Star Bulk Carriers: Get Paid Monthly From This 16%-Yielder

Could Star Bulk Stock Have 142% Upside Potential?

When it comes to shipping, most investors probably think of midstream companies, or businesses that transport oil and gas. But there’s another subset of the marine shipping industry that can provide investors with great long-term capital appreciation and high-yield dividends: dry bulk shipping.

The dry bulk shipping market is expected to experience modest growth over the coming years due to an increase in demand for key commodities, including iron ore, coal, cement, sand, and grain.

In 2023, the global market for dry bulk shipping was worth approximately $158.0 billion. It’s forecast to hit approximately $187.0 billion by 2030, expanding at a compound annual growth rate (CAGR) of 2.5%. (Source: “Dry Bulk Shipping Industry Business Analysis Report 2024-2030 Featuring Key Players – Oldendorff Carriers, Pacific Basin Shipping, and Star Bulk Carriers,” ResearchAndMarkets, January 16, 2025.)

Chances are that the growth rate would be higher if it were not for economic uncertainty with regards to global tariffs. With that said, dry bulk shipping companies with a big global presence should be able to weather any short-term unpredictability far better than smaller shipping companies.

And that’s what makes Star Bulk Carriers Corp (NASDAQ:SBLK) so compelling.

Athens-Greece-based Star Bulk Carriers is the largest dry bulk shipping company with a fleet of 153 bulk carriers, ranging in size from Supramax vessels to Newcastlemax vessels. Every year, Star Bulk ships more than 70 million metric tons of cargo across the world’s oceans. (Source: “Overview,” Star Bulk Carriers Corp, May 8, 2025.)

With an average age of approximately 11.9 years, the company’s vessels give it exposure to all cargo types and trade routes. For example, its Capesize vessels are mainly responsible for transporting cargo from the Americas and Australia to East Asia.

Star Bulk’s Supramax vessels carry dry bulk between the Americas, Europe, Africa, and Australia, and throughout Asia.

2024 Net Income Jumps 75%

For the fourth quarter ended December 31, 2024, Star Bulk announced that voyage revenue increased 17% on an annual basis to $308.9 million. Its net income was up approximately seven percent at $42.4 million, or $0.36 per share. (Source: “STAR BULK CARRIERS CORP. REPORTS NET PROFIT OF $42.4 MILLION FOR THE FOURTH QUARTER OF 2024, AND DECLARES QUARTERLY DIVIDEND OF $0.09 PER SHARE,” Star Bulk Carriers Corp, February 18, 2025.)

The company’s time charter equivalent (TCE) revenues climbed 13% to $216.7 million. The daily TCE rate was down 12% at $16,129. Star Bulk ended the quarter with cash and equivalents of $436.2 million, compared with $259.7 million at the end of 2023.

For full year 2024, its voyage revenue was up 33% at $1.26 billion, while net income jumped 75.5% to $304.6 million, or $2.67 per share. Star Bulk’s adjusted net income rallied 56% to $285.5 million, or $2.63 per share. Its TCE revenue advanced 36% to $931.5 million. The daily TCE rate grew 16% to $18,392.

Looking ahead, Star Bulk continues to benefit from strong interest by major financial institutions in lending to it. The company has successfully raised new debt and refinanced existing facilities on highly attractive terms, reducing costs while extending maturities.

Management noted that, while the first quarter is traditionally weaker and geopolitical issues remain, Star Bulk is cautiously optimistic about the medium-term outlook for the dry bulk market.

Quarterly Dividend of $0.09/Share Declared

In December, Star Bulk announced an amended dividend and share buy-back policy. Under the new policy, the company may, at its discretion, allocate up to 60% of excess cash flow towards dividends, with the rest used for share buybacks, growth initiatives, and fleet renewal. (Source: “STAR BULK CARRIERS CORP. ANNOUNCES AN AMENDED DIVIDEND POLICY AND SHARE BUY-BACK UNDER A NEW SHARE REPURCHASE PROGRAM,” Star Bulk Carriers Corp, December 16, 2024.)

The shipper also initiated a new program of up to an aggregate of $100.0 million.

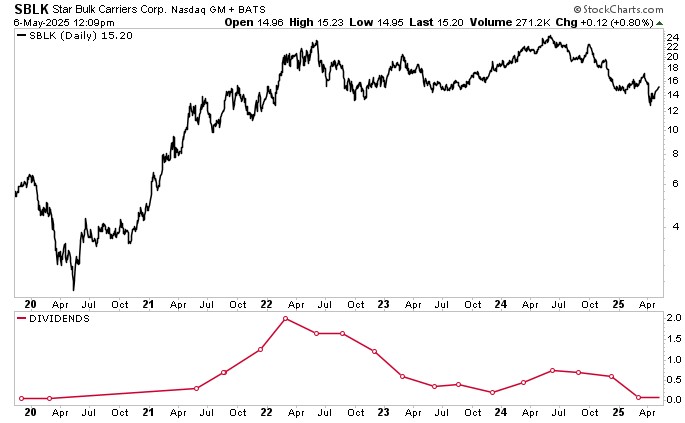

For the fourth quarter of 2024, Star Bulk’s excess cash flow was $17.6 million; this resulted in a dividend of $0.09 per share, or $2.40 on an annual basis, for a forward yield of approximately 16%.

On the share repurchase front, the company has repurchased approximately 900,000 shares since the renewal of its share repurchase program in December.

SBLK Stock: 140%+ Upside Potential?

Star Bulk Carriers has been snapping up its own shares, because management believes the company is undervalued. Despite reporting solid fourth-quarter and full-year-2024 results, SBLK stock is currently (as of May 8) down 19% over the last six months and down 32% on an annual basis. On the plus side, the stock is up 16% over the last month and up more than two percent year to date.

The outlook for SBLK stock remains a little more interesting, with Wall Street analysts providing a 12-month share price target range of $21.77 to $36.88. This points to potential gains of up to 142%.

Chart courtesy of StockCharts.com

The Lowdown on Star Bulk Carriers Corp

Star Bulk Carriers is a marine shipping stock with a strong balance sheet that’s reporting solid financial results. In fact, thanks to that balance sheet and the company’s scale and deep industry expertise, Star Bulk is well positioned to capitalize on future opportunities and continue delivering value to its shareholders.

This includes the 269 institutions that hold 36.06% of all outstanding SBLK shares. Some of the biggest holders include Oaktree Capital Management LP, Arrowstreet Capital, and Morgan Stanley.

Management also has skin in the game, with insiders owning 15.6% of all outstanding SBLK shares. This should help motivate the company to continue to generate solid gains and a reliable dividend.