluerock Residential Growth REIT Inc’s renovation pace has returned to its pre-COVID-19 levels, delivering upgrades to almost 250 units, with an average return on investment (ROI) of 24%.

Thanks to its strong balance sheet, the REIT is looking to acquire new properties and put its capital to work. In aggregate, Bluerock has been engaged in the acquisition of more than 35 million square feet of real estate valued at approximately $10.0 billion. The company currently operates 17,000 apartments and continues to grow.

In the first quarter of 2021, Bluerock’s occupancy rate stood at 95.4%, up by 120 basis points year-over-year. The company collected 97% of its rents in the quarter, compared to 97% in the fourth quarter of 2020.

As the economy continues to reopen, Bluerock’s monthly average lease rate growth continues to accelerate. In July, the REIT’s average lease growth accelerated to 15.3%, up from 12.0% in June, 10.2% in May, 7.7% in April, 5.8% in March, 3.5% in February, and 1.5% in January.

Q2 Portfolio Performance

During the second quarter, Bluerock’s total revenue was $53.8 million, up by 1.5% from $53.0 million in the same prior-year period. Its year-to-date revenue increased by 0.3% year-over-year from $109.3 million to $110.0 million. (Source: “Bluerock Residential Growth REIT Announces Second Quarter 2021 Results,” Bluerock Residential Growth REIT Inc, August 5, 2021.)

The REIT’s rental revenues grew by 4.2% year-over-year from $47.7 to $49.7 million.

The company’s same-store revenues increased by 6.4%, and its same-store net operating income (NOI) increased by 6.5%. Its same-store average rent increased by three percent, and its same-store average occupancy expanded by 80 basis points.

Bluerock’s property NOI in the second quarter of 2021 increased by 5.8% year-over-year from $29.1 to $30.8 million. In the quarter, the portfolio’s blended lease growth rate was 10.3%.

Bluerock Residential Growth REIT Inc’s property operating margins in the quarter improved year-over-year from 61.1% to 62.0%.

The company’s portfolio occupancy was 96.2% as of June 30, 2021, up by 90 basis points from the prior year.

“We are very pleased with our operating results led by rapid acceleration of rent growth throughout the quarter, demonstrating the high quality and favorable locations of our communities,” said Ramin Kamfar, chairman and CEO. (Source: Ibid.)

Bluerock Residential Growth REIT Inc reported a second-quarter net loss attributable to common stockholders of $5.4 million, or $0.21 per share, compared to net income of $15.1 million, or $0.61 per share, in the same prior-year period. Its net income in 2021 was impacted by two asset sales generating $19.0 million in gains on the sale of real estate investments, compared to $58.0 million in the second quarter of 2020.

The REIT’s net loss attributable to common stockholders included non-cash expenses of $22.4 million ($0.80 per share) in the second quarter of 2021, compared to $19.0 million ($0.79 per share) in the same prior-year period.

Its CFFO in the second quarter of 2021 were $6.0 million, or $0.16 per diluted share, compared to $5.1 million, or $0.15 per diluted share, in the same prior-year period.

During the second quarter, Bluerock Residential Growth REIT Inc raised a quarterly record of $119.0 million through its Series T Preferred Stock offering, with the issuance of 4.8 million shares at $25.00 per share. The company also repurchased 4.6 million shares of its own common stock at an average price of $9.79 per share.

Bluerock finished the quarter with $244.5 million of unrestricted cash and availability under revolving credit facilities and $1.4 billion of debt.

Quarterly Dividend of $0.16 From Bluerock Residential Growth REIT Stock

During the second quarter, the company’s board of directors declared a quarterly cash dividend of $0.1625 per share, or $0.65 on an annual basis, for a yield of 6.1%. (Source: “Bluerock Residential Growth REIT (BRG) Announces Third Quarter Dividends on Common Stock,” Bluerock Residential Growth REIT Inc, September 10, 2021.)

Some investors might like to see the company pay higher dividends, but a 6.1% yield is nothing to sneeze at. And the fact that the company held its payout steady instead of cutting it during the worst economic crisis in 100 years is something to behold.

This reliability and stability mean income hogs can count on BRG stock’s high-yield dividends to reward them when times are good, and when they’re awful.

Chart courtesy of StockCharts.com

The Lowdown on Bluerock Residential Growth REIT Inc

Bluerock Residential Growth REIT Inc is a great REIT with a big property portfolio that’s getting bigger.

The company has been reporting strong business growth and improving cash flow. Furthermore, its reliable, high-yield dividends make Bluerock Residential Growth REIT stock an excellent option for dividend hogs.