20.4%-Yielding Genco Shipping Stock Hikes Dividend 56%

GNK Stock Delivers Rewards to Shareholders

A recession might be looming, but it’s expected to be relatively mild and short. This kind of economic headwind could send investors fleeing from the marine shipping industry, but that would be a mistake. While the dry bulk shipping sector, in particular, is expected to face some challenges this year, it doesn’t appear as though the challenges will have much of an impact (if any) on Genco Shipping & Trading Limited (NYSE:GNK).

Genco Shipping is the largest U.S.-headquartered dry bulk shipping company. The New York City-based company provides a full-service logistics platform for the transportation of commodities worldwide. Its diverse fleet of ships comprises 17 Capesize vessels and 27 minor bulk Ultra/Supra vessels. (Source: “Q3 2022 Earnings Presentation,” Genco Shipping & Trading Limited, November 10, 2022.)

The company’s fleet combines the upside earnings potential of Capesize vessels, which are focused on major bulk cargoes (i.e., iron ore for steel production), with the more stable earnings stream of minor bulk vessels.

Genco Shipping says it has a unique value strategy that will drive shareholder value over the long term. This strategy includes paying sizeable quarterly cash dividends, deleveraging through debt repayments, and taking growth opportunities to increase its asset base.

Since the beginning of 2021, the company has paid down $269.5 million, or 60%, of its debt. During the first nine months of 2022, Genco Shipping & Trading Limited:

- Declared dividends totaling $2.07 per share

- Paid down $66.3 million of debt

- Completed the acquisition of two high-quality, fuel-efficient Ultramax vessels

- Inked several time charter agreements to secure cash flows and de-risk recent acquisitions

Another Quarter of Great Financials

Genco Shipping’s business strategies have allowed the company to continue reporting tremendous financial results.

In the third quarter ended September 30, 2022, the company’s voyage revenues totaled $136.0 million, down from $155.3 million in the same period of 2021. (Source: “Genco Shipping & Trading Limited Announces Third Quarter Financial Results,” Genco Shipping & Trading Limited, November 9, 2022.)

The decrease in total revenue was primarily due to lower revenues from the company’s major bulk vessels, partially offset by a net increase in revenues from its minor bulk vessels, which came on the heels of the delivery of six Ultramax vessels.

Genco Shipping & Trading Limited’s third-quarter net income was $40.8 million, or $0.95 per share, versus third-quarter 2021 net income of $57.1 million, or $1.34 per share. Its adjusted net income in the quarter was $42.7 million, or $1.00 per share.

The company’s average daily time charter equivalent (TCE) rate in the third quarter of 2022 was $23,624, compared to $29,287 in the third quarter of 2021. This represents Genco Shipping & Trading Limited’s sixth consecutive quarter of daily TCE rates above $20,000.

During the third quarter of 2022, the dry bulk freight market softened as a result of COVID-related lockdowns in China and a lower volume of iron ore exports from Brazil. Since then, the freight market has rebounded and stands at firm levels for both Capesize and Supramax vessels.

Moreover, Genco Shipping & Trading Limited’s estimated fourth-quarter daily TCE rate is strong at $20,451, well above the current daily spot price of $13,500 for Capesize and Supramax vessels.

The company ended the third quarter of 2022 with an increased liquidity position of $287.4 million.

John C. Wobensmith, Genco Shipping & Trading Limited’s CEO, said he expects the company’s “low cash flow breakeven rates to continue to be a core differentiator for Genco and support our ability to continue to execute our value strategy for the remainder of 2022 and into 2023 as we take advantage of our sizeable and leading drybulk platform for the benefit of shareholders.” (Source: Ibid.)

Genco Shipping & Trading Limited Increases Its Quarterly Dividends

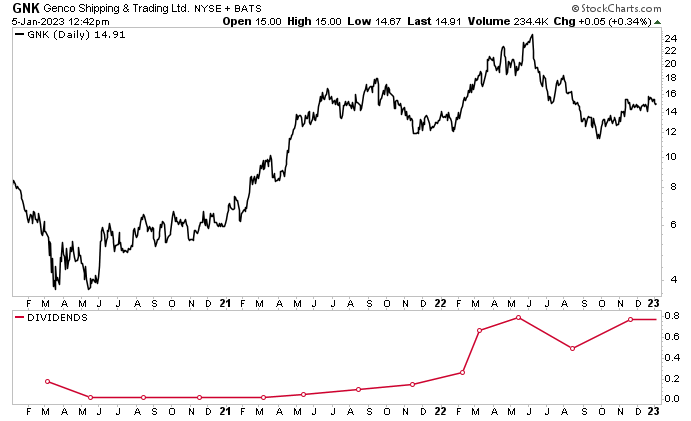

In the third quarter of 2022, Genco Shipping declared a cash dividend of $0.78 per share, for a yield of 20.4%. This payout represents a 56% increase over the $0.50 from the second quarter of 2022 and an even bigger increase over the $0.10 from the third quarter of 2021. This represents Genco Shipping & Trading Limited’s 13th consecutive quarterly payout, for a cumulative total of $3.795 per share.

Commenting on the new dividend, Wobensmith said, “During the third quarter, we generated strong earnings driven by our sixth consecutive quarter of TCE exceeding $20,000 per day together with lower expense levels. Prudent cargo coverage taken during the second quarter resulted in significant benchmark freight outperformance during Q3 2022.” (Source: Ibid.)

He continued, “The combination of these factors enabled us to increase our quarterly dividend by 56% on a sequential basis. Since implementing our value strategy, we have declared dividends of $2.74 per share over the last four quarters, delivering on our commitment to return substantial capital to shareholders.”

The company’s commitment to its shareholders has resulted in more than just ultra-high-yield dividends that would make any dividend hog happy. In terms of share price, Genco Shipping stock has been outperforming the broader market. As of this writing, GNK stock is up by 15% over the last three months and 10% year-over-year.

Chart courtesy of StockCharts.com

The Lowdown on Genco Shipping Stock

Genco Shipping & Trading Limited is a fabulous marine shipping company with a diverse fleet of vessels, solid cash position, and low debt level.

The company has significantly reduced its daily vessel breakeven rate. This frees up cash, which Genco Shipping & Trading Limited uses to reward investors with rising, high-yield dividends. Thanks to the company’s recently launched business strategy, GNK stock should be able to continue providing investors with reliable, growing, ultra-high-yield dividends. It helps that the company’s payout ratio is a measly 40.9%.