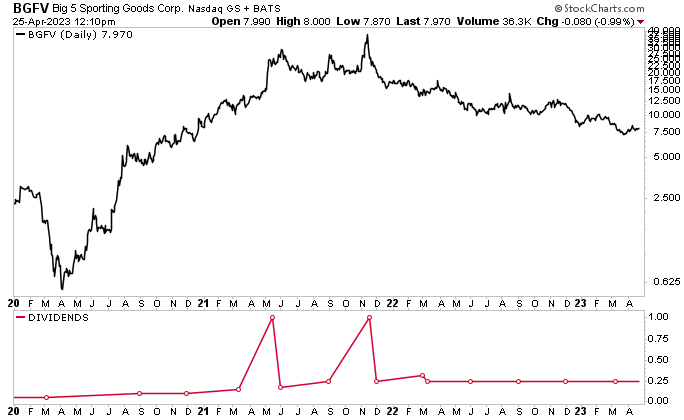

Big 5 Sporting Goods Stock: Debt-Free 12.4%-Yielder Has 35%+ Upside

BGFV Stock Up 180%+ From Pre-Pandemic Level

Big 5 Sporting Goods Corp (NASDAQ:BGFV) is an undervalued specialty realtor that has a great amount of long-term potential.

The company has a rock-solid balance sheet, it plans to open new stores, and—despite macroeconomic headwinds that have softened discretionary spending—it generated a “solid year of earnings” in 2022. Moreover, Big 5 Sporting Goods stock pays reliable, growing, ultra-high-yield dividends.

Despite all the good things going on at Big 5 Sporting Goods Corp, its share price has lagged recently. As of this writing, BGFV stock is down by 11.4% year-to-date and 46.0% year-over-year. On the plus side, Big 5 Sporting Goods stock is up by more than 180% from its pre-pandemic level.

Even with BGFV stock being in the red in 2023, Wall Street analysts aren’t concerned. The stock’s downward move has simply put it in a better trading range. Analysts’ average 12-month share-price target for Big 5 Sporting Goods stock is $11.00, which points to potential upside of about 38%.

Why is Wall Street so bullish on BGFV stock?

The company is one of America’s top retailers of name-brand sporting goods and accessories. The name “Big 5” comes from the first five stores the company opened in California.

The products that the company sells include athletic shoes, apparel, accessories, and equipment for team sports, tennis, golf, snow sports, camping, hunting, and fishing. Those products include the company’s private-label items under the trademarks “Golden Bear,” “Harsh,” “Pacifica,” and “Rugged Exposure.” (Source: “Form 10-K,” United States Securities and Exchange Commission. March 1, 2023.)

Big 5 Sporting Goods Corp ended the first quarter of its fiscal 2023 with 430 stores. During the remainder of fiscal 2023, it expects to open about five new stores, move one store, and close about two stores. (Source: “Big 5 Sporting Goods Corporation Announces Fiscal 2022 Fourth Quarter and Full Year Results,” Big 5 Sporting Goods Corp, February 28, 2023.)

Chart courtesy of StockCharts.com

2022 Was a “Dynamic Year” for Big 5 Sporting Goods Corp

Despite economic headwinds, Big 5 Sporting Goods produced a significant amount of earnings in 2022. It ended 2022 in a superb financial position, with a debt-free balance sheet supported by a healthy inventory position. The company’s disciplined inventory management enabled the company to prioritize merchandise margins and drive up its gross profit.

Steven G. Miller, Big 5 Sporting Goods’ chairman, president, and CEO, said 2022 was “a dynamic year.” (Source: Big 5 Sporting Goods Corp, February 28, 2023, op. cit.)

For the fourth quarter of its fiscal 2022 (ended January 1, 2023), the company announced that its net sales slipped by 12.8% year-over-year to $238.3 million. Its gross profit in the fourth quarter was $79.8 million, compared to $103.0 million in the same quarter of the prior fiscal year. The company’s gross profit margin in its fiscal 2022 fourth quarter was 33.5%, versus 37.7% in the fourth quarter of fiscal 2021.

