Altus Midstream Co: Safe 9.2%-Yielding Natural Gas Stock Up 48% in 2021

ALTM Stock’s Price & Dividends Thrive in Difficult Times

The COVID-19 pandemic has hobbled many industries, but few were hit as hard as the energy sector, where demand and prices cratered as the economy ground to a halt. Despite one of the bleakest economic environments in 100 years, Altus Midstream Co (NASDAQ:ALTM) performed exceptionally well in 2020.

The Houston, TX-based company that stores, processes, and transports natural gas announced that its revenue increased by nine percent year-over-year to $148.0 million, its net income more than doubled to $0.28 per share, its operating income went up by 323% to $63.2 million, its cash on hand soared by 304% to $24.2 million, and its returns to investors quadrupled. (Source: “Altus Midstream Company (ALTM),” Yahoo! Finance, last accessed September 10, 2021.)

In fact, Altus did so well in 2020 that it actually initiated a quarterly cash dividend last December, at a rate of $1.50 per share, or $6.00 on an annual basis. (Source: “Altus Midstream Initiates Cash Dividend on Common Shares,” Altus Midstream Co, December 10, 2021.)

Clay Bretches, president and CEO, noted, “Given our healthy balance sheet and plan to generate free cash flow in 2021 and beyond, we believe the best path to deliver shareholder value is to return cash through a dividend.” (Source: Ibid.)

“We expect earnings from our ownership in joint venture pipelines and our gathering and processing business, along with our relentless focus on cost reduction, will position us well for the foreseeable future.”

Altus Midstream Co has since announced two additional $1.50 quarterly dividends. The last one was in early August.

At the current price of Altus Midstream stock, the company’s annual $6.00 dividend represents a dividend yield of 9.2%. With a payout ratio of just 53.2%, it’s fair to say that the dividend is safe. In fact, the company has enough liquidity to even raise it.

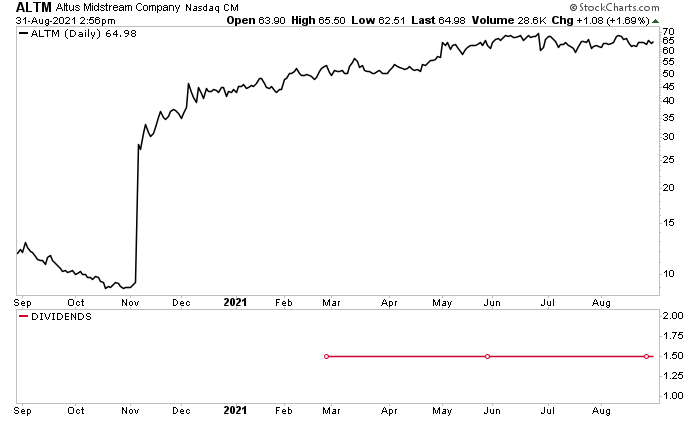

As you can see in the chart below, investors were euphoric about ALTM stock after Altus Midstream Co reported strong third-quarter results in early November 2020 and said it planned to recommend to its board of directors a quarterly dividend of $1.50 per share beginning in March 2021.

Which is exactly what happened.

So, in addition to providing investors with a safe and stable dividend, Altus Midstream stock has been inching higher in price. As of this writing, ALTM stock is up by:

- Six percent over the last three months

- 28% over the last six months

- 47% year-to-date

- 430% year-over-year

Chart courtesy of StockCharts.com

The company’s outlook is bullish, fueled by the company’s joint-venture pipelines, in particular the Permian Highway Pipeline that started up in January 2021.

Altus Midstream is a pure-play, Permian-to-Gulf Coast business that owns gas gathering, processing, and transmission assets serving production in the Delaware Basin. Moreover, it owns equity interests in four Permian-to-Gulf Coast pipelines. (Source: “Investor Presentation: August 2021,” Altus Midstream Co, last accessed September 10, 2021.)

The company owns a 27% interest in the $2.2-billion, 430-mile Permian Highway Pipeline, which connects to the U.S. Gulf Coast and Mexico markets.

The joint venture began operations in January 2021 and has a capacity of 2.1 billion cubic feet per day. Its capacity is fully subscribed under long-term binding agreements with minimum volume commitments.

Altus Midstream Co also owns equity interests in three other joint venture pipelines.

The $1.8-billion Gulf Coast Express project started operations in September 2019. The daily capacity is 2.0 billion cubic feet per day, and it’s fully subscribed under long-term binding agreements with minimum volume commitments.

Altus Midstream owns a 33% stake in the $1.5-billion, 658-mile Shin Oak pipeline. It connects Orla and Waha, TX to a natural gas liquid (NGL) fractionation and storage complex in Mont Belvieu.

The company owns a 15% stake in the EPIC Crude Pipeline, which connects the Permian Basin and Eagle Ford basins to Corpus Christi, TX. The pipeline commenced operations in April 2020. The project consists of about 700 miles of pipeline, with a current capacity of approximately 600 million barrels per day.

Wonderful Financial Results

Altus Midstream’s infrastructure assets provide the company with a steady income stream. In the second quarter, the company’s revenue increased by 12.5% year-over-year to $35.6 million, its net income soared by 1,925% to $49.8 million, and its diluted earnings per share increased by 624% to $1.31. (Source: “Altus Midstream Announces Second-Quarter 2021 Results,” Altus Midstream Company, August 4, 2021.)

For the second consecutive quarter, the company was cash-flow-positive. For the eighth consecutive quarter, it achieved lower operating costs. Meanwhile, its activity increased.

“The contributions from our joint venture pipeline projects, combined with an increase in volumes from our gathering and processing business, bolstered our financial results,” said Bretches. “With our competitive, low-cost operating structure, we are well-positioned to achieve year-over-year cost savings in excess of 15%.” (Source: Ibid.)

“We are outperforming on all guidance metrics and have adjusted our annual guidance based on our strong performance in the first half of the year,” said Ben Rodgers, CFO.

The company has raised its gathered volume outlook to 415–430 million cubic feet per day. It also raised the lower end of its adjusted EBITDA guidance range to $260.0–$270.0 million.

The Lowdown on Altus Midstream Co

Altus Midstream Co is a great natural gas midstream venture that has performed well even during the pandemic.

The company has been reporting solid quarterly results, it raised its full-year guidance, and—with the startup of the Permian Highway natural gas pipeline last quarter—its growth capital obligations are nominal. That positions it to generate meaningful free cash flow for the remainder of the year.

All that bodes well for Altus Midstream stock investors.