APTS Stock: Don’t Ignore This Beaten-Up REIT With 8.5% Yield

Preferred Apartment Communities Inc. Set to Reward Investors in 2021

When it comes to real estate investment trusts (REITs), the ones that own apartment buildings provide some of the most reliable, high-yield dividends.

During a typical economic downturn, most people still pay their rent, making apartment REITs a cash cow. This premise gets a little strained during a global economic crisis in which government-ordered quarantine and shut-in orders prevent people from making money.

That might explain why investors kicked Preferred Apartment Communities Inc. (NYSE:APTS) and other REITs over a cliff in February 2020. But that reaction might have been overdone—and it sets up Preferred Apartment Communities stock for a solid rebound in 2021.

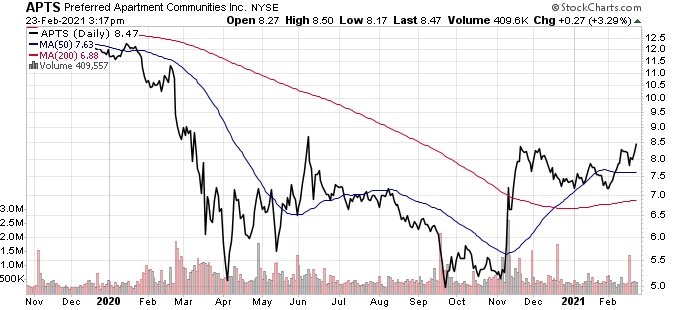

As you can see in the following chart, APTS stock took a nosedive in the first half of 2020. From the start of January 2020 until early April, the stock tumbled 60%.

Chart courtesy of StockCharts.com

While Preferred Apartment Communities stock has recovered somewhat, it still needs to climb 42% to get to where it was on January 2, 2020. The stock needs to climb an additional 70% to get to where it was trading in the months leading up to the COVID-19 pandemic.

Those kinds of gains might seem untenable in the near term, but there’s every reason to believe that APTS stock will return to its former glory.

Preferred Apartment Communities is a REIT that, as its name suggests, invests in apartments. But it’s more than that. The company also invests in office properties and grocery-anchored shopping centers. Some of its commercial anchors are Walmart Inc (NYSE:WMT), Kroger Co (NYSE:KR), Publix Super Markets, Inc., and Harris Teeter, LLC. (Source: “Business Update,” Preferred Apartment Communities Inc., January 28, 2021.)

As of January 28, the REIT owned 100 properties in 34 markets in 13 U.S. states, predominantly in the southeast region of the country. Florida, Texas, Georgia, and North Carolina account for the majority of its $4.3-billion footprint. (Source: “Portfolio,” Preferred Apartment Communities Inc., last accessed February 24, 2021.)

In November 2020, Preferred Apartment Communities completed the sale of student housing assets for $478.7 million. The sale is part of its previously announced objectives to exit the student housing space, simplify its focus on its core Sunbelt multifamily business, and realign its balance sheet.

You might assume that, because of the coronavirus pandemic, Preferred Apartment Communities would have had a difficult time collecting rent. But it wasn’t as bad as you’d think. In fact, because of the company’s strong tenant base, it was quite negligible.

| Quarter | Multifamily Properties Rent Collected | Grocery-Anchored Retail Properties Rent Collected | Office Properties Rent Collected |

| Q1 2020 | 100% | 99% | 100% |

| Q2 2020 | 99% | 91% | 100% |

| Q3 2020 | 99% | 96% | 100% |

| Q4 2020 | 99% | 97% | 100% |

(Source: Preferred Apartment Communities Inc., January 28, 2021, op. cit.)

As expected, during the first quarter of 2020, it was business as usual. The second quarter was a different story, but the only area that was materially affected was the REIT’s grocery-anchored retail properties.

Because Preferred Apartment Communities owns high-quality multifamily properties, its tenants in that segment kept up with their rent payments. Moreover, the company’s office real estate is rented primarily to large private and public firms that are—as the 2020 rent collection figures suggest—financially stable. Rent collection in the REIT’s grocery-anchored retail segment took a hit like the broader retail sector did, but it has mostly rebounded.

Still, ongoing concerns about how COVID-19 would impact the company’s bottom line forced management to reduce APTS stock’s quarterly dividend from $0.262 in the first quarter to $0.175 per unit in the second quarter.

While no one wants to see a reduction in dividend payouts, it did leave Preferred Apartment Communities Inc. on a stronger financial footing.

Before the coronavirus pandemic, Preferred Apartment Communities stock had a history of regularly raising its quarterly dividend—in most cases, twice a year. In 2014, the first full year that the REIT provided a dividend, it paid out $0.655. In 2019, it paid out $1.046 per unit. (Source: “APTS Dividend History,” Nasdaq, last accessed February 24, 2021.)

Even During a Pandemic, Preferred Apartment Communities Inc. Performs Well

Last November, Preferred Apartment Communities announced that its revenue in the third quarter increased 5.4% year-over-year to $126.7 million. Its year-to-date revenue was up 10.3%, at $381.1 million. (Source: “Preferred Apartment Communities, Inc. Reports Results For Third Quarter 2020,” Preferred Apartment Communities Inc., November 9, 2020.)

In the third quarter, the company’s fund flows from operations (FFO) increased to $0.17, from a loss of $0.01 in the second quarter. Its core FFO increased to $0.26 per share, from $0.22 per share in the prior quarter. Its adjusted FFO per share increased to $0.07 for the third quarter of 2020, from $0.05 for the second quarter of 2020.

Preferred Apartment Communities’ core FFO payout ratio to common stockholders and unitholders was approximately 67.8%.

Thanks to the company’s strong liquidity and cash flow (and eventual reduction in COVID-19-related operational costs), I won’t be surprised to see management resume increasing APTS stock’s quarterly dividend.

Until then, unitholders will have to make do with a strong, 8.5% yield, with an annual payout of $0.70 per unit.

The Lowdown on Preferred Apartment Communities Stock

Preferred Apartment Communities Inc. is a financially solid REIT that saw its share price tank during the coronavirus pandemic. To make matters worse, the company slashed its dividend in the second quarter of 2020.

But the outlook for Preferred Apartment Communities stock is solid. The company’s rent collection figures are at pre-pandemic levels, it has strengthened its balance sheet, and it continues to pursue an aggressive acquisition strategy.

APTS stock is undervalued, but it should appreciate over the next few quarters. The company’s 8.5% dividend yield should help make the wait worthwhile.