Atlantica Stock: Price of 8.4%-Yielder Up 23% Over 3 Months

AY Stock Could Shine in 2024

I believe 2024 will be an interesting year for holders of high-yield dividend stocks, especially after interest rates begin to decline. Investors who’ve become accustomed to high amounts of interest income should now consider looking at high-yield dividend stocks.

Atlantica Sustainable Infrastructure PLC (NASDAQ:AY) might be just what they’re looking for. The mid-cap company has paid dividends for 10 consecutive years and has increased its dividends for seven straight years.

Atlantica’s objective is to drive renewable energy infrastructure projects while delivering long-term value to investors. (Source: “Company Overview,” Atlantica Sustainable Infrastructure PLC, last accessed January 4, 2024.)

The company’s portfolio currently comprises 2.2 gigawatts (GW) of operating assets. The company’s projects in development feature 2.0 GW of renewable energy and 5.8 gigawatt hours (GWh) of energy storage.

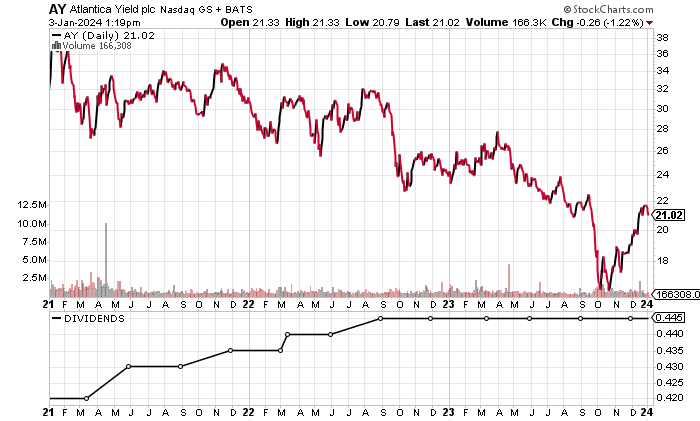

As of this writing, AY stock has rallied by 23.0% over the last three months.

Moreover, investors can collect dividends from Atlantica Sustainable Infrastructure PLC while they wait for its share price to move toward its 10-year high of $48.49, which it achieved in January 2021.

Chart courtesy of StockCharts.com

More Than $1 Billion in Revenues Per Year

Atlantica Sustainable Infrastructure PLC has consistently generated more than $1.0 billion in annual revenues. The company has grown its revenues in two of its last four reported years. Its highest annual revenues in the period of 2018 through 2022 were $1.21 billion in 2021.

Analysts estimate that Atlantica increased its revenues to $1.12 billion in 2023 and that it will grow its revenues to $1.18 billion in 2024. (Source: “Atlantica Sustainable Infrastructure plc (AY),” Yahoo! Finance, last accessed January 4, 2024.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2018 | $1.04 | N/A |

| 2019 | $1.01 | -3.1% |

| 2020 | $1.01 | 0.2% |

| 2021 | $1.21 | 19.6% |

| 2022 | $1.10 | -9.1% |

(Source: “Atlantica Sustainable Infrastructure PLC,” MarketWatch, last accessed January 4, 2024.)

On the bottom line, the company reported three straight years of generally accepted accounting principles (GAAP) profits, prior to reporting GAAP-diluted earnings-per-share (EPS) losses for 2021 and 2022.

But there’s positive news. Analysts estimate that Atlantica Sustainable Infrastructure PLC reversed its trend of losses and earned $0.28 per diluted share in 2023. Their consensus estimate for 2024 is even more encouraging, with the company’s earnings expected to more than double to $0.59 per diluted share.

The analysts have high earnings estimates of $0.78 and $1.21 per diluted share for 2023 and 2024, respectively. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $0.42 | N/A |

| 2019 | $0.61 | 48.1% |

| 2020 | $0.12 | -80.9% |

| 2021 | -$0.27 | -330.6% |

| 2022 | -$0.05 | 82.5% |

(Source: MarketWatch, op. cit.)

Moving on to Atlantica Sustainable Infrastructure PLC’s funds statement, the company has consistently generated positive free cash flow (FCF). Its five-year best FCF was $654.0 million in 2022.

| Fiscal Year | FCF (Millions) | Growth |

| 2018 | $401.0 | N/A |

| 2019 | $363.6 | -9.3% |

| 2020 | $460.5 | 26.7% |

| 2021 | $540.5 | 17.4% |

| 2022 | $654.0 | 21.0% |

(Source: MarketWatch, op. cit.)

The major risk for Atlantica Sustainable Infrastructure PLC is its debt of $5.54 billion as of the end of September 2023. While that’s negative, the company also held $764.9 million in cash at that time. (Source: Yahoo! Finance, op. cit.)

For now, the company’s financial situation is okay. Atlantica used its FCF to reduce its debt by $506.9 million in 2022 while issuing $101.1 million in fresh debt. (Source: MarketWatch, op. cit.)

The following table shows that Atlantica Sustainable Infrastructure PLC covered its interest expense via higher earnings before interest and taxes (EBIT) in 2020 and 2021 before its EBIT fell slightly short of its interest expense in 2022.

The company’s interest coverage ratio of 0.96 in 2022 was on the weak side.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $420.1 | $378.4 |

| 2021 | $386.6 | $361.3 |

| 2022 | $321.5 | $333.3 |

(Source: Yahoo! Finance, op. cit.)

Atlantica Sustainable Infrastructure PLC’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a reasonable 5.0, which was also its average score for the period of 2018 through 2022.

That number is just above the midpoint of the Piotroski score’s range of 1.0 to 9.0.

Strong FCF Makes Atlantica Stock’s Dividend Safe

Atlantica Sustainable Infrastructure PLC’s quarterly dividend of $0.445 per share represents a forward yield of 8.36% (as of this writing). The company’s current dividend yield is higher than its five-year average of 6.02%, due to share-price deterioration.

AY stock’s dividend coverage ratio of 2.0 suggests that its dividend streak should be intact. (Source: Yahoo! Finance, op. cit.)

| Metric | Value |

| Dividend Growth Streak | 7 Years |

| Dividend Streak | 10 Years |

| 7-Year Dividend Compound Annual Growth Rate | 2.0% |

| 10-Year Average Dividend Yield | 7.3% |

| Dividend Coverage Ratio | 2.0 |

The Lowdown on Atlantica Sustainable Infrastructure PLC

Atlantica stock makes sense for contrarian investors who are looking for dividend income and the potential for above-average price appreciation.

The proportion of institutional ownership of AY stock is moderate, at 42.3% of the outstanding shares (as of this writing). Among the 271 institutions that currently hold shares of Atlantica Sustainable Infrastructure PLC, Morgan Stanley (NYSE:MS) is the top holder, with a 4.4% stake.

Atlantica stock has significantly high insider ownership, at 42.3% of the outstanding shares. This incentivizes the company’s insiders to improve its operations and deliver shareholder value.