Overlooked 8.8%-Yielding BGFV Stock Helps Fight Inflation

Why Big 5 Sporting Goods Stock Is Compelling

Consumer cyclical businesses do well during economic booms, and they suffer during economic downturns. Many retail companies did well during the COVID-19 pandemic, but they’ve failed to maintain that momentum. One specialty retailer, however, has been reporting financials above guidance, raising its dividends, and even rewarding its shareholders with special dividends: Big 5 Sporting Goods Corporation (NASDAQ:BGFV).

The company is a leading athletics and outdoor goods retailer with about 430 stores in 11 western U.S. states. (Source: “About,” Big 5 Sporting Goods Corporation, last accessed June 30, 2022.)

Big 5 Sporting Goods sells products including athletic shoes, apparel, and accessories, as well as equipment for team sports, tennis, golf, snow sports, fitness activities, camping, hunting, and fishing. The products include the company’s own private-label items under the trademarks “Golden Bear,” “Harsh,” “Pacifica,” and “Rugged Exposure.”

The “Big 5” in the company’s name comes from the first five stores the company opened in California. (Source: “History,” Big 5 Sporting Goods Corporation, last accessed June 30, 2022.)

Despite Headwinds, Q1 Results Came in Above of Guidance

For the first quarter ended April 3, Big 5 Sporting Goods reported revenue of $242.0 million, compared to $272.8 million in the same prior-year period. The company’s gross profit in the first quarter was $85.9 million, compared to $97.9 million in the first quarter of the prior year. (Source: “Big 5 Sporting Goods Corporation Announces Fiscal 2022 First Quarter Results,” Big 5 Sporting Goods Corporation, May 3, 2022.)

Its net income in the first quarter of 2022 was $9.1 million, or $0.41 per diluted share. That was above the high end of the company’s guidance range of $0.30 to $0.40 per diluted share. This compares to Big 5 Sporting Goods Corporation’s record first-quarter 2021 net income of $21.5 million, or $0.96 per diluted share (which included a previously reported benefit of $0.06 per diluted share). Its net income in the first quarter of 2019 was $1.7 million, or $0.08 per diluted share.

The company ended the first quarter of 2022 with no borrowings under its credit facility. It also had cash and cash equivalents of $62.0 million.

Big 5 Sporting Goods Corporation’s merchandise inventories at the end of the first quarter of 2022 were up by 18.2% year over year, reflecting a more normalized inventory level relative to sales, along with a higher carryover of winter-related inventory.

During the first quarter of 2022, the company repurchased 94,983 shares of its own common stock.

Steven G. Miller, Big 5 Sporting Goods Corporation’s chairman, president, and CEO, said, “We are pleased to report first quarter earnings results that were slightly ahead of the high end of the guidance range that we provided and significantly ahead of any pre-pandemic first quarter in our history.” (Source: Ibid.)

He added, “As we emerge from the pandemic, the foundation of our business remains extremely solid. While our results versus 2021 reflect very difficult comparisons against last year’s record first quarter, when sales surged due to COVID-related factors, in this year’s first quarter we generated historically strong earnings despite facing a variety of headwinds throughout the period, including unfavorable winter weather, Omicron-related challenges, supply chain disruptions, and inflationary pressures.”

Big 5 Sporting Goods Corporation’s Business Outlook

For the second quarter of 2022, Big 5 Sporting Goods Corporation expects to report a same-store sales decline in the high teens, compared to its record sales in the second quarter of 2021.

The company’s sales during the second quarter of 2021 benefited from pent-up demand following the easing of pandemic-related restrictions. Compared to the pre-pandemic second quarter of 2019, the company’s second-quarter 2022 guidance reflects a same-store sales increase in the high single-digit range.

Big 5 Sporting Goods Corporation expects its net earnings in the second quarter of 2022 to be in the range of $0.40 to $0.50 per share. That compares to record net earnings of $1.63 per diluted share in the second quarter of 2021 and zero net earnings in the second quarter of 2019.

