Why Best Buy Is a Top Income Pick: A Dividend That Just Soared 21%

I never thought I’d say this, but Best Buy Co Inc (NYSE:BBY) is a top dividend stock.

Why is that so crazy? Because just a few short years ago, it was pretty much a given that Best Buy would go the way of bankrupt Circuit City, as the rise of digital giant Amazon.com, Inc. (NASDAQ:AMZN) was thought of as just too powerful for any electronics store to survive.

Thanks to management’s turnaround initiatives, however, Best Buy stock is up more than 275% from its five-year lows and now even pays an attractive dividend, leaving investors who wrote the company off with plenty of crow to chew on.

Well, the good news for those same investors is that Best Buy shares plunged nearly nine percent last week on a disappointing earnings report and outlook, providing a fresh window to jump in.

So is this the time to finally get in on Best Buy’s turnaround story? If you’re an income investor looking for a rapidly growing dividend to go along with a juicy yield, I definitely think that’s the case.

Electronic Shock

To be sure, Best Buy’s Q4 results weren’t pretty.

While the company topped earnings per share (EPS) estimates for the 13th straight quarter, revenue slipped one percent year-over-year to $13.5 billion, missing the consensus by $140.0 million. More importantly, Best Buy’s same-store sales, the key metric in measuring retail performance, declined 0.9% in the U.S., suggesting that management’s turnaround efforts are losing a bit of traction.

Management blamed the top-line pressure on largely isolated issues, including “constrained product availability”—calling out items like Samsung Electronics Co Ltd phones, tablets, wearables, and drones—and soft sales within the gaming category.

“Our revenue was hindered by unprecedented product availability constraints across multiple vendors and categories, only some of which were anticipated,” said Hubert Joly, Best Buy’s chairman and CEO. “Additionally, there was considerably weaker-than-expected demand in the gaming category.” (Source: “Best Buy Reports Better-Than-Expected Fourth Quarter Earnings,” Best Buy Co Inc, March 1, 2017.)

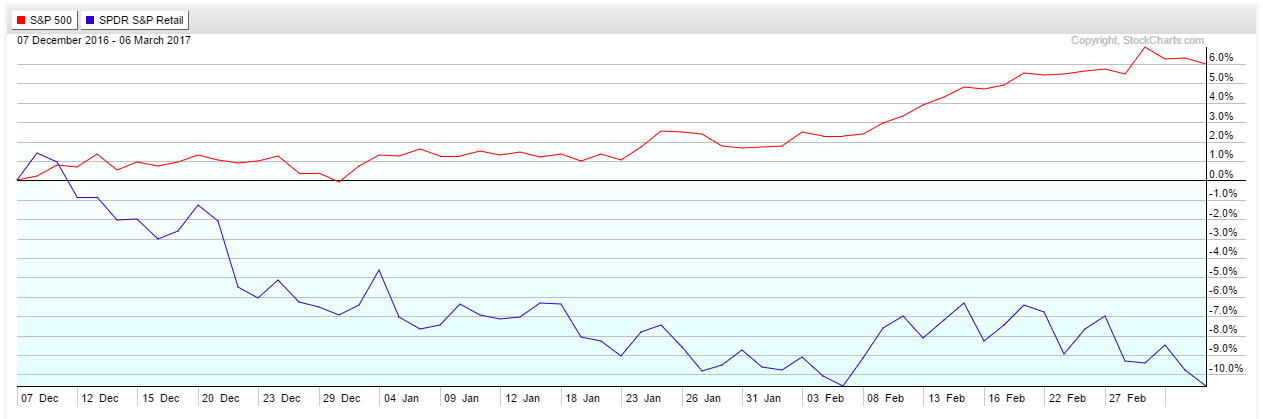

But in my opinion, Best Buy’s top-line trouble has much more to do with wider industry weakness, as sluggish U.S. economic growth and ever-intensifying digital pressure have triggered a retail bloodbath of sorts in recent months. As a result, the SPDR S&P Retail (ETF) (NYSE:XRT) has plunged more than 10% over just the past three months against the S&P’s gain of six percent.

