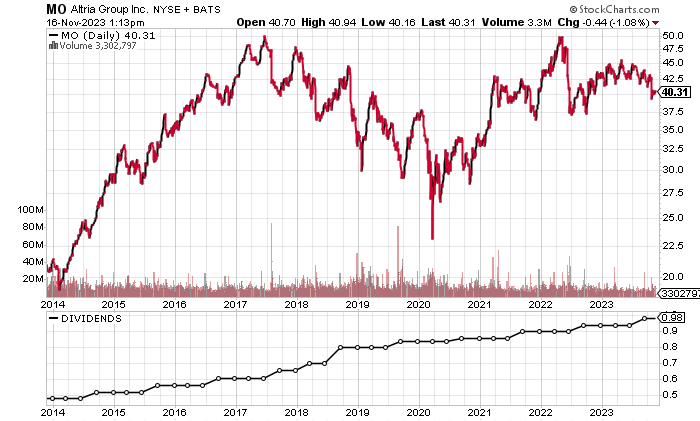

Altria Stock: “Sin” Value Stock Is Yielding 9.6%

MO Stock’s Dividends Raised 58 Times in 54 Years

In my search for high-quality, high-yield dividend stocks, Altria Group Inc (NYSE:MO) surfaced on my screen.

Altria stock was previously a dividend king (a stock that has increased its dividends for at least 50 straight years), but it was booted out of that category after a few missteps that saw it miss a dividend increase in 2008. (Source: “Dividend Information,” Altria Group Inc, last accessed November 17, 2023.)

I’m willing to forgive the company, though, since it has increased its dividends a whopping 58 times over the past 54 years. (Source: “Altria Reports 2023 Third-Quarter and Nine-Months Results,” Altria Group Inc, October 26, 2023.

Moreover, MO stock has an average yield over the past 10 years of 7.6%.

“A strong and consistently growing dividend remains a top priority for us,” commented Altria’s chief financial officer, Sal Mancuso, in a letter to shareholders in March. (Source: “An Open Letter from Sal Mancuso, Chief Financial Officer, Altria Group,” Altria Group Inc, March 23, 2023.)

He added, “Therefore, to provide investors with confidence in consistent dividend growth, we are establishing a new progressive dividend goal that targets mid-single digits dividend growth annually.”

Established in 1822, Altria Group Inc, which famous for its “Marlboro” brand, has become a leading harvester and seller of tobacco in the U.S. (Source: “Altria Group, Inc. (MO),” Yahoo! Finance, last accessed November 17, 2023.)

Altria stock currently trades at an attractive price. Down by 12.0% in 2023 (as of this writing) and lagging behind the S&P 500 and the Dow Jones Industrial Average, MO stock is suited for income investors who desire consistent dividends and above-average price appreciation.

Chart courtesy of StockCharts.com

How Altria Group Inc Provides Significant Value & Income

Despite the attacks on the tobacco industry in the past few decades, Altria has managed to grow its business. The company’s revenues increased for four straight years before making a small drop in 2022.

Analysts estimate that Altria Group Inc will report a slight revenue contraction of 0.6% to $20.55 for full-year 2023, followed by a 0.7% rise to $20.71 billion for 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | Revenues (Billions) | Growth |

| 2018 | $19.63 | N/A |

| 2019 | $19.80 | 0.9% |

| 2020 | $20.84 | 5.3% |

| 2021 | $21.11 | 1.3% |

| 2022 | $20.69 | -2.0% |

(Source: “Altria Group Inc.” MarketWatch, last accessed November 17, 2023.)

On the cost side, Altria consistently generated high gross margins in its past five reported years.

| Fiscal Year | Gross Margin |

| 2019 | 50.6% |

| 2020 | 49.8% |

| 2021 | 53.8% |

| 2022 | 56.8% |

(Source: “Altria Group, Inc. (MO),” Nasdaq, last accessed November 17, 2023.)

On its bottom line, Altria Group Inc has delivered generally accepted accounting principles (GAAP) profits in four of its last five reported years. Its five-year best GAAP-diluted earnings per share (EPS) were $3.69 in 2018, followed by four years of lower EPS. In a positive sign, its GAAP-diluted EPS rebounded by 138.7% in 2022.

Analysts expect Altria Group Inc’s adjusted earnings to rise to $4.95 per diluted share in full-year 2023, compared to $4.84 in 2022. They expect this to be followed by $5.12 per diluted share in 2024. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2018 | $3.69 | N/A |

| 2019 | -$0.70 | -119.0% |

| 2020 | $2.40 | 442.8% |

| 2021 | $1.34 | -44.4% |

| 2022 | $3.19 | 138.7% |

(Source: MarketWatch, op. cit.)

Altria Group Inc’s funds statement shows it churning out high free cash flow (FCF) in its past five reported years, with FCF growth in two of its last four reported years.

| Fiscal Year | FCF (Billions) | Growth |

| 2018 | $8.15 | N/A |

| 2019 | $7.59 | -6.9% |

| 2020 | $8.15 | 7.4% |

| 2021 | $8.24 | 1.1% |

| 2022 | $8.05 | -2.3% |

(Source: MarketWatch, op. cit.)

On its balance sheet, Altria Group Inc was dealing with a debt of $25.1 billion as of the end of September. This was partially offset by $1.54 billion in cash. (Source: Yahoo! Finance, op. cit.)

While the company’s debt load appears daunting on the surface, its profitability, FCF, and ability to cover its interest expenses shouldn’t pose a problem.

Altria Group Inc’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is a strong reading of 7.0. That’s just below the top of the Piotroski score’s range of 1.0 to 9.0.

The following table shows that Altria has managed to consistently cover its interest expenses via much higher earnings before interest and taxes (EBIT). Furthermore, the company’s interest coverage ratio for the past 12 months was a healthy 10.9 times. From 2018 to 2022, its average interest coverage ratio was 10.7 times.

| Fiscal Year | EBIT (Billions) | Interest Expense (Billions) |

| 2019 | $10.49 | $1.28 |

| 2020 | $10.87 | $1.22 |

| 2021 | $11.56 | $1.19 |

| 2022 | $8.52 | $1.13 |

(Source: Yahoo! Finance, op. cit.)

Altria Stock’s Dividend Growth Should Continue

Altria Group Inc’s high FCF has allowed it to continue its 54-year streak of paying dividends. The company recently raised its quarterly dividend from $0.94 to $0.98 per share, for a yield of 9.62% (as of this writing). (Source: “Dividend Information,” Altria Group Inc, op. cit.)

Although growing its earnings will be a challenge for the company, its excellent operating results should allow it to continue ramping up its dividends. (Source: Yahoo! Finance, op. cit.)

| Metric | Value |

| Dividend Growth Streak | 13 Years |

| Dividend Streak | 54 Years |

| 7-Year Dividend Compound Annual Growth Rate | 7.5% |

| 10-Year Average Dividend Yield | 7.6% |

| Dividend Coverage Ratio | 1.3 |

The Lowdown on Altria Group Inc

Altria has a long history of paying and raising dividends. The company has also returned capital to investors via buying back its own shares. Altria Group Inc bought back $1.6 billion worth of its own stock in 2022 and nearly $6.0 billion worth since 2018. (Source: MarketWatch, op. cit.)

For income investors, MO stock is worth a look. Shareholders get paid dividends while they wait for the price to pick up.