Armada Hoffler Properties Inc: Bullish Stock With Rising High-Yield Dividends

AHH Stock Weathers COVID-19 Pandemic

With businesses shuttered during the coronavirus pandemic, quarantined employees forced to work from home, and others laid off, it hasn’t exactly been a good time for real estate investment trusts (REITs).

This has especially been true for those operating in the office, retail, and multifamily property space. But with the economy opening back up and pent-up demand driving a rebound, it’s time to start looking at some once-unloved REITs such as Armada Hoffler Properties Inc (NYSE:AHH).

Armada Hoffler Properties is a vertically integrated, self-managed REIT with four decades of experience developing, building, acquiring, and managing office, retail, and multifamily properties. (Source: “2020 Annual Report,” Armada Hoffler Properties Inc, last accessed September 16, 2021.)

The company’s assets are primarily located in the mid-Atlantic and southeastern U.S., with a strategic concentration in the Greater Baltimore/Washington, D.C. area, Coastal Virginia, and a selection of markets throughout the Carolinas.

Armada Hoffler Properties Inc describes itself as three REITs wrapped into one: asset management, construction, and development.

The company’s construction experience included mid-rise and high-rise buildings; retail strip malls; retail power centers; multifamily apartment communities; hotels and conference centers; single-tenant and multi-tenant industrial, distribution, and manufacturing facilities; educational, medical, and special-purpose facilities; government projects; and mixed-use town centers.

Its portfolio currently includes 36 retail properties with 3.6 million rentable square feet, seven office properties with 1.3 million rentable square feet, and 12 multifamily properties with 3,527 units.

At the end of the second quarter, the company’s office space was 96.7% occupied, its retail space was 94.7% occupied, and its multifamily space was 92.2% occupied. Moreover, Armada Hoffler Properties Inc’s total construction contract backlog was $70.2 million.

The company’s biggest office and retail tenants include Morgan Stanley (NYSE:MS), Lowe’s Companies Inc (NYSE:LOW), Bed Bath & Beyond Inc. (NASDAQ: BBBY), Duke University, and John Hopkins Medicine.

Armada Hoffler Properties also has a $500.0-million pipeline with properties in various stages of development, redevelopment, and stabilization. This includes a $52.0-million 223-multifamily property being developed in Gainesville, GA; a $48.0-million mixed-use project in Virginia Beach, VA that includes 39,000 square feet of retail space and 131 luxury apartments; and Wills Warf, a mixed-use development project in the Harbor Point area of Baltimore, MD.

Armada Hoffler Properties also has an aggressive acquisition strategy.

On August 25, the company announced that it had completed the off-market acquisition of two high-volume retail centers: Overlook Village in Asheville, NC for $28.4 million and Greenbrier Square in Chesapeake, VA for $36.5 million. Currently, Overlook Village is 100% occupied, while Greenbrier Square is 95.4% occupied, with one value-add opportunity. (Source: “Armada Hoffler Properties Acquires Overlook Village and Greenbrier Square,” Armada Hoffler Properties Inc, August 25, 2021.)

Because Armada Hoffler Properties’ retail and office properties are anchored by tier-one tenants, the REIT was able to weather the pandemic better than others. The company’s office and conventional multifamily property portfolios maintained occupancy in the mid-90% range and rent collections near 100%. (Source: “2020 Annual Report,” Armada Hoffler Properties Inc, op. cit.)

The REIT’s retail portfolio has demonstrated remarkable durability, with 88% rent collection during the pandemic. The company expects to be back to its historical norm of approximately 95% leased in the next year or so.

Armada Hoffler Properties Inc Reports Strong Q2 Results & Raises FFO Guidance

For the second quarter ended June 30, Armada Hoffler Properties Inc reported net income of $5.6 million, or $0.07 per share, compared to $11.2 million, or $0.14 per share, in the same prior-year period. (Source: “Armada Hoffler Properties Reports Second Quarter 2021 Results,” Armada Hoffler Properties Inc, August 3, 2021.)

The REIT’s funds from operations (FFO) came in at $22.9 million, or $0.28 per share, versus $22.0 million, or $0.28 per share, in the three months ended June 30, 2020.

Armada Hoffler Properties’ normalized FFO was $23.3 million, or $0.29 per diluted share, compared to $22.6 million, or $0.29 per diluted share, in the three months ended June 30, 2020.

