Arbor Realty Trust Stock: 11.7%-Yielder Up 13% in 2023

Why ABR Stock’s Low Valuation Is Compelling

The past few years have been disheartening for holders of real estate investment trust (REIT) units, given to the sharp rise in interest rates and economic concerns.

But many REIT stocks have been rallying off their lows and beginning to reward patient investors. Take Arbor Realty Trust Inc (NYSE:ABR), for example.

Founded in 2003, Arbor Realty Trust Inc has developed into a nationwide REIT that invests in multifamily and single-family rental residences, as well as commercial real estate. (Source: “Profile,” Arbor Realty Trust Inc, last accessed September 28, 2023.)

Arbor Realty Trust stock plummeted to $3.54 per unit when the COVID-19 pandemic threat surfaced in March 2020. If you had the fortitude to buy ABR units in March 2020, your position would be up by $11.30 per share, or 319% (as of this writing). In 2023, ABR stock has been beating the S&P 500.

Moreover, Arbor Realty Trust Inc pays nice dividends. Better yet, the company has paid those dividends for 12 straight years and has raised them for 11 straight years. And despite the fact that Arbor Realty Trust stock’s price is up by 13% in 2023, its yield is a healthy 11.68%.

Nice Bounce Off 52-Week Low

As I just mentioned, ABR stock has had a stellar run since the pandemic in March 2020. It has also risen by a lot from its 52-week low of $10.10 in April of this year.

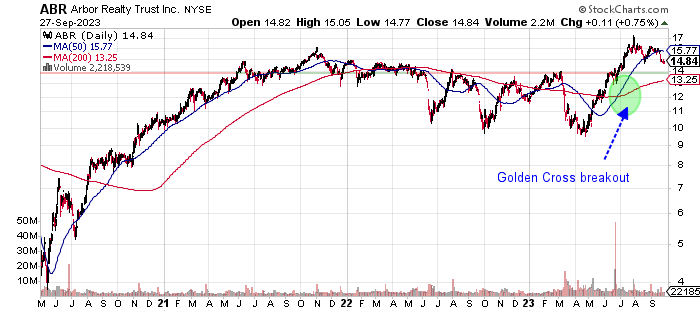

Shares of Arbor Realty Trust Inc have come down from their 52-week high of $17.74 in July, though, which presents a tremendous opportunity to investors. The stock is hovering between its 200-day moving average (MA) of $13.99 and its 50-day MA of $15.95.

The technical outlook for Arbor Realty Trust stock is encouraging, due to the bullish golden cross pattern that’s currently in place on its chart. This kind of pattern occurs when a stock’s 50-day MA is above its 200-day MA, and it generally suggests that there will be additional gains.

Chart courtesy of StockCharts.com

High Free Cash Flow; Profits Set to Rise

Arbor Realty Trust Inc increased its revenues from 2019 to its record-high $619.1 million in 2022. The company’s revenues in 2021 and 2022 were their highest in history. Its revenue compound annual growth rate (CAGR) during the 2019–2022 period was a strong 21.0%.

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $349.4 | N/A |

| 2020 | $434.1 | 24.2% |

| 2021 | $590.9 | 36.1% |

| 2022 | $619.1 | 4.8% |

(Source: “Arbor Realty Trust, Inc (ABR),” Yahoo! Finance, last accessed September 28, 2023.)

On the bottom line, Arbor Realty Trust has produced consistent profits on a generally accepted accounting principles (GAAP) basis. Its GAPP-diluted earnings per share (EPS) grew in two of the last three years. Despite the decline in 2022, it was still the third-best earnings result in the company’s history.

Analysts estimate that Arbor Realty Trust Inc will report higher earnings of $2.12 per diluted share in 2023 and $1.88 per diluted share in 2024.

ABR stock trades at a reasonable forward price-earnings multiple of 7.0 times its consensus 2023 EPS estimate and 7.8 times its 2024 EPS estimate.

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.27 | -15.3% |

| 2020 | $1.41 | 10.8% |

| 2021 | $2.28 | 62.0% |

| 2022 | $1.67 | -26.6% |

(Source: “Arbor Realty Trust Inc.” MarketWatch, last accessed September 28, 2023.)

Arbor Realty Trust delivered positive free cash flow (FCF) in the last three straight years. In 2022, its FCF broke above the $1.0-billion threshold. The high FCF should allow the company to continue paying dividends, buy back its own shares, and reduce its debt load.

| Fiscal Year | FCF | Growth |

| 2019 | -$226.3 Million | -553.9% |

| 2020 | $55.2 Million | 124.4% |

| 2021 | $251.1 Million | 355.2% |

| 2022 | $1.13 Billion | 348.2% |

(Source: MarketWatch, op. cit.)

There’s some financial risk with Arbor Realty Trust Inc, namely its debt of $12.7 billion on its balance sheet, which is partly offset by cash of $847.7 million. High debt is typical of REITs, though, and Arbor Realty Trust’s working capital is strong. (Source: Yahoo! Finance, op. cit.)

The company’s financial situation is manageable for now. Arbor Realty Trust’s current Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a strong 8.0, which is just a notch below the top of the Piotroski score’s range of 1.0 to 9.0.

Arbor Realty Trust Stock’s Dividends Grow for 11 Straight Years

Arbor Realty Trust Inc’s most recent quarterly dividend, which was paid in August, was $0.43 per share, translating to a current yield of 11.68%. ABR stock’s five-year average dividend yield is 9.6%. (Source: Yahoo! Finance, op. cit.)

Considering the company’s expected earnings, its dividends will likely continue rising.

| Metric | Statistic |

| Dividend Growth Streak | 11 Years |

| Dividend Streak | 12 Years |

| 10-Year Dividend CAGR | 15.0% |

| 10-Year Average Dividend Yield | 14.0% |

| Dividend Coverage Ratio | 1.3 |

The Lowdown on Arbor Realty Trust Inc

Arbor Realty Trust stock pays high-yield dividends and has high potential for price appreciation.

Arbor Realty Trust Inc’s insiders hold a small 2.18% stake in the company’s outstanding shares, but they purchased 30,990 shares across three transactions during the last six months. (Source: Yahoo! Finance, op. cit.)

As of August 31, there was a relatively large short position on ABR stock of 41.8 million shares, representing 23.2% of the float. If Arbor Realty Trust units continue to rally, I would expect more short covering and support for the stock.