Euroseas Ltd: Could Shares of 9%-Yielder Have 105% Upside?

ESEA Stock Hikes Quarterly Payout 8.3%

In the income pick spotlight today: Euroseas Ltd (NASDAQ:ESEA).

The dry bulk shipping industry experienced a better 2024 than expected. The outlook for this industry remains solid, in spite of a potential global trade war.

The global market for dry bulk shipping hit $157.8 billion in 2023, and it’s expected to reach approximately $187.0 billion in 2030, expanding at a compound annual growth rate of 2.5%. (Source: “Dry Bulk Shipping Industry Business Analysis Report 2024-2030 Featuring Key Players – Oldendorff Carriers, Pacific Basin Shipping, and Star Bulk Carriers,” ResearchAndMarkets, January 16, 2025.)

That kind of annual growth wouldn’t exactly be exciting if it were in the technology sector, but for the marine shipping industry, this represents reliably solid, predictable growth. And this situation should help a dry bulk shipping company like Euroseas Ltd improve its profitability and enhance its dividend payouts.

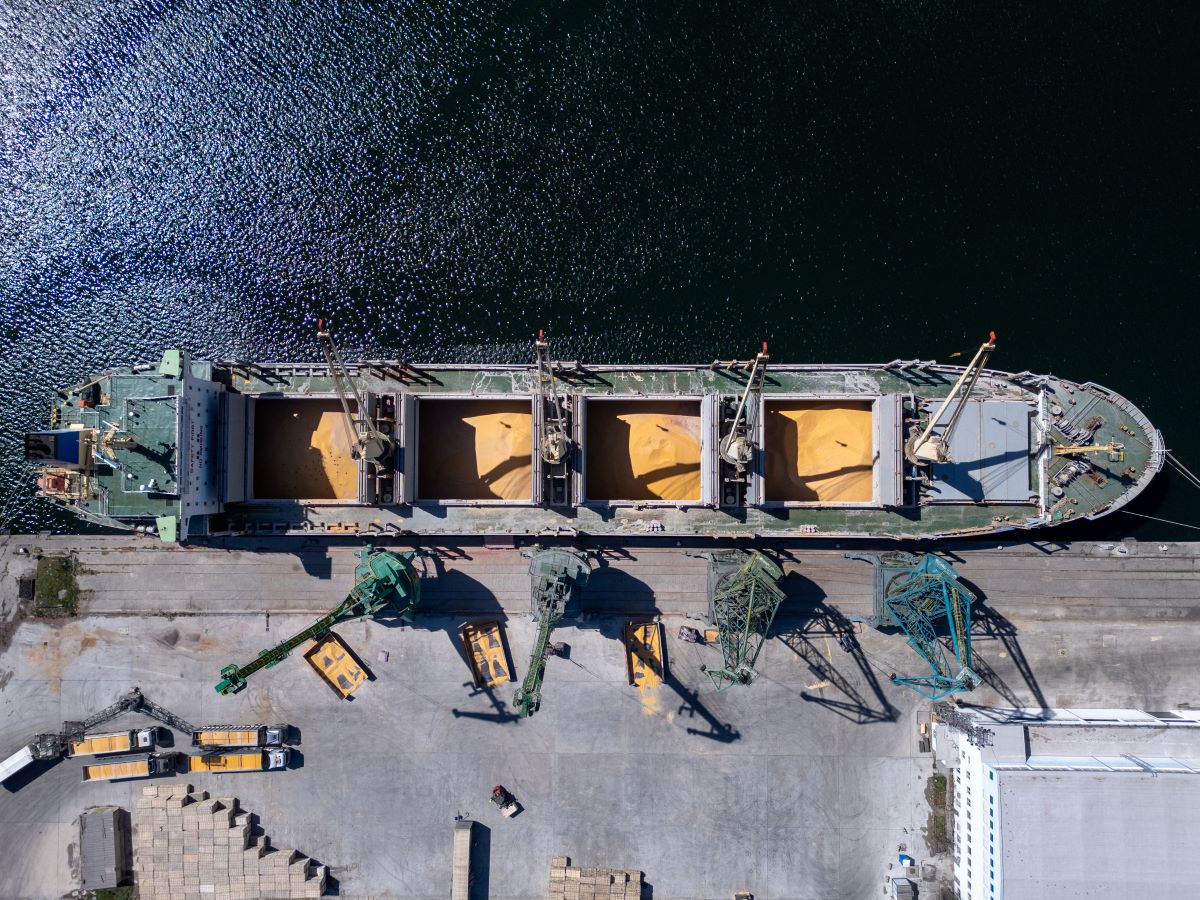

Euroseas is a marine shipping company that has been around for more than a century but only went public in 2005. The Athens-Greece-based company owns and operates drybulk and container carrier vessels and provides seaborne transportation for drybulk and containerized cargoes. (Source: “Overview,” Euroseas Ltd, last accessed April 21, 2025.)

