McDonald’s Corp Is a Top Dividend Stock for 2021 & Beyond

McDonald’s Corp Serving Up Tasty Returns to Dividend Investors

People love to bash McDonald’s Corp (NYSE:MCD). The company has a reputation for pushing processed, unhealthy, sugary foods; it lacks the “cool” factor of new fast-casual chains; and millennials who watched Super Size Me in school believe a burger and fries basically amounts to poison.

But you won’t hear investors complaining.

Since October 2009, shares of the burger giant that everyone loves to hate have posted a whopping gain, including reinvested dividends, of 437%. That’s almost double the total return from the broader S&P 500 over the same period.

And investors have good reason to expect those results to continue. In early October, McDonald’s Corp’s sales report blew Wall Street’s expectations out of the water. And several research outfits slapped “buy” ratings on the company’s shares, practically begging their clients to get into McDonald’s stock.

Income hunters should take notice, too.

Admittedly, I don’t often feature businesses like McDonald’s in Income Investors because, aside from Starbucks Corporation (NASDAQ:SBUX), I’ve generally avoided writing about restaurant stocks. It’s a challenging, competitive business with high upfront costs and razor-thin profit margins. In other words, exactly the opposite of the types of companies I often highlight. And those fundamentals explain why restaurant stocks have generally posted disappointing returns for their shareholders.

The COVID-19 pandemic has also hammered the business. In some parts of the country, rolling shutdowns have meant many eateries can no longer serve customers indoors. They have to rely on deliveries and takeout for the bulk of their sales. In other parts of the country, restaurants can only remain open if they maintain a minimum of six feet of physical distance between tables, but this has drastically limited their dining-room capacity and, by extension, their sales potential.

Regardless, restaurants nationwide have witnessed a catastrophic plunge in revenues. At the height of the pandemic in April, food service and drinking establishments reported a 52% year-over-year decline in sales. That has pushed dozens of chains to the brink of bankruptcy, with hundreds more on the brink of default. Despite the mounting challenges, McDonald’s has managed to buck the trend. (Source: “Dining Out: Restaurant Sales Warm in September but Lack Heat of Previous Months,” S&P Global Market Intelligence, October 16, 2020.)

The secret to McDonald’s Corp’s success comes down to its unique business model. You see, the company operates hardly any restaurants itself. Instead, the company sells franchise rights to local business owners who actually operate the individual stores. In exchange, McDonald’s collects royalty payments, typically about four percent of gross sales, on every meal sold. (Source: “Here’s What It Costs to Open a McDonald’s Restaurant,” Business Insider, May 6, 2019.)

This model has one big advantage: franchisees, not McDonald’s, have to front all the costs of building and maintaining the restaurants. The franchisees also have to perform the grunt work like cleaning stores, training staff, and haggling with regulators. McDonald’s, meanwhile, can keep its feet up and let the passive stream of income roll in. And because the company isn’t the one paying to keep locations up and running, almost every dollar of revenue flows straight to the bottom line.

It all comes back to the 80/20 rule of business, which I have referenced in previous articles. In any industry, 20% of activities generate 80% of the profits. Winning companies exclusively focus on the lucrative activities while outsourcing the rest of their operations.

Nike Inc (NYSE:NKE) focuses exclusively on branding and designing apparel while contracting out the manufacturing to partners. Coca-Cola Co (NYSE:KO) sells soda syrup and outsources the bottling, distribution, and retailing. Apple Inc. (NASDAQ:AAPL) designs remarkable technology but lets Chinese factory giant Foxconn Technology Co Ltd actually build the products.

It works the same way with McDonald’s. Management has ruthlessly focused on the 20% of activities (branding and real estate) that generate the bulk of the money. And they’ve left the other 80% to partners.

You can see the success of this business model in the company’s free cash flow (FCF). This metric simply measures how much cash a business has generated minus the amount of money that management must invest to maintain and grow operations.

In 2019, McDonald’s generated $5.7 billion in FCF on $21.1 billion of sales, which comes out to a margin of 27%. This stands at an order of magnitude above the profitability we normally see from restaurant businesses. And it explains why McDonald’s stock has shot the lights out in recent years while its rivals have struggled.

Chart courtesy of StockCharts.com

More recently, McDonald’s has managed to sidestep the carnage we’ve seen in the rest of the restaurant industry.

