Agree Realty Stock a 5%-Yielder for Monthly Income Seekers

Why ADC Stock Has a 31-Year Dividend Streak

The Federal Reserve expects to cut interest rates three times this year and make additional cuts in 2025. The downward projection of interest rates will help companies expand their margins, along with easing their financing costs.

Capital-intensive companies such as real estate investment trusts (REITs) would benefit from lower interest rates. Take the case of Agree Realty Corporation (NYSE:ADC), a mid-cap REIT that focuses on properties for the retail sector.

The company has built more than 40 community shopping centers, largely in the midwestern and southeastern U.S. As of December 31, 2023, Agree Realty’s real estate holdings comprised 2,135 properties spread across 49 states and roughly 44 million square feet of gross leasable space. (Source: “About Us.” Agree Realty Corporation, last accessed April 4, 2024.)

The growth of online shopping has driven concerns about the future of the U.S. brick-and-mortar retail sector. The COVID-19 pandemic added to the concerns, but many retail REITs have survived.

Fortunately, Agree Realty Corporation has established tenants, which lowers the risk of occupancy issues that may arise.

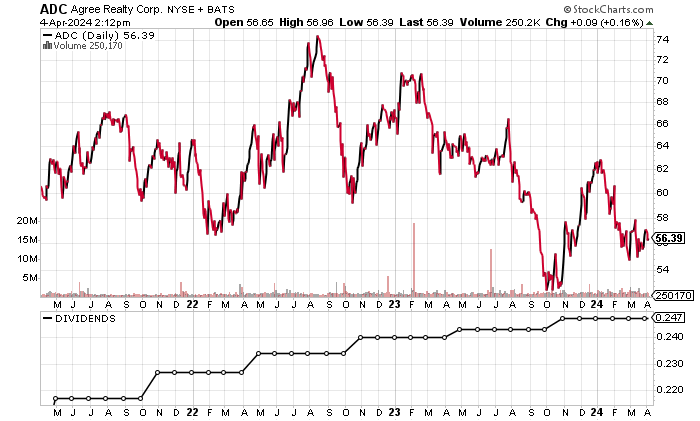

Despite the company having more than doubled its annual revenues since 2020, ADC stock has been struggling. As of this writing, Agree Realty stock is down by 10.5% this year and 16.0% over the past year. Its high of $80.51 in February 2020, which was just prior to the pandemic shutdowns, is much higher than its current share price.

Chart courtesy of StockCharts.com

Agree Realty Corporation’s Revenues & Profits Set to Rise

Agree Realty Corporation is a solid REIT that has consistently reported sound financial results that have allowed it to pay steady dividends.

Its revenues have increased by double-digit percentages for four straight years to a record-high $537.5 million in 2023. That was 186% higher than its 2019 revenues and well above its 2020, 2021, and 2022 revenues.

Analysts estimate that Agree Realty will continue ramping up its revenues, albeit at a lower rate. This is likely due to a combination of some slowing and a normalization of its revenue growth.

Analysts expect the company’s revenues to rise by 10.6% to $594.5 million in 2024, followed by 9.0% to $647.7 million in 2025. (Source: “Agree Realty Corporation (ADC),” Yahoo! Finance, last accessed April 4, 2024.)

| Fiscal Year | Revenues (Millions) | Growth |

| 2019 | $187.5 | N/A |

| 2020 | $248.6 | 32.6% |

| 2021 | $339.3 | 36.5% |

| 2022 | $429.8 | 26.7% |

| 2023 | $537.5 | 25.1% |

(Source: “Agree Realty Corp.” MarketWatch, last accessed April 4, 2024.)

Agree Realty Corporation has consistently generated gross margins above 80%, as the following table shows.

| Fiscal Year | Gross Margin |

| 2019 | 87.5% |

| 2020 | 87.2% |

| 2021 | 87.9% |

| 2022 | 87.8% |

| 2023 | 87.6% |

On the bottom line, Agree Realty Corporation has consistently generated generally accepted accounting principles (GAAP) profitability, with GAAP-diluted earnings-per-share (EPS) growth in two of the last four years.

Analysts expect the company to grow its adjusted earnings to $1.84 per diluted share in 2024, versus $1.63 per diluted share in 2023. They expect this to be followed by $1.88 per diluted share in 2025. (Source: Yahoo! Finance, op. cit.)

| Fiscal Year | GAAP-Diluted EPS | Growth |

| 2019 | $1.93 | N/A |

| 2020 | $1.74 | -10.1% |

| 2021 | $1.78 | 2.6% |

| 2022 | $1.83 | 2.4% |

| 2023 | $1.70 | -7.0% |

(Source: MarketWatch, op. cit.)

Agree Realty Corporation has also consistently generated positive free cash flow (FCF), with growth in the last four straight years. The company achieved record-high FCF in 2023.

The company’s high FCF allows for dividends, capital expenditures, and debt reduction.

| Fiscal Year | FCF (Millions) | Growth |

| 2019 | $136.7 | N/A |

| 2020 | $147.0 | 7.6% |

| 2021 | $254.6 | 73.1% |

| 2022 | $364.8 | 43.3% |

| 2023 | $388.1 | 6.4% |

(Source: MarketWatch, op. cit.)

Agree Realty Corporation’s balance sheet needs some attention, given its $2.4 billion in total debt and $10.9 million in cash at the end of 2023. (Source: Yahoo! Finance, op. cit.)

On the plus side, the expected lower interest rates will help reduce the company’s financing costs.

Furthermore, Agree Realty has managed to easily cover its annual interest expenses with higher earnings before interest and taxes (EBIT). The company’s interest coverage ratio of 3.1 in 2023 was healthy.

| Fiscal Year | EBIT (Millions) | Interest Expense (Millions) |

| 2020 | $133.2 | $40.1 |

| 2021 | $175.7 | $50.4 |

| 2022 | $219.3 | $63.4 |

| 2023 | $254.6 | $81.1 |

(Source: Yahoo! Finance, op. cit.)

Agree Realty Corporation’s Piotroski score—an indicator of a company’s balance sheet, profitability, and operational efficiency—is 4.0. That’s just below the midpoint of the Piotroski score’s range of 1.0 to 9.0, which suggests that improvements are needed.

Agree Realty Stock’s Dividend Health Looks Fine

Effective January 2021, Agree Realty Corporation changed its dividend payment schedule from quarterly to monthly. As of this writing, ADC stock has a dividend yield of 5.21%.

Agree Realty should be able to continue paying dividends, and based on the company’s expected profitability and FCF, I expect its dividends to rise.

| Metric | Value |

| Dividend Growth Streak | 11 Years |

| Dividend Streak | 31 Years |

| 7-Year Dividend Compound Annual Growth Rate | 5.9% |

| 10-Year Average Dividend Yield | 4.9% |

| Dividend Coverage Ratio | 1.4 |

The Lowdown on Agree Realty Corporation

I view Agree Realty stock’s price weakness as an opportunity for investors to consider shares of a sound company with a long track record of paying dividends. Agree Realty stock could be ideal for those who are looking for monthly income.

Institutional ownership of ADC stock is extremely strong, with 529 institutions holding the majority of Agree Realty’s outstanding shares (as of this writing). The top two institutional investors are The Vanguard Group, Inc., with a 14.15% stake, and BlackRock Inc (NYSE:BLK), with a 12.58% stake. (Source: Yahoo! Finance, op. cit.)

Moreover, as interest rates decline, Agree Realty should be able to strengthen its operations and fundamentals, which should help support its dividends.