8.2%-Yielding Antero Midstream Stock Pays Reliable Dividends

How AM Stock Is Able to Pay Safe, Ultra-High-Yield Dividends

There are many ultra-high-yield dividend stocks masquerading as financially solid stocks with tremendous long-term growth potential. Unfortunately, many dividend hogs get sucked in by high dividends and ignore the fundamentals. That’s a great strategy if you’re looking to lose your initial capital. That isn’t the case with Antero Midstream Corp (NYSE:AM), though.

Antero owns and operates energy production assets in two of the lowest-cost natural gas and natural gas liquid (NGL) basins in North America: the Marcellus Shale and Utica Shale, which are both in the Appalachian Basin of the eastern U.S. (Source: “About Us,” Antero Midstream Corp, last accessed December 6, 2022.)

The Marcellus Shale is an unconventional reservoir that produces natural gas, NGL, and oil. It’s the largest and most prolific unconventional natural gas reservoir in the U.S., producing nearly 35% of the total U.S. natural gas supply in 2021.

The company’s core assets include natural gas gathering pipelines, compression stations, processing/fractionation plants, and water handling facilities. (Source: “Corporate Presentation: December 2022,” Antero Midstream Corp, last accessed December 6, 2022.)

Through its Natural Gas Gathering, Compression, Processing, and Fractionation business segments, Antero Midstream provides gathering and compression services to Antero Resources Corporation under long-term fixed-fee service agreements. The company also provides processing and fractionation services through its 50/50 joint venture with MPLX LP (NYSE:MPLX).

Antero Midstream Corp’s Gathering and Processing segment includes:

- 500 miles of low- and high-pressure gathering pipelines

- Over 3.2 billion cubic feet per day of compression capacity

- 40,000 barrels of natural gas processing capacity (through the MPLX joint venture)

- 1.6 billion cubic feet per day of processing capacity (through the MPLX joint venture)

(Source: “Gathering and Processing,” Antero Midstream Corp, last accessed December 6, 2022.)

Antero Midstream’s Water and Handling Treatment segment includes:

- 38 fresh water storage facilities, with a storage capacity of 18 million barrels

- 100,000 barrels per day of wastewater treatment capacity

- Over 275 miles of freshwater pipelines

The company’s closed-loop system of freshwater pipelines and storage facilities supports Antero Resources Corporation’s operations in the Marcellus and Utica Shale. (Source: “Water Handling,” Antero Midstream Corp, last accessed December 6, 2022.)

Thanks to the company’s long-term fixed service fee agreements, it has a steady and reliable revenue stream and predictable cash flow. This allows the company to provide Antero Midstream stockholders with safe, ultra-high-yield dividends. It also allows the company to safely expand its operations.

Antero Midstream Corp Drops $205 Million on Acquisition

In September, Antero Midstream plunked down $205.0 million in cash for Marcellus Shale gas gathering and compression assets from Crestwood Equity Partners LP (NYSE:CEQP). The assets include 72 miles of dry gas gathering pipelines and nine compressor stations with about 700.0 million cubic feet per day of compression capacity. It also adds about 425 undeveloped drilling locations and 120,000 gross dedicated acres. (Source: “Antero Midstream Agrees to Acquire Bolt-On Marcellus Gathering and Compression System,” Antero Midstream Corp, September 12, 2022.)

Other highlights of the deal include:

- It’s estimated to be more than 10% accretive to free cash flow after dividends through 2026

- It includes about 425 undeveloped drilling locations and 120,000 gross dedicated acres

- It increases compression capacity by 20% and gathering pipeline mileage by 15%

- More than $50.0 million of discounted future capital avoidance, integration, and operational synergies

“Today’s bolt-on acquisition provides significant synergies that drive attractive economics and immediate Free Cash Flow accretion to Antero Midstream,” said Paul Rady, Antero Midstream Corp’s chairman and CEO. (Source: Ibid)

$30 Million of Free Cash Flow After Dividends

For the third quarter ended September 30, Antero Midstream reported revenue of $231.0 million, which is up by two percent from $224.8 million in the same period of last year. By segment, $176.0 million came from Gathering and Processing and $55.0 million came from Water Handling. (Source: “Antero Midstream Announces Third Quarter 2022 Financial and Operational Results,” Antero Midstream Corp, October 26, 2022.)

The company’s net income in the third quarter slipped slightly to $84.0 million, or $0.17 per share. Meanwhile, its adjusted net income in the quarter was $96.0 million, or $0.20 per share. Its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were $233.0 million. Antero Midstream Corp’s net cash provided by operating activities in the third quarter was $177.0 million. Its free cash flow after dividends was $30.0 million, compared to a $13.0-million deficit in the prior-year third quarter.

“This transition to generating consistent Free Cash Flow after dividends significantly de-risks our business model over the next several years and positions us well to achieve our leverage target of 3.0x or less by year end 2024,” said Rady. (Source: Ibid.)

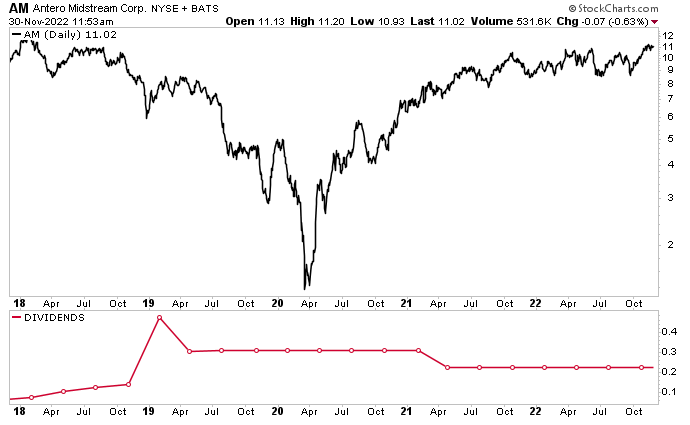

AM stock has a long history of ultra-high-yield dividends. In September, Antero Midstream Corp’s board declared a quarterly cash dividend of $0.225 per share, for a current yield of 8.2%. Antero Midstream stock has a trailing annual dividend yield of 8.1% and a five-year average dividend yield of 11.3%.

This dividend stock has also been rewarding buy-and-hold investors with market-thumping share-price gains. As of this writing, AM stock is up by:

- Five percent over the last month

- 11% over the last three months

- 24.5% year-to-date

- 24.0% year-over-year

Chart courtesy of StockCharts.com

The Lowdown on Antero Midstream Stock

Antero Midstream Corp is an excellent energy company with a tremendous balance sheet, reliable high-yield dividends, and—lately—impressive share-price appreciation.

Thanks to high natural gas prices and the company’s long-term fixed service fee agreements, this momentum should continue, which is good news for AM stock investors.