Because of outstanding actual and forecasted growth in property net operating income (NOI), management raised its full-year 2021 normalized FFO guidance to $1.02 to $1.06 per diluted share, up from the company’s previous guidance range of $0.98 to $1.02 per share.

Commenting on the second-quarter results, Louis Haddad, president and CEO, said, “Leasing activity across all sectors of our core portfolio is at the highest velocity we’ve seen in years, the development pipeline is well-stocked and proceeding rapidly, an ample supply of off-market acquisition opportunities have been uncovered, third-party construction engagements are shaping up to become high volume contracts later this year, and most importantly, we are in a strong liquidity position with access to additional capital sources from the potential disposition of non-core assets.” (Source: Ibid.)

Armada Hoffler Properties Stock Dividends on the Rise Again

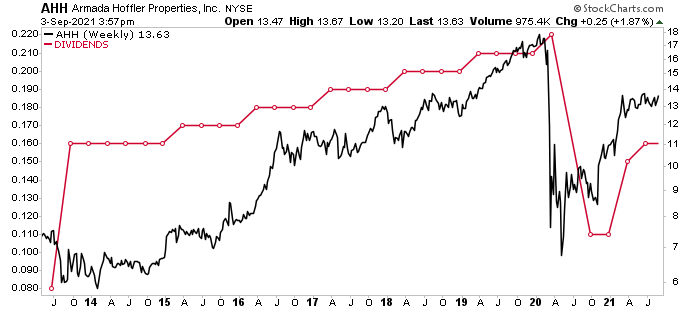

In the years preceding the COVID-19 pandemic, Armada Hoffler Properties Inc had a solid history of raising its annual dividend. In fact, the company raised it every year from 2014 through 2019, from $0.64 per share ($0.16 quarterly) to $0.84 per share ($0.21 quarterly). (Source: “AHH Dividend History” Nasdaq, last accessed September 16, 2021.)

By all accounts, it looked like the good times would continue in 2020. Armada Hoffler Properties raised its quarterly dividend to $0.22 in the first quarter of that year, but then COVID-19 hit, which brought uncertainty and belt-tightening.

As you can see in the following chart, the company suspended its quarterly dividend in the second quarter of 2020, lowered it to $0.11 per share in the third quarter, and held it there in the fourth quarter.

Chart courtesy of StockCharts.com

But then the optimism of 2021 kicked in. In February, the company announced a 36% increase to its first-quarter 2021 cash dividend to $0.15 per share. In May, it announced a second-quarter payout of $0.16 per share. This represented the second consecutive quarterly increase, up by 6.7% quarter-over-quarter and up by 45.5% cumulatively year-to-date. (Source: “Armada Hoffler Properties Announces Second Consecutive Quarterly Increase In The Cash Dividend On Common Shares,” Armada Hoffler Properties Inc, May 3, 2021.)

“Although the first quarter was somewhat uneventful in terms of notable developments that would change our near term outlook, substantial progress in leasing together with new growth opportunities provided a basis for the Board’s decision to continue ramping the dividend,” said Haddad. (Source: Ibid.)

On September 2, the company announced that it was holding its third-quarter cash dividend at $0.16, or $0.64 on an annual basis, for a yield of 4.7%. While Armada Hoffler Properties Inc didn’t raise its third-quarter dividend, it also didn’t cut it. That should give investors confidence about the company’s long-term outlook.

The fact that the company raised its full-year FFO guidance for 2021 shows investors that the company has more than enough confidence to not just maintain its dividend, but also raise it over the coming quarters.

As you can see in the above chart, both Armada Hoffler stock’s price and quarterly dividends have room to run. AHH stock is up by 25% year-to-date and roughly 40% year-over-year, but it needs to climb by an additional 30% to get to its pre-COVID-19 levels. Meanwhile, Armada Hoffler stock’s quarterly payout needs to increase by 37% to get to its pre-coronavirus level of $0.22.

Management sounds confident it will get there, which is a good sign for income hogs.

The Lowdown on Armada Hoffler Properties Inc

Armada Hoffler Properties stock has taken a hit during the COVID-19 pandemic, but the company’s occupancy and rent collection numbers have remained quite high.

In 2021, Armada Hoffler Properties Inc said the leasing activity of its core property portfolio is at its highest velocity in years and that “the building blocks for superior, if not game-changing, performance are in place.” That’s great news for AHH stock investors.