Big 5 Sporting Goods Corp’s net income in the fourth quarter of fiscal 2022 was $1.7 million, or $0.08 per diluted share. That’s down from $19.9 million, or $0.89 per diluted share, in the fourth quarter of fiscal 2021.

In its full fiscal 2022, the company’s net sales were $995.5 million, compared to $1.2 billion in fiscal 2021. Big 5 Sporting Goods Corp’s full-year net income was $26.1 million, or $1.18 per diluted share. For fiscal 2021, the company reported record net income of $102.4 million, or $4.55 per diluted share.

Big 5 Sporting Goods Corp ended 2022 with no borrowings under its credit facility and a cash balance of approximately $25.6 million. At the end of 2021, the company had no borrowings under its credit facility and $97.4 million of cash and cash equivalents.

The company’s merchandise inventories at the end of fiscal 2022 were 9.6% higher than at the end of fiscal 2021, when the company’s inventories were significantly constrained by supply-chain disruptions.

First-Quarter 2023 Outlook

For the first quarter of fiscal 2023, Big 5 Sporting Goods Corp expects to report that its same-store sales decreased in the mid-single-digit range compared to the fiscal 2022 first quarter. This would be far better than its same-store sales in the fourth quarter of fiscal 2022, when the company’s same-store sales decreased by 13.2% year-over-year.

The company’s same-store sales guidance for the first quarter reflects an expectation that macroeconomic headwinds continued to have a negative impact on consumer discretionary spending.

“Looking at our current trending, while our seasonal winter products have performed well in the first quarter to date, macroeconomic conditions have continued to impact our customers’ discretionary spending,” said Miller. (Source: Ibid.)

Management estimates that Big 5 Sporting Goods Corp’s fiscal 2023 first-quarter earnings were in the range of a loss of $0.02 per share to a profit of $0.06 per share. That’s compared to earnings of $0.41 per diluted share in the first quarter of fiscal 2022.

Quarterly Dividend Maintained at $0.25/Share

There’s no doubt that Big 5 Sporting Goods stock is being held down by industry headwinds, but its outlook is fabulous. In the meantime, to help shareholders weather stock market uncertainty and volatility, BGFV stock provides investors with growing, high-yield dividends.

In March, Big 5 Sporting Goods Corp paid out quarterly cash dividends of $0.25 per share, for a current yield of about 12.4%. The ultra-high-yield dividend is safe: the company’s payout ratio is 84.5%, which is comfortably below the 90% threshold I like to see.

The company’s payout is up substantially from its quarterly dividends of $0.05 per share in 2019. In 2020, during the depths of the COVID-19 pandemic, Big 5 Sporting Goods increased its dividend to $0.10 per share.

Thanks to Big 5 Sporting Goods Corp’s continued strength in its business, cash flow generation, and balance sheet, it increased its payout three times in 2021: to $0.15 per share in March, $0.18 per share in May, and $0.25 in August. (Source: “BGFV Dividend History,” Nasdaq, last accessed April 26, 2023.)

On top of that, the company declared two special dividends of $1.00 per share in 2021.

The Lowdown on Big 5 Sporting Goods Stock

The specialty retail industry has taken a hit lately due to persistently high inflation and a reduction in discretionary spending. Nevertheless, Big 5 Sporting Goods Corp still managed to report a tremendous year of earnings and gross profit.

While the company expects that economic headwinds hurt discretionary spending in the first quarter, management’s long-term outlook for the U.S. economy is strong, with the company expecting to open five new stores in 2023.

Thanks to its solid balance sheet—as well as cooling inflation and predictions that the upcoming recession will be short and mild—Big 5 Sporting Goods Corp is in an excellent position to benefit from the rebounding economy.

Meanwhile, BGFV stock’s reliable, growing, high-yield dividends can help patient investors weather the near-term stock market uncertainty.