11.6%-Yield Berry Stock Has High Upside Potential

Why BRY Stock Is Attractive

The Organization of Petroleum Exporting Countries (OPEC) recently extended its cap on oil production in an effort to stabilize and support oil prices. On the supply side, this should help hold prices, especially if the global demand for energy increases.

To play the oil and natural gas segment, consider Berry Corporation (NASDAQ:BRY), a small onshore upstream oil and natural gas producer with a market valuation of $482.4 million as of June 5.

The company, formerly called Berry Petroleum Company, has a long history dating back to 1909. It’s currently focused on the San Joaquin Basin in California (oil 100%) and the Uinta Basin in Utah (oil 65%, gas 35%). (Source: “2024 Q1 Earnings Investor Presentation,” Berry Corporation, May 1, 2024.)

The following are the company’s key operational metrics as of the first quarter of 2024:

- Average production: 25,400 barrels of oil equivalent per day (BOE/D)

- Oil production: 23,800 BOE/D

- California production: 21,300 BOE/D

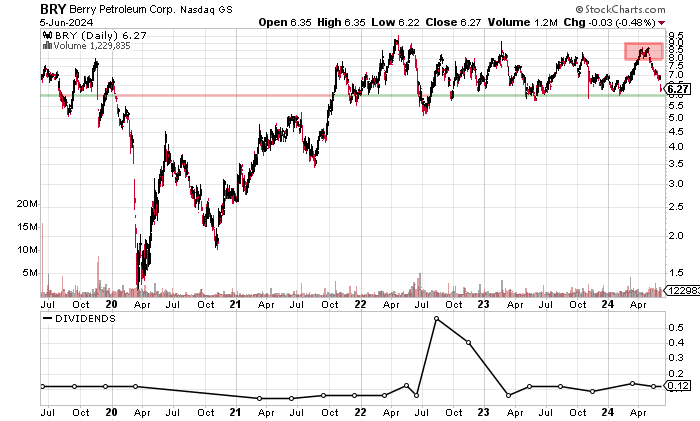

Berry stock is currently struggling after declining to a 52-week low of $6.18 on June 4. The stock’s one-year chart shows two peaks that were followed by sell-offs back to the $6.00 level.

For contrarian income investors who are willing to assume some risk, BRY stock has a compelling risk/reward trade-off at its current price level.

Chart courtesy of StockCharts.

Berry Corporation Needs to Improve Its Fundamentals

Berry Corporation’s current fundamentals show that the company needs to improve its operational results.

Its revenues managed to grow by high double-digit percentages in 2021 and 2022. Moreover, the company generated record-high revenues of more than $1.0 billion in 2022. (Source: “Berry Corp. (bry),” MarketWatch, last accessed June 5, 2024.)

Unfortunately, Berry Corporation reported an 18.2% revenue decline in 2023, and the current estimates call for the company’s revenue weakness to extend into 2024.

Analysts estimate that the company will report a revenue contraction to $684.4 million in 2024 before reporting a rebound to $705.9 million in 2025. (Source: “Berry Corporation (BRY),” Yahoo! Finance, last accessed June 5, 2024.)

| Fiscal Year | Revenues | Growth |

| 2019 | $597.4 Million | N/A |

| 2020 | $406.1 Million | -32.0% |

| 2021 | $701.4 Million | 72.7% |

| 2022 | $1.1 Billion | 50.5% |

| 2023 | $863.5 Million | -18.2% |

(Source: MarketWatch, op. cit.)

Berry Corporation has struggled with its cost management, as evidenced by its inconsistent gross margins, including a contraction to a five-year low in 2023.

| Fiscal Year | Gross Margin |

| 2019 | 58.8% |

| 2020 | 48.0% |

| 2021 | 57.5% |

| 2022 | 55.3% |

| 2023 | 45.6% |

Berry Corporation’s gross-margin weakness led its generally accepted accounting principles (GAAP)-diluted earnings per share (EPS) to fall in 2023.

A bright spot is the company’s earnings outlook. Analysts expect the company to report adjusted earnings of $0.75 per diluted share in 2024, compared to $0.51 in 2023. They expect this to be followed by a surge to $0.96 in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $0.53 | N/A |

| 2020 | -$3.29 | -720.1% |

| 2021 | -$0.19 | 94.1% |

| 2022 | $3.03 | 1,663% |

| 2023 | $0.48 | -84.1% |

(Source: MarketWatch, op. cit.)

Berry Corporation’s funds statement shows inconsistent free cash flow (FCF). A plus is that, in the last two years, the company generated its highest annual FCF levels since 2019, despite a decline in 2023.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $3.0 | N/A |

| 2020 | $114.1 | 3,676% |

| 2021 | -$11.1 | -109.7% |

| 2022 | $221.8 | 2,097% |

| 2023 | $117.6 | -47.0% |

(Source: MarketWatch, op. cit.)

Berry Corporation’s balance sheet carried $450.9 million in total debt and only $3.5 million in cash at the end of March. (Source: Yahoo! Finance, op. cit.)

While the company’s debt-to-equity ratio is higher than what I’d like to see, I don’t envision any immediate concerns.

A company’s ability to pay interest is revealed by comparing its earnings before interest and taxes (EBIT) to its interest expenses.

The following table shows that Berry Corporation’s EBIT easily covered its interest expenses in 2022 and 2023 after the rough COVID-19 pandemic years of 2020 and 2021. The company’s interest coverage ratio in 2023 was 2.6 times.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | -$235.8 | $34.3 |

| 2021 | $17.8 | $31.9 |

| 2022 | $238.6 | $30.9 |

| 2023 | $90.8 | $35.4 |

(Source: Yahoo! Finance, op. cit.)

Berry Corporation’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a soft reading of 3.0, which is below the midpoint of the Piotroski score’s range of 1.0 to 9.0.

There’s room for improvement, given that the company’s score from 2019 through 2023 averaged a far better 5.0.

Berry Stock’s Dividends Should Continue

BRY stock’s forward dividend yield of 11.59% (as of this writing) is relatively high and largely due to share-price deterioration.

I expect that Berry Corporation will try to maintain its seven-year dividend streak. This will likely happen, given the company’s higher expected profitability, and as long as its FCF flow remains positive.

The company’s dividend coverage is strong at 3.6 times.

| Metric | Value |

| Dividend Streak | 7 Years |

| 10-Year Average Dividend Yield | 5.5% |

| Dividend Coverage Ratio | 3.6 |

The Lowdown on Berry Corporation

Berry Corporation has some work ahead of it on the revenue side, but the company’s recent higher profitability is a positive sign. Furthermore, contrarian income investors can collect nice dividends while waiting for the company to improve its operations and drive a rally in Berry stock’s price.

Another positive sign is that institutional ownership of BRY stock is extremely high, with 245 institutions holding 93.4% of the outstanding shares (as of this writing). Insider interest is low at 2.6%, but company insiders have been heavy buyers of Berry stock lately. Over the last six months, insiders acquired a net 1.4 million shares of the stock. (Source: Yahoo! Finance, op. cit.)