Black Stone Minerals Stock: 7.3%-Yielding O&G Stock Hikes Dividend 48%

Black Stone Minerals LP’s Outlook Is Bullish

Black Stone Minerals LP (NYSE:BSM) is an ultra-high-yield dividend stock that has been on a tear since the stock market bottomed in March 2020. BSM stock’s rally has been fueled by high commodity prices, which have helped drive the company’s production activity and cash flows.

Meanwhile, strong cash flows and a low debt balance help Black Stone Minerals stock return a higher percentage of the partnership’s cash flow to unitholders in the form of growing dividends: $3.8 billion worth over the last 20 years. It’s difficult to find that kind of opportunity in the current economic environment.

Black Stone Minerals is the largest pure-play oil and gas mineral and royalty owner in the U.S. The company has more than 20 million mineral and royalty acres (7.4 million net), with interests in 41 states. (Source: “Piper Sandler – 22nd Annual Energy Conference: March 2022,” Black Stone Minerals LP, last accessed May 26, 2022.)

The partnership has leading positions in several of the most active resource plays, as well as a perpetual call option across the lower 48 states in dozens of prospective plays. Some of its most heavily concentrated positions are in the Permian, Haynesville, and Bakken basins.

Because it’s a minerals play, Black Stone Minerals LP has exposure to oil and gas, but without the hassle of operating costs or capital spending. And thanks to its scale, the company has opportunities to partner with operators to initiate or accelerate drilling.

And demand for oil and gas has been soaring, even with concerns about a recession. The post-COVID-19 economic recovery plus the war in Ukraine have shifted the supply/demand balance. That’s why West Texas Intermediate crude oil has remained above $110.00 per barrel for the first time since 2011. International demand for liquefied natural gas (LNG) is also robust.

Thanks to its diverse footprint, Black Stone Minerals is able to moderate the long-term energy-price volatility that affects many of its peers. Horizontal permitting has increased since the 2020 COVID-19 pandemic lows, with net well additions growing steadily in most quarters.

Black Stone Minerals LP’s share of permits remains in line with historical averages throughout the economic downturn, but it increased throughout 2021 and currently stands at an all-time high. Meanwhile, rig activity on the partnership’s acreage is back to pre-pandemic levels.

Q1 Distributable Cash Flow Up 30%; Adjusted Earnings Up 27%

For the first quarter ended March 31, Black Stone Minerals reported mineral royalty volume of 29.6 thousand barrels of oil equivalent per day (MBOE/D) (71% natural gas), compared to 35.2 MBOE/D in the fourth quarter of 2021 and 31.1 MBOE/D in the first quarter of 2021. The decrease, which was most pronounced in the Shelby Trough, was partly due to the timing of new wells coming online. (Source: “Black Stone Minerals, L.P. Reports First Quarter Results,” Black Stone Minerals LP, May 2, 2022.)

The partnership’s working interest production in the first quarter of 2022 was 3.3 MBOE/D, a 15% decrease from the fourth quarter of 2021 and a 43% decrease from the first quarter of 2021.

The continued decline in working interest volume is in keeping with the company’s decision to farm out its working-interest participation to third-party capital providers.

Black Stone Minerals LP’s total reported first-quarter 2022 production averaged 32.9 MBOE/D, compared to 39.1 MBOE/D in Q4 2021 and 36.8 MBOE/d in Q1 2021.

The partnership’s average realized price per barrel of oil equivalent was $51.25 for the first quarter of 2022. This was an increase of 16% from $44.12 in the fourth quarter of 2021 and a 95% increase from $26.27 in the first quarter of 2021.

Black Stone Minerals LP’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in the first quarter of 2022 were $98.8 million, up by 27.3% from $77.6 million in the fourth quarter of 2021 and up by 64.6% from $60.0 million in the first quarter of 2021.

The company’s distributable cash flow in the first quarter of 2022 was $92.6 million, a 30% increase from $71.3 million in the fourth quarter of 2021 and a 72.1% increase from $53.8 million in the first quarter of 2021.

BSM Stock’s Dividend Hiked by Nearly 50%

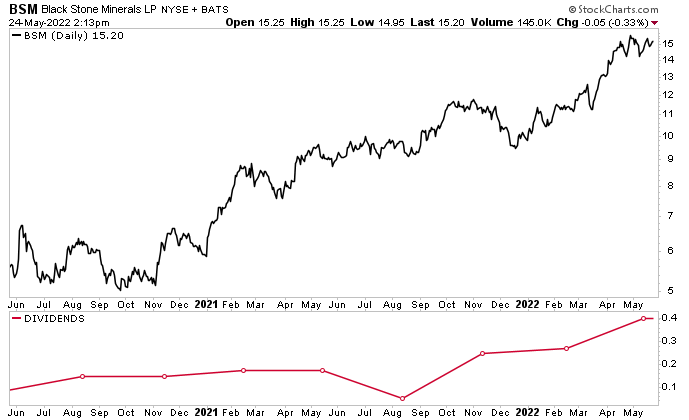

In April, Black Stone Minerals announced that its board approved a cash distribution of $0.40 per unit for the first quarter, for a yield of 7.3%. (Source: “Black Stone Minerals, L.P. Announces Substantial Distribution Increase and Schedules Earnings Call to Discuss First Quarter 2022 Results,” Black Stone Minerals LP, April 25, 2022.)

The new distribution represented a 48% increase over the $0.27 per unit paid out in the fourth quarter and a 128% increase over the $0.175 per unit paid out in the first quarter of 2021.

Chart courtesy of StockCharts.com

Trading at record levels, as of this writing, Black Stone Minerals stock is up by:

- Five percent over the last month

- 33% over the last six months

- 54% year-to-date

- 68% year-over-year

The Lowdown on Black Stone Minerals Stock

Black Stone Minerals LP, the biggest pure-play oil and gas mineral and royalty owner in the U.S., has been taking full advantage of the sustained recovery of crude oil and natural gas prices.

Because of the extensive inventory in its mineral portfolio, the partnership has ample opportunities for organic growth, without needing additional capital for acquisitions.

Through BSM stock, investors gain exposure to a diverse, industry-leading mineral portfolio with access to two of the most active areas in the country. Thanks to the company’s strong cash flow, Black Stone Minerals stock has a long history of delivering solid returns to its shareholders.