AG Mortgage Investment Trust Inc: This “Alternative Bank” Yields 13%

MITT Stock: Is This Dividend Safe?

Tired of low interest rates? You’re not the only one. Thanks to the Federal Reserve, millions of investors struggle to earn decent income.

High-yield stocks look tempting, but the payments dry up right after you buy them. And usually those measures come with some large capital losses to boot.

For that reason, I ignore most of the big yields. You don’t have to dig deep into the financials to spot problems. But once in a while, a stock crosses my desk that surprises me.

Take AG Mortgage Investment Trust Inc (NYSE:MITT), for instance. The trust borrows money from lenders and invests the proceeds into safe, government-backed mortgages. I’ve nicknamed these businesses “alternative banks,” though they have no physical branches or locations.

And it’s a profitable business. At the time of this writing, MITT stock yields nearly 13%. But can such a high payout possibly be safe? Let’s dig into the numbers.

Is MITT Stock in Fine Financial Health?

With alternative banks, we look at a metric called “core earnings.” This provides us with an estimate as to how much cash the trust can return to unitholders.

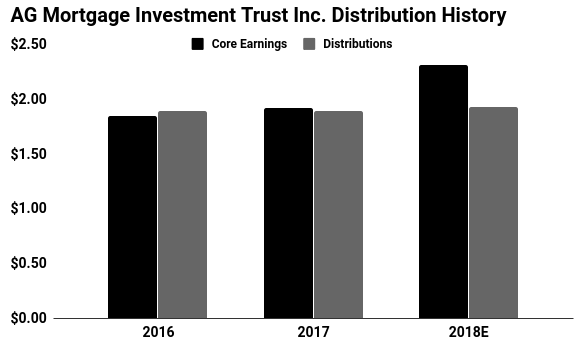

Analysts estimate that the trust will have generated $2.32 in core earnings in 2018. Over the same period, management has paid out $1.93 in distributions. This comes out to a payout ratio of 83%.

Generally, I like to see companies pay out 90% or less of their earnings as dividends. So AG Mortgage has left itself with sufficient wiggle room to keep making payments in a bad year.

Furthermore, the trust’s portfolio consists of some of the safest investments around.

The company has plowed most of its capital into residential mortgages. These loans tend to be quite reliable, given that house payments are one of the last payments that people skip in a downturn.

AG Mortgage also purchases default insurance from the government. So even if a homeowner defaults, “Uncle Sam” has promised to make up the difference.

(Source: “Dividend History,” AG Mortgage Investment Trust Inc, last accessed January 17, 2019.)

The Bottom Line on MITT Stock

So is MITT stock a sure thing? Not really.

Alternative banks make their money on the difference—called the “spread”—between short- and long-term interest rates. If the gap between these two yields declines, so too does AG Mortgage’s profits.

And that’s exactly what has happened in recent months. While the Federal Reserve has boosted short-term interest rates, long-term bonds pay about the same amount. This means less cash flow for AG Mortgage and fewer dividend hikes for MITT stock.

That said, management has done a good job hedging these risks. They have also kept the trust’s debt load manageable. That should allow AG Mortgage Investment Trust to sail through the current business cycle better than most.

In other words, MITT stock’s 13% yield looks safe for now.