Because 95% of the company’s U.S. restaurants have drive-through windows, governments have granted most McDonald’s locations permission to remain open during the pandemic. (Source: “McDonald’s Drive-Thrus Allowed Its US Restaurants to Largely Stay Open,” Restaurant Dive, July 28, 2020.)

And partnerships with delivery services such as “Uber Eats,” “SkipTheDishes,” and “DoorDash” have given McDonald’s the ability to connect with customers too nervous to venture out in public.

Innovative marketing campaigns have padded the company’s sales, too. This summer, McDonald’s added a slew of popular new items to its menu, including “Spicy McNuggets,” “Mighty Hot Sauce,” and the “Chips Ahoy McFlurry.”

Management also inked a lucrative partnership deal with rap singer Travis Scott, who promoted the chain on numerous occasions across his social media accounts. The promotion turned out to be so successful, in fact, that some McDonald’s outlets reported long lines, in addition to running out of “Big Mac” burgers. (Source: “McDonald’s Adds Two New Menu Items, Including Spicy McNuggets,” NBC News, August 25, 2020.)

The combination of these factors has led to blowout financial results. In early October, McDonald’s reported that its U.S. same-store sales grew by almost five percent year-over-year. That’s an absolutely jaw-dropping number, given the current state of the economy. And more incredibly, analysts expect the growth rate to accelerate in upcoming quarters. (Source: “McDonald’s Reports Third Quarter 2020 Comparable Sales, Raises Quarterly Cash Dividend And Announces November Investor Update,” McDonald’s Corp, October 8, 2020.)

“Our third-quarter performance demonstrates the underlying resilience of the McDonald’s brand,” wrote President and CEO Chris Kempczinski in a note to shareholders.

“Our unique strengths, including our unrivaled drive-thru presence around the world, advanced delivery and digital capabilities, and marketing scale have become even more important during the pandemic.” (Source: Ibid.)

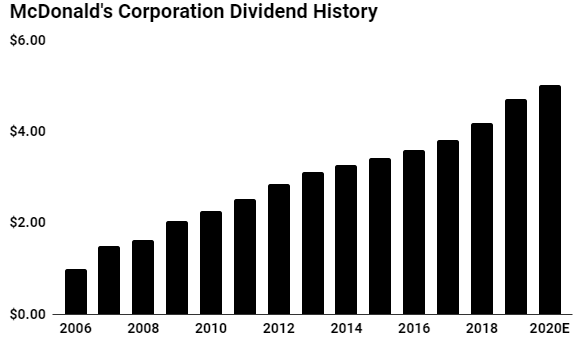

For shareholders, McDonald’s Corp’s unique business model has translated to a growing income stream. The company has boosted its dividend like clockwork annually since 1976. That track record has earned McDonald’s stock a spot on the prestigious list of S&P Dividend Aristocrats, a collection of elite names that have boosted their payouts for at least 25 consecutive years.

More recently, management announced that they would bump the company’s quarterly cash dividend three percent to $1.29 per share. That raise may disappoint some long-time shareholders, considering it represents McDonald’s smallest annual raise to investors on a percentage basis. But given the current COVID-19 pandemic and the state of the restaurant industry, it’s a pretty impressive accomplishment. And it’s a testament to the strength of the McDonald’s brand. (Source: Ibid.)

(Source: “Dividend History,” McDonald’s Corp, last accessed November 5, 2020.)

McDonald’s also returns an enormous amount of cash to shareholders through its share repurchase program. The scale of this program varies by year, depending on the profitability of the business, but between 2009 and 2019, management has bought back between $1.0 and $11.0 billion per year in outstanding shares.

Dividend investors often fail to appreciate the value of these programs, but they’re actually quite simple to wrap your head around. Think of a business as a pizza divided up into slices. If you reduce the number of slices, each remaining slice becomes more valuable.

The McDonald’s stock repurchase program works the same way. Over the past decade, management has quietly cut the number of outstanding shares in half, so the remaining stockholders have managed to double their stake in a wonderful business.

Bottom line: Foodies might turn up their noses at fast-food joints, but thanks to a unique business model, drive-through windows, and innovative marketing campaigns, McDonald’s has served up impressive returns to shareholders. And that should result in a growing stream of dividends for years to come.

For these reasons, McDonald’s Corp could be a top dividend stock for 2021 and beyond.