Pembina Pipeline Corp: Ultra-High-Yielder Hits Record High

Wall Street Sees More Upside for Pembina Pipeline

Income investors like energy stocks because the world runs on oil, and will continue to. Moreover, energy stocks that make a lot of money provide some of the frothiest dividends on Wall Street. While the outlook for crude oil has turned bearish, one bullish energy play that recently hit a record high, and continues to have great potential, is Pembina Pipeline Corp (NYSE:PBA, TSE:PPL).

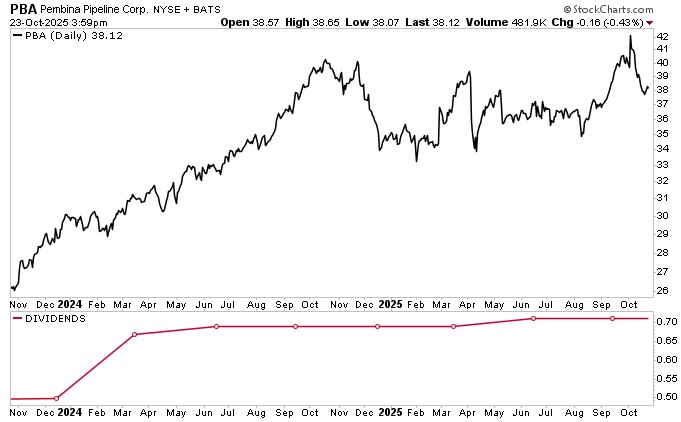

Pembina stock has been having a decent year, rising approximately four percent over the last six months and nine percent year to date. PBA stock hit an all-time record high of $42.40 on October 6. It has pulled back a little since then to around $38.12.

Despite the solid gains, Wall Street sees PBA hitting fresh highs over the coming months, with analysts providing a 12-month share price target of $41.34 to $45.72 per share. This points to potential gains of approximately 8.5% to 20%.

There are reasons to remain bullish on Pembina Pipeline. It’s been reporting solid financial results and providing robust guidance. The company recently entered a major export agreement for liquified petroleum gases (LPG), and it continues to expand its pipelines and announce new acquisitions.

For income investors, Pembina also provides a reliable high-yield dividend. It currently provides a quarterly dividend of CDN$0.71 per share, or $2.84 on an annual basis, for a yield of 5.32%. (Source: “Stock & Dividend,” Pembina Pipeline Corp, last accessed October 23, 2025.)

Chart courtesy of StockCharts.com

About Pembina Pipeline Corp

Pembina Pipeline Corp is a Calgary-Alberta-based oil and gas company that provides energy transportation and midstream services. It operates through four segments: Partnerships, Pipelines, Facilities, and Marketing & New Ventures. (Source: “Operations,” Pembina Pipeline Corp, last accessed October 23, 2025.)

Through the Partnership segment, Pembina has relationships with the Alberta Carbon Grid, Cedar LNG (a floating LNG facility), and Chinook Pathways (formed to pursue ownership in the Trans Mountain Pipeline).

The Pipelines segment provides customers with pipeline transportation, terminalling, and storage and rail services in key market hubs in Canada and the U.S. for crude oil, condensate, natural gas liquids, and natural gas.

The division manages pipeline transportation capacity of three million barrels of oil equivalent per day (MMoe/d), above-ground storage of 10 million barrels of oil (MMbbls) and rail terminalling capacity of approximately 105 thousand barrels of oil equivalent per day (mboe/d).

Solid Q2 Results

Pembina reported solid financial results for the second quarter ended June 30, 2025. All figures are in Canadian dollars. The company reported second-quarter earnings of $417.0 million, or $0.65 per share. (Source: “Pembina Pipeline Corporation Reports Results for the Second Quarter of 2025 and Provides Business Update,” Pembina Pipeline Corp, August 7, 2025.)

It reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $1.01 billion, and adjusted cash flow from operating activities of $698.0 million, or $1.20 per share.

During the quarter, the company:

- Enhanced its propane exports, including a $145.0-million optimization of its 20,000-bpd Prince Rupert Terminal that will expand market access and significantly reduce shipping costs per unit.

- Entered a long-term tolling agreement with AltaGas Ltd. for 30,000 bpd of liquified petroleum gases export capacity.

- Acquired the remaining 8.33% interest in three gas processing trains and related infrastructure from Whitecap Resources Inc. for $55.0 million and concurrently entered into new and extended long-term take-or-pay agreements.

- Continues to advance more than $1.0 billion in proposed conventional pipeline expansions to meet rising transportation demands from growing production in the Western Canadian Sedimentary Basin. These expansions are secured by long-term contracts underpinned by take-or-pay agreements.

- Revised its outlook for its 2025 capital investment program to $1.3 billion, reflecting continued progression of proposed conventional pipeline expansions, approval of new projects, and acquisitions.

Tightens 2025 Guidance

Pembina updated its 2025 adjusted EBITDA guidance range to $4.225 billion to $4.425 billion from previous guidance of $4.2 billion to $4.5 billion.

Looking ahead, due to seasonal and asset specific factors, Pembina expects third-quarter results to be consistent with second-quarter results, with stronger results expected in the fourth quarter.

Increases Quarterly Dividend to $0.71/Share

What’s better than a stock trading near record levels?

One that also raises its dividend payout.

Back in May, Pembina increased its quarterly dividend by three percent to $0.71 per share from $0.69 per share. (Source: “Stock & Dividend,” Pembina Pipeline Corp, last accessed October 23, 2025.)

In August, the company maintained its quarterly payout at $0.71 per share, or $2.74 per share on an annual basis, for a forward yield of $5.32%.

The Lowdown on Pembina Pipeline Corp

Pembina Pipeline Corp is a great pipeline stock reporting solid financial results. This helps it provide shareholders with a growing annual distribution—four years and counting. It also provides shareholders with reliable, long-term capital appreciation, too.

Over the last five years, with dividends reinvested, PBA stock has provided total returns of 150%. Without reinvesting dividends, the total return slips to 74%.

PBA stock is trading near record levels, but Wall Street analysts expect that momentum to continue and for the stock to hit fresh highs over the coming quarters.

That’s good news for passive income investors and the 692 institutions that hold 64.8% of all outstanding shares. Three of the biggest holders include Royal Bank of Canada, The Vanguard Group Inc., and Goldman Sachs Group Inc. (Source: “Pembina Pipeline Corporation (PBA),” Yahoo! Finance, last accessed October 23, 2025.)