Delek Logistics Partners: Bullish 10%-Yielder Reports Record Q2 Results

Delek Logistics Bullish on Industry Tailwinds

Today, I’m putting the income spotlight on Delek Logistics Partners LP (NYSE:DKL).

Crude oil prices have traded in a fairly tight range of late on concerns about how a global trade war will affect the economy. That being said, crude oil prices can still experience some daily or weekly gains and losses on unexpected events.

On September 9, oil prices climbed after Israel carried out a surprise attack in Doha, Qatar, striking Hamas leadership. It was the first time that Israeli has attacked Qatar.

Qatar has called the attack on Hamas headquarters a “cowardly attack.” Israel, meanwhile, said the attack was in retribution for the shooting attack at a Jerusalem bus stop on September 8 that killed five people. (Source: “Oil Prices Jump as Israel Strikes in Qatar,” OilPrice, September 9, 2025.)

This is yet again another example of why we need to ween ourselves off crude oil from politically dubious and unstable regimes like Qatar, Saudi Arabia, and other nations in the Middle East and further promote smaller, well-established national energy companies like Delek Logistics

With a market capitalization of just $2.3 billion, Delek Logistics is a smaller energy company, but it’s throwing up the kind of quarterly results that its significantly larger peers wish they could. The company reported record fourth-quarter 2024 results and record first- and second-quarter 2025 results. It also provided solid guidance, increased its dividend for the 50th consecutive quarter, and its units are outpacing the S&P 500.

What’s not to love?

Delek Logistics Partners LP is a midstream, energy master limited partnership (MLP) that provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, and terminalling water disposal and recycling customers in the U.S. (Source: “Investor Update,” Delek Logistics Partners LP, April 1, 2025.)

The partnership’s infrastructure includes 850 miles of crude and product transportation pipelines and a 700-mile crude oil gathering system.

Delek’s key areas of operations are centered around the Permian Basin, the Delaware Basin, and other regions in the Gulf Coast area. This includes Texas, Tennessee, Arkansas, and Oklahoma.

Another Record Quarter for Delek Logistics

Delek Logistics continues to have excellent momentum, reporting record first- and second-quarter 2025 results. For the second quarter ended June 30, Delek announced that net income increased 8.5% on an annual basis to $44.6 million, or $0.83 per unit. (Source: “Delek Logistics Reports Record Second Quarter 2025 Results,” Delek Logistics Partners LP, August 6, 2025.)

The partnership’s net cash provided by operating activities jumped 22.6% to $107.4 million from $87.6 million in the second quarter of 2024. Its distributable cash flow as adjusted was up 6.9% at $72.5 million.

Delek’s second-quarter earnings before interest, taxes, depreciation and amortization (EBITDA) slipped to $90.1 million, compared to $102.4 million in the second quarter of 2024. Its adjusted EBITDA advanced 18% to $120.9 million from $102.4 million in the second quarter of 2024.

Commenting on the results, Avigal Soreq, the company’s president, said, “During the second quarter Delek Logistics continued its strong execution by completing the construction of new Libby 2 plant and several crude & water gathering projects.”

“We are also making progress on adding AGI & sour gas treating capabilities at the Libby Complex and look to further expand the overall processing capacity,” Soreq added.

Quarterly Distribution Increased to $1.115/Unit

Thanks to reliable distributable cash flow, Delek Logistics is able to provide investors with a growing distribution. In July, it increased its quarterly cash distribution from $1.11 per common unit to $1.115 per unit. This works out to an annual distribution of $4.46 per unit, for a forward dividend yield of 10.25%. (Source: “Delek Logistics Partners, LP Increases Quarterly Cash Distribution to $1.115 per Common Limited Partner Unit,” Delek Logistics Partners LP, July 29, 2025.)

In prepared remarks from the partnership’s second-quarter results, Soreq, said, “We are proud of the 50th consecutive increase in our distribution and we expect to continue to increase our distribution in the future. Due to our strong execution we are increasingly confident in our full year Adjusted EBITDA guidance of $480mm to $520mm.”

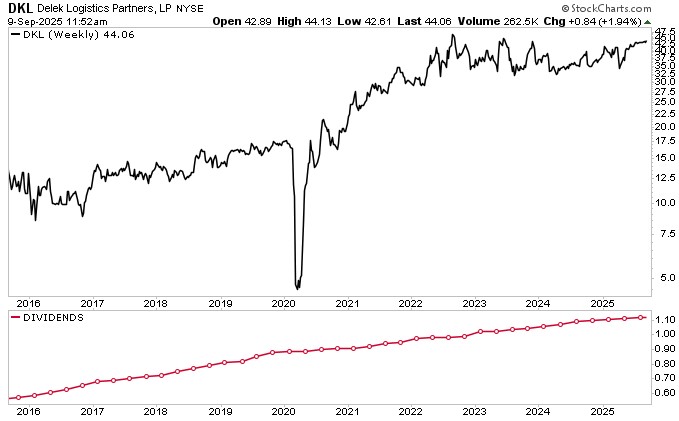

DKL Units Up 19% Year Over Year

DKL unitholders are having a good year, too. As of September 9, DKL units are outpacing the broader market, up:

- 6.0% over the last three months

- 12.5% year to date

- 19% year over year

Bigger gains are expected, with Wall Street analysts providing a 12-month share price high target of $47.00.

Chart courtesy of StockCharts.com

The Lowdown on Delek Logistics

The energy sector has been choppy, but Delek Logistics continues to ignore the white noise, reporting record results in 2025. The partnership also maintained its full-year 2025 guidance for adjusted EBITDA of $480.0 million to $520.0 million.

Delek’s share price is outpacing the broader market, and it increased its payout for the 50th straight quarter.