Chubb Ltd: One Dividend Stock for the Next 100 Years

One Dividend Stock to Own and Never Sell?

I hope my readers understand the core tenet of my income investing philosophy: I seek out wonderful dividend stocks that have rewarded their shareholders, not just for years or decades, but for generations.

I have dubbed these businesses “Forever Assets.” And if you look at my paid advisory Automated Income, I’ve stuffed the core portfolio full of them: The Walt Disney Co (NYSE:DIS) (media), Atmos Energy Corporation (NYSE:ATO) (utilities), Waste Management, Inc. (NYSE:WM) (garbage collection), and Procter & Gamble Co (NYSE:PG) (household supplies).

With these names in your portfolio, you don’t have to worry about things like recessions, trade wars, or stock market crashes. If history is any guide, these firms will keep chugging along, serving their customers and paying dividends to shareholders.

Today I want to bring you another striking example in insurance giant Chubb Ltd (NYSE:CB). Now stick with me here. I understand that reading about insurance ranks somewhere above doing your taxes and below riding a bicycle without a seat.

But thanks to a quirk in this company’s business model, Chubb stock pays out buckets of cash to shareholders as dividends. Investors in this business have made a fortune over the past few decades. And I think CB stock could deliver outsized returns over the next few decades too.

Keep reading and you’ll find out why.

Let me ask you a question: say you had to limit all of your future investments to one industry. Which one would you pick?

For me, insurance would be the first business that pops to mind. And if you think about it for a second, the reason is quite simple. Insurance, unlike any other business in the world, is the only industry that has a negative cost of capital.

In every other business, companies have to pay for the privilege of using money. Banks have to pay interest to depositors. Corporations have to pay dividends to investors. Startups and growing businesses may not have to make explicit payments to their backers. But over time, shareholders in these firms expect some kind of capital gain on their investment.

In all fields of capitalistic endeavors, entrepreneurs pay for the money needed to run their business. All endeavors, that is, except insurance.

Now stick with me here. When an insurance company writes a new policy, it always collects the premium up front. But it could be years or decades before the company ever needs to pay out a claim.

In the meantime, the company is free to invest this pile of money as it pleases.

This cash, called the float, basically amounts to an interest-free loan that doesn’t need to be repaid for a while. And with these funds, the insurance company can pocket any interest, dividends, and capital gains on its investments.

When managed correctly, these businesses are veritable licenses to print money. That explains why billionaire Warren Buffett built his business conglomerate, Berkshire Hathaway Inc. (NYSE:BRK.B) around an insurance company.

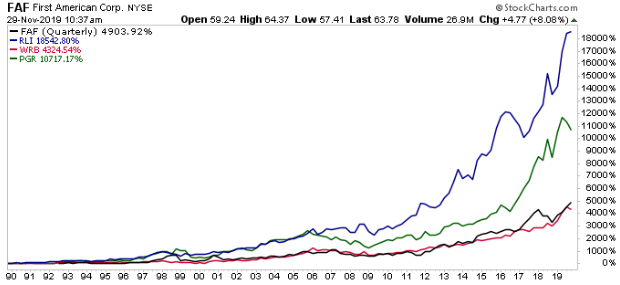

But in recent decades, investors have earned even better returns with smaller rivals. As you can see in the chart below, lesser-known insurance companies—such as RLI Corp. (NYSE:RLI), Progressive Corp (NYSE:PGR), First American Financial Corp (NYSE:FAF), and W. R. Berkley Corp (NYSE:WRB)—have posted blowout profits.

Chart courtesy of StockCharts.com

Here’s what sets Chubb stock apart from the pack. In mid-2015, the company merged with rival ACE Ltd. in a deal that created the largest property and casualty insurer in the world. This raw size means the company can spread its fixed expenses over a larger base of sales. That allows Chubb to undercut its competitors on price and earn higher margins on each policy.

You can see this advantage show up in the company’s financial results.

Over the past three years, Chubb has spent less than $0.30 in overhead costs on every dollar received in premiums. Smaller competitors, by comparison, spend closer to $0.36 on the dollar in expenses. (Source: “Chubb Limited Investor Presentation December 2018,” Chubb Limited, last accessed December 23.)