BGFV Stock’s Quarterly Dividend Up 400% From Pre-Pandemic Level

With COVID-19 quarantine orders lifted in 2021, many consumer cyclical companies reported record results for that year. This sent valuations into nosebleed territory. It’s been a different story in 2022, with inflation at 40+year highs, interest rates on the rise, and fears of a recession weighing down much of the stock market.

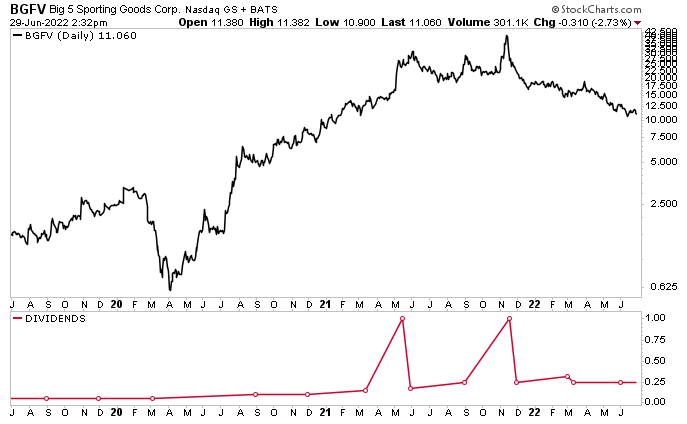

Despite these headwinds, Big 5 Sporting Goods Corporation continues to do well. The company’s numbers are down from its record 2021 numbers (a year in which Big 5 Sporting Goods stock paid out two $1.00 special dividends), but they’re well above its 2019 numbers.

We know Big 5 Sporting Goods’ outlook is solid because it has held its quarterly payout at $0.25 per share, for a yield of 8.8%. The $0.25 payout represents a 38% increase over the $0.18 that BGFV stock paid out in the second quarter of 2021 and a 400% increase over the $0.05 it paid out in the second quarter of 2019. (Source: “BGFV Dividend History,” Nasdaq, last accessed June 30, 2022.)

Big 5 Sporting Goods Corporation has raised its dividend five times since the pandemic began. This includes a 100% increase in 2020 from $0.05 per share to $0.10.

For investors who are concerned about whether Big 5 Sporting Goods stock can continue to reward investors with ultra-high-yield dividends, the answer is yes. The company even has room to raise its dividend again this year. Its payout ratio is just 23.3%, which is way below the 90% threshold I’m willing to stomach.

Big 5 Sporting Goods Stock’s Recent Share-Price Performance

As might be expected, BGFC stock has taken a hit recently, along with the rest of the stock market. As of this writing, shares of Big 5 Sporting Goods Corporation are down by 39% year-to-date and 50% year-over-year.

Big 5 Sporting Goods stock has been doing well compared to where it was before COVID-19, though. It’s up by more than 250% from its February 2019 level. For technical traders, BGFC stock has found support at $6.14 and resistance at $12.20.

There’s only one analyst following Big 5 Sporting Goods Corporation, and that analyst has a 12-month price target of $23.00. This points to upside of 108%. Big 5 Sporting Goods stock is 10% away from its current resistance level, and it needs to climb by more than 70% just to get where it was at the start of this year, before industrywide headwinds dragged it lower.

Chart courtesy of StockCharts.com

The Lowdown on Big 5 Sporting Goods Corporation

Big 5 Sporting Goods Corporation is an under-the-radar consumer cyclical company that did exceptionally well during the pandemic. While its numbers are lower than where they were during its record-setting 2021, its first-quarter 2022 results came in above guidance.

The company is in a great position, and it expects to report another profitable quarter. Big 5 Sporting Goods has recently been benefiting from the same growth drivers that boosted its top- and bottom-line financial growth over the last two years, including favorable product trends, higher merchandise margins, and meaningfully reduced print advertising spending.

That doesn’t mean there won’t be speed bumps along the way, but the annual pay raises that Big 5 Sporting Goods stock provides through its safe and growing high-yield dividends can help buy-and-hold investors ride out the current volatility.