The shipper has a fleet of 19 vessels, including 12 feeder and seven intermediate containerships. Euroseas’ 19 containerships have a cargo capacity of 58,861 twenty-foot equivalent units (TEUs), which is the length of a container.

On a fully delivered basis of its vessels under construction, Euroseas’ fleet will increase to 26 containerships with a cargo capacity of about 75,461 TEUs.

Euroseas Ltd: 2024 Revenue Jumps 12%

For the fourth quarter ended December 31, 2024, Euroseas announced that revenue increased 8.7% on an annual basis to $53.3 million. (Source: “Euroseas Ltd. Reports Results for the Year and Quarter Ended December 31, 2024,” Euroseas Ltd, February 27, 2025.)

The company’s net income slipped 1.3% to $24.4 million, or $3.49 per share. Adjusted net income came in at $23.3 million, or $3.33 per diluted share.

During the fourth quarter, on average, 23 vessels were owned and operated, earning an average time charter equivalent (TCE) rate of $26,479 per day, compared to 19 vessels in the same period of 2023 that were earning an average $29,266 per day.

Euroseas’ full-year total revenue advanced 12.4% to $212.9 million. Its full-year 2024 net income slipped marginally to $112.8 million, or $16.20 per share. Adjusted full-year net income was $103.5 million, or $14.87 per diluted share.

In 2024, on average, 21.73 vessels were owned and operated and were earning an average TCE rate of $28,054 per day, compared to 18.25 vessels in the same period of 2023 that were earning an average $29,714 per day.

Commenting on the results, Aristides Pittas, Euroseas’ chairman and chief executive officer, said, “During the fourth quarter of 2024, the containership markets broadly maintained their levels with the larger feeders noticeably increasing. Similarly firm levels for containership rates have prevailed so far in 2025 with rates in all feeder and intermediate sectors inching up.”

“This strength in rates is evident in our own fixtures as well, where we managed to book two of our intermediate containerships for three-year contracts at very profitable rates following the spade of fixings we did late last year for three of our newbuilding vessels and two oldest ones.”

Increases Quarterly Distribution to $0.65/Share

After paying a reliable dividend for years, Euroseas Ltd paused its payout back in 2013. But changing industry dynamics, including increased profitability and earnings visibility, allowed the company’s board to reinstate both its dividend and share repurchase program in May 2022.

Euroseas has raised its quarterly payout twice since then. Thanks to the company’s strong charterbook and growing fleet, it expects its earnings to remain strong and its cash reserve to grow.

Given the increased liquidity, Euroseas’ board increased its quarterly dividend to $0.65 per share, or $2.60 per share on an annual basis, for a forward dividend yield of 8.85%. (Source: “Dividend History,” Euroseas Ltd, last accessed April 21, 2025.)

Management also said that, in spite of revenue and earnings visibility, Euroseas’ share price “trades at a large discount” to its net asset value. This affords the company an opportunity to continue its share repurchase program.

ESEA Stock Has 105% Upside Potential

As noted above, management at Euroseas believes its share price is fundamentally undervalued. Though it is doing better than the broader market, up 10% over the last three months, 1.2% year to date, and 15.8% on an annual basis.

Conservative Wall Street expects ESEA stock to continue its winning ways over the coming quarters, with analysts providing a 12-month share price target range of $53.00 to $60.00 per share.

This points to potential gains of approximately 82% to 105% with ESEA.

Chart courtesy of StockCharts.com

The Lowdown on Euroseas Ltd

Euroseas Ltd is a leading global marine shipping company with one of the lowest operating cost structures among publicly traded shipping companies. It has a large modern fleet that is going to get a lot bigger, with its cargo capacity jumping 28% to 5,461 TEUs.

Euroseas continues to report solid financial results, boasts a strong orderbook, and has unrestricted cash of $80.7 million. Thanks to its robust cash position, the company has been able to increase its quarterly payout twice since 2024.

Of note, 59.58% of all outstanding ESEA shares are held by insiders. This significant insider ownership should entice management to ensure Euroseas Ltd performs well over the long run. (Source: “Holders,” Yahoo! Finance, last accessed April 21, 2025.)