Big 5 Sporting Goods Stock: 8.3%-Yielder’s Q2 Earnings Top Pre-Pandemic Levels

BGFV Stock’s Dividend Up 150% Since Third-Quarter 2020

Discretionary spending takes a big hit when the economy is doing poorly or the economic outlook is weak. We’re sort of facing both of those headwinds right now. Inflation is at a decades-high level, interest rates are on the rise, and so too is household debt.

Despite these headwinds, Big 5 Sporting Goods Corp (NASDAQ:BGFV) continues to report wonderful financial results and exceptional earnings growth. This, in turn, has led the company to continue providing Big 5 Sporting Goods stockholders with growing, high-yield dividends.

BGFV stock recently paid a quarterly cash dividend of $0.25 per share, for a yield of 8.3%. The payout is the same as what Big 5 Sporting Goods Corp distributed in the third quarter of last year, but it’s up by 150% from the $0.10 it paid out in the third quarter of 2020 and up by 400% from the $0.05 it paid in the third quarter of 2019. (Source: “BGFV Dividend History,” Nasdaq, last accessed September 20, 2022.)

Big 5 Sporting Goods stock’s high-yield dividend is safe because the payout ratio is just 36.1%, which is way below the 90% threshold I can stomach.

Big 5 Sporting Goods is a leading sporting goods retailer in the western U.S., where it operates 431 stores in 11 states. The name “Big 5” comes from the first five stores the company opened in California. (Source: “About,” Big 5 Sporting Goods Corp, last accessed September 20, 2022.)

The stores sell products including athletic shoes, apparel, and accessories, including equipment for team sports, tennis, golf, snow sports, camping, hunting, and fishing. The products include the company’s own private-label items under the trademarks “Golden Bear,” “Harsh,” “Pacifica,” and “Rugged Exposure.”

Big 5 Sporting Goods Corp Reports Strong Q2 Earnings

For the second quarter ended July 3, Big 5 Sporting Goods reported net sales of $253.8 million, compared to second-quarter 2021 record net sales of $326.0 million. Its same-store sales in the second quarter of fiscal 2022 fell by 22.3% year-over-year but were up by 3.9% versus the comparable period in pre-pandemic fiscal 2019. (Sources: “Big 5 Sporting Goods Corporation Announces Fiscal 2022 Second Quarter Results,” Big 5 Sporting Goods Corp, August 3, 2022.)

The company’s gross profit in the second quarter of fiscal 2022 was $88.9 million, compared to $126.9 million in the second quarter of fiscal 2021. The company’s gross profit margin in the second quarter of fiscal 2022 was 35.0%, versus 38.9% in the second quarter of the prior year.

Big 5 Sporting Goods Corp’s second-quarter 2022 net income was $8.9 million, or $0.41 per diluted share, which was within the company’s guidance range of $0.40 to $0.50 per diluted share. During the second quarter of 2021, the company generated record second-quarter net income of $36.8 million, or $1.63 per diluted share.

Compared to the company’s earnings in its pre-pandemic fiscal second quarters, its fiscal 2022 second-quarter earnings were the highest in its history.

Big 5 Sporting Goods Corp ended the second quarter of fiscal 2022 with no borrowings under its credit facility, and with cash and cash equivalents of $36.6 million. This compares to the end of the fiscal 2022 first quarter, which had no borrowings under the company’s credit facility and $62.0 million of cash and cash equivalents.

Big 5 Sporting Goods’ merchandise inventories at the end of the fiscal 2022 second quarter had increased by 26.8% year-over-year, reflecting more normalized inventory levels relative to sales.

Business Outlook

For the third quarter of fiscal 2022, Big 5 Sporting Goods Corp expects macroeconomic headwinds to continue having a negative impact on consumer discretionary spending.

The company expects its same-store sales to decrease in the high-single-digit range, compared to its same-store sales in the fiscal 2021 third quarter. But compared to the pre-pandemic fiscal 2019, the company’s same-store sales are expected to increase in the low-single-digit range.

Big 5 Sporting Goods Corp expects its fiscal 2022 third-quarter earnings per diluted share to be in the range of $0.22 to $0.32, compared to $1.07 in the third quarter of fiscal 2021 and $0.30 in the third quarter of fiscal 2019.

During the fiscal 2022 second quarter, the company repurchased 199,336 shares of its own common stock, which is a good sign for the future.

BGFV Stock’s Recent Share-Price Performance

Big 5 Sporting Goods stock isn’t exactly setting Wall Street on fire these days, but few specialty retailer stocks are. In fact, few stocks are making large gains.

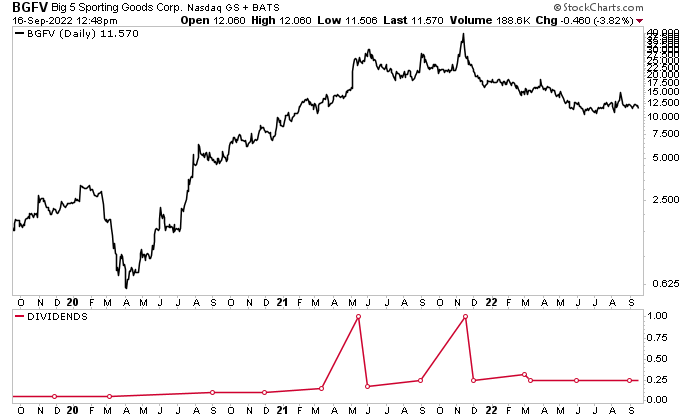

That said, BGFV stock has continued to do well since the COVID-19 pandemic brought the global economy to its knees. Many consumer cyclical stocks did well in 2020, only to give up serious ground in 2021 and 2022. Big 5 Sporting Goods stock is down by 35% year-to-date, but it’s up by more than 300% over its pre-pandemic level.

Chart courtesy of StockCharts.com

The Lowdown on Big 5 Sporting Goods Stock

Big 5 Sporting Goods Corp is an overlooked consumer cyclical company that did exceptionally well during the COVID-19 pandemic. Despite macroeconomic headwinds that accelerated during the second quarter of fiscal 2022, the company’s earnings and revenue far exceeded those of its pre-pandemic second quarters.

The company ended the second quarter of 2022 with a solid balance sheet and healthy inventory positions, and it remains in a great position to achieve solid operating results in the second half of this year.

That means BGFV stock could be one to watch.