Source: StockCharts.com

With Best Buy expecting same-store sales to fall between one and two percent in the current quarter, I don’t see that pressure letting up anytime soon.

So while Best Buy has certainly done well to stave off Amazon in order to become a viable player again, it’s obvious that it is still quite vulnerable to the strong headwinds facing retail.

Best Days Still Ahead

Still, there are several reasons to remain bullish on Best Buy, not the least of which are found in the very same earnings report.

See, despite supply constraints and wider industry softness, the company’s EPS managed to grow 27% year-over-year on strong pricing and continued cost reductions. Operating margin increased 80 basis points to 6.7% as strong sales within higher-margin computing and home theater categories, as well as falling domestic operating expenses, did well to offset pressure in mobile.

In other words, the goal that Best Buy had set out for itself years ago (to become a leaner and more profitable company) is still very much being met. And the factors that are well within management’s control, such as promotional discipline, merchandise mix, and operating costs, continue to be handled with long-term shareholder value in mind.

In fact, Best Buy saved another $50.0 million in operating expenses in Q4, with the company having now achieved $350.0 million of its three-year target to reduce costs by $400.0 million. This will give management plenty of cash to revamp stores and build up the online business while basically keeping expenses flat.

Furthermore, Best Buy’s online initiatives continue to gain plenty of momentum, with e-commerce sales jumping 17.5% in Q4. E-commerce revenue now represents about 19% of the company’s total domestic revenue, versus 15.6% in the year-ago period, reinforcing my bullishness over the company’s long-term positioning.

Healthy Capital Returns

Of course, what really makes Best Buy’s turnaround special to me is that management has generously shared its improvements with shareholders. As income investors, that’s all we can ask for.

For the year, free cash flow clocked in at $2.0 billion, up nicely from $633.0 million in the year-ago period. Of that cash flow, management returned a solid $1.2 billion to shareholders through dividends and repurchases, which was on top the $1.5 billion already returned in fiscal 2016.

If that two-year total wasn’t healthy enough, Best Buy announced a new two-year, $3.0 billion repurchase plan along with the results last week, taking a bit of the sting out of the disappointing quarter. Of course, the most bullish news for income investors was management’s decision to boost the quarterly dividend 21% to $0.34, or $1.36 for the year.

With management fully committed to getting back on the growth track while also targeting a dividend payout ratio of between 35% and 45%, I’d fully expect continued dividend increases going forward.

“The increase in the dividend and acceleration of our share repurchase program are aligned with our long-term capital allocation strategy and display continued confidence in our ongoing business performance and future cash-flow generation,” Joly said. (Source: “Best Buy Announces Increased Capital Return to Shareholders,” Best Buy Co Inc, March 1, 2017.)

Best Buy a Best Buy?

But has Best Buy fallen enough in price to warrant a purchase? Well, considering how solidly the company’s margins, cash flow, and dividends continue to increase, I’d definitely say so.

In fact, Best Buy now sports a forward dividend yield of 3.1%. That tops big-box rivals like Wal-Mart Stores Inc (NYSE:WMT) (2.9%) and Costco Wholesale Corporation (NASDAQ:COST) (1.1%), as well as the S&P 500 (2.1%). Moreover, Best Buy’s paltry price-to-cash flow of 6.5 represents a clear discount to Amazon’s rather lofty multiple of 25.

Given Best Buy’s still-improving fundamentals and juicy long-term digital upside, I’d expect that valuation gap to narrow over time.

The Bottom Line On BBY Stock

I’d seriously consider taking advantage of Best Buy’s recent pullback. Although weak consumer spending and intense pressure from Amazon has weighed heavily on retailers, Best Buy’s cost-cutting initiatives and pricing discipline continue to stabilize cash flow, while its growing online presence provides attractive long-term potential.

Moreover, with management fully dedicated to sharing the cash flow spoils with investors, Best Buy’s above-average dividend yield is as stable as it is striking.