Multiply those savings against hundreds of billions of dollars written in insurance claims, and you’re suddenly talking about a lot of money.

More important than its profit margins, Chubb also has a long history of conservative insurance underwriting. Since 2008, the company has paid out only $0.90 to customers for every dollar received in premiums. Warren Buffett calls this type of profit free money, and I agree.

This income is a big deal for a simple, but somewhat counterintuitive, reason: the vast majority of insurers don’t actually make money writing insurance. Most just break even on that aspect of the business, instead earning almost all of their profit by investing their float. Chubb Ltd, by comparison, has historically done a great job avoiding risky policies and by keeping low-risk customers through discounts.

These duel advantages have translated to outstanding returns. Over the past decade, Chubb has earned $0.12 in annual profit on every dollar that shareholders have invested into the business. By comparison, the typical insurance company earns yearly returns between $0.08 and $0.09 on the dollar.

So what does management do with all of this money?

You guessed it. They pay most of it out to the company’s shareholders.

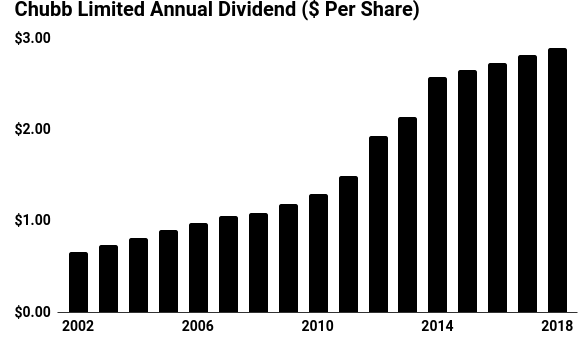

Chubb Ltd has boosted its quarterly distribution for 26 consecutive years. That recently earned the company a spot on the elite list of Dividend Aristocrats, a collection of S&P 500 companies that have hiked their payouts for at least a quarter-century. Today, CB stock pays a quarterly dividend of $0.75 per share. That comes out to an annual yield of two percent.

Management pads these payouts through the company’s stock repurchase program. Think of a business like a pizza divided into slices. By reducing the number of slices, the remaining pieces become larger. Stock repurchase programs work in the same way. By reducing the number of outstanding shares, each remaining share becomes more valuable. In effect, the remaining investors have a larger claim to the future profits of the business.

I sometimes describe stock repurchases as “stealth dividends.” In the case of Chubb, the company spent $1.1 billion on this program in 2018. If you were to include this figure in your total yield calculation, that raises the upfront payout on CB shares to four percent—not a bad deal in a world of zero-percent interest rates.

(Source: “Historical Dividend Information,” Chubb Ltd, last accessed December 23, 2019)

So what could go wrong here? With a remarkable track record, I see three big risks for Chubb: catastrophic losses, currency swings, and low prices.

Freak weather and natural disasters can hammer insurance profits. Chubb buys reinsurance, industry lingo for insurance products sold to financial companies to protect them against “once-in-100-years” events. Still, a string of catastrophes can wipe out profitability for several quarters. Shareholders have to accept this fact.

The other issues look more mundane.

Chubb earns about 40% of its profits outside the United States. A strong U.S. dollar will reduce the value of those foreign earnings. Over the long run, however, currency swings tend to even out. So they’re not something I pay much attention to.

Margins present a bigger risk. From time to time, insurance companies drop their prices in a bid to gain market share. That often results in large losses when customers eventually start making claims. Historically, though, Chubb has always chosen profitability over sales. But it’s an issue worth keeping an eye on.

Bottom line: insurance companies represent the ultimate “Forever Asset.” They’re quiet, entrenched businesses with a large competitive advantage and a long history of rewarding shareholders. Thanks to its raw size, Chubb Ltd stands head and shoulders above the pack.

I don’t know where Chubb stock will trade over the next quarter or two. But over the next few decades, I suspect that investors will be well compensated for their patience.