Bain Capital Specialty Finance Stock: 4 Special Dividends Declared for 2024

Why BCSF Stock Is Compelling Right Now

With interest rates still at decade highs, financial service companies have been making a lot of money—at least they are if they have a lot of floating-rate loans in their portfolios.

That’s where Bain Capital Specialty Finance Inc (NYSE:BCSF), a business development company (BDC), really shines.

A whopping 93.8% of the BDC’s $2.29-billion total investment portfolio consists of senior secured, floating-rate loans. (Source: “Fourth Quarter Ended December 31, 2023 Earnings Presentation,” Bain Capital Specialty Finance Inc, February 28, 2024.)

That has helped Bain Capital report tremendous quarterly and full-year 2023 results and provide investors with reliable, growing, high-yield distributions. Better still, the company recently announced that it will be paying additional (special) dividends every quarter in 2024.

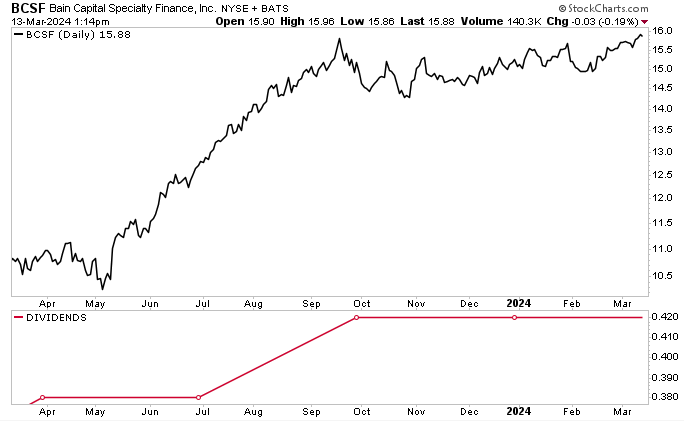

Moreover, Bain Capital Specialty Finance Inc’s strong financial results, which have been fueled by high interest income, have helped juice Bain Capital Specialty Finance stock’s price. As of this writing, BCSF stock is up by 48% year-over-year and 5.5% year-to-date.

So, what is a BDC?

At Income Investors, we’ve nicknamed BDCs “alternative banks.” That’s because they operate like traditional financial institutions, but unlike regular banks, they don’t serve the general public. BDCs have no branches or ATMs. Furthermore, they don’t provide mortgages, checking accounts, or credit cards.

That explains why alternative banks have remained one of Wall Street’s best-kept secrets for years.

The BDC industry has carved out a lucrative niche in the financing marketplace: small and midsized companies. These customers need to borrow more funds than the amounts typically provided by traditional bank loans.

Alternative banks typically lend capital to companies that generate annual revenues in the range of $20.0 to $100.0 million.

Although BDCs are a lifeline for businesses that need an influx of cash, they’re also a boon for dividend-hog investors. That’s because alternative banks legally have to pay out at least 90% of their taxable income to investors as dividends.

About Bain Capital Specialty Finance Inc

Bain Capital Specialty Finance is a BDC that specializes in direct loans to middle-market companies in North America, Europe, and Australia. Its investments are predominantly senior secured, floating-rate loans. (Source: Bain Capital Specialty Finance Inc, February 28, 2024, op. cit.)

Bain Capital Specialty Finance Inc’s diverse investment portfolio currently comprises 137 companies that operate in 31 different industries. By industry, its largest investments include aerospace and defense; high tech; business services; consumer goods; transportation; and health care and pharmaceuticals.

The investment portfolio’s weighted average yield at amortized cost is 13.0%.

Strong Quarterly & Full-Year Results

For the fourth quarter of 2023, Bain Capital reported total investment income of $74.9 million, up by 3.5% from $72.4 million in the third quarter of 2023. The company’s net investment income in the fourth quarter was $34.9 million, or $0.54 per share, down slightly from $35.6 million, or $0.55 per share, in the third quarter. (Source: “Bain Capital Specialty Finance, Inc. Announces December 31, 2023 Financial Results,” Bain Capital Specialty Finance Inc, February 27, 2024.)

During the fourth quarter, Bain Capital invested $206.4 million in 43 portfolio companies, including $56.1 million in two new companies.

For the full year, the company reported total investment income of $297.8 million, up by 35.6% from $219.5 million in 2022. Its net investment income in 2023 was $141.6 million, or $2.19 per share, up by 38% from $102.7 million, or $1.59 per share in 2022.

Commenting on the results, Michael Ewald, Bain Capital Specialty Finance Inc’s CEO, said, “BCSF reported strong quarterly and full year 2023 results as we benefited from attractive levels of interest income, net asset value growth and continued stable credit performance across our primarily senior secured portfolio.” (Source: Ibid.)

Management Declared 4 Extra Dividends for 2024

In February, Bain Capital Specialty Finance Inc’s board declared a first-quarter dividend of $0.42 per share. (Source: Ibid.)

That translates to a yield of 10.56% (as of this writing).

And thanks to the company’s excellent 2023 financial performance, its board also declared additional dividends totaling $0.12 per share for 2024. The special dividends will be paid out in four equal amounts of $0.03 per share during the year.

With the additional payments of $0.12 per share in 2024, Bain Capital Specialty Finance stock’s yield translates to 11.3%.

Chart courtesy of StockCharts.com

The Lowdown on Bain Capital Specialty Finance Inc

Bain Capital Specialty Finance is a terrific BDC that generates a lot of cash. The company reported wonderful fourth-quarter and full-year results for 2023 and declared four extra dividends for 2024 that will total $0.12 per share.

The outlook for BDC stocks like BCSF stock is bright. The current elevated interest rates are expected to help BDCs continue generating relatively high net investment income and dividend coverage.

That expectation is especially applicable to Bain Capital Specialty Finance Inc, given the floating-rate nature of its loan portfolio and its supplemental dividends.