Exxon Stock: One Dividend Payer to Own Forever

Exxon Mobil Has Paid Dividends Since 1882

What do firms like Colgate-Palmolive Company (NYSE:CL), Consolidated Edison, Inc. (NYSE:ED), and The Coca-Cola Co (NYSE:KO) all have in common?

In short, all three stocks have paid out dividends for over 100 years. Think about everything that has happened over that time: wars, depressions, and asset bubbles. Yet through it all, these businesses have continued to mail out checks to their loyal shareholders.

This achievement has earned these firms a spot on an elite list of investments often called “forever assets.” These companies represent a group of stocks you can buy today and pass down to your grandchildren. The dividend checks will likely roll in not just for years or decades, but for generations.

I have stuffed the Automated Income Core Portfolio for paid subscribers with a number of such companies: Ecolab Inc. (NYSE:ECL), CSX Corporation (NASDAQ:CSX), Royal Bank of Canada (NYSE:RY), and Walt Disney Co (NYSE:DIS). When you own stocks like these, you no longer have to worry about trade wars or rising interest rates.

If history is any guide, these companies will cruise through any recession while paying out higher dividends to shareholders. For this reason, some of the world’s wealthiest investors—including Warren Buffett, Michael Bloomberg, and the Walton Family—hold these assets in their portfolios.

Today, I want to review one of my favorite forever assets, energy giant Exxon Mobil Corporation (NYSE:XOM). The company, which has paid out distributions since 1882, ranks as one of the oldest dividend stocks on the planet. For this reason, shares usually fetch quite a premium in the marketplace. But following the recent downturn in the oil patch, we have a rare chance to scoop up the name at a discount.

The Business

Exxon Mobil Corporation can trace its roots go back to 1870, under the banner of the Standard Oil Company and Trust. Management, directed by industrialist John D. Rockefeller, built a sprawling empire producing, transporting, refining, and marketing energy products.

By the turn of the century, the company enjoyed near monopoly power over the oil and gas sector. The business extracted so much money out of the economy, Congress forced Standard Oil to break up operations into seven different entities. (Source: “Standard Oil Company and Trust,” Encyclopaedia Britannica, last accessed March 8, 2019.)

Exxon Mobil Corporation, one of the firms to get spun off during the anti-trust debacle, has quietly rebuilt the Standard Oil empire of old. The company’s massive energy business spans the globe, hauling more the four-million barrels of oil equivalent out of the ground each day.

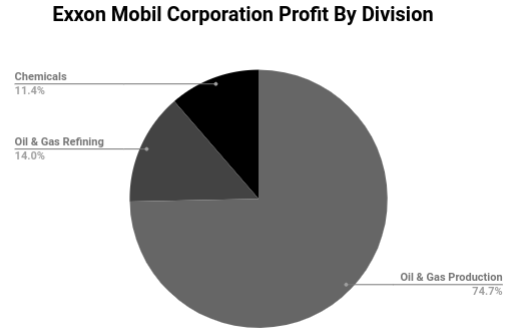

In total, Exxon alone accounts for five out of every 100 barrels of crude produced nationwide. In addition to producing crude, the company also has its hands in pipelines, chemicals, transportation, oil refining, and liquefied natural gas. (Source: “Quarterly Earnings,” Exxon Mobil Corporation, February 1, 2019.)

(Source: “2018 Investor Information,” Exxon Mobil Corporation, last accessed March 25, 2019.)

Analysts see two big advantages in this integrated business model.

First, the company captures every dollar of profit in the supply chain, from getting crude out of the earth to the final sale to customers at the gas stations. This also allows Exxon to adjust operations on command to serve the most profitable markets.

Second, owning a portfolio of different businesses provides a certain degree of diversification. If oil prices drop, losses in energy production can be offset by higher margins from refining and chemical operations. This results in a more stable stream of income, especially compared to peers in the oil patch.

But Exxon Mobil Corporation’s real competitive advantage comes down to its size. Anyone who ever said the best things come in small packages never worked in the energy business. In this industry, you need raw scale to complete projects, outmuscle competitors, and earn respectable returns for shareholders.

As the largest privately owned oil producer in the world, Exxon can spread its fixed costs over a much wider base of sales. Size also endows the business with tremendous bargaining power with suppliers. This allows Exxon to produce crude at a lower cost per barrel than rivals.

These advantages have resulted in outstanding returns for shareholders, even during periods of weak energy prices. During the 2009 financial crisis, for instance, oil bottomed at $28.00 per barrel. Most energy companies reported big losses that year.

Exxon Mobil Corporation, in contrast, generated $0.16 in profit on every dollar of debt and equity invested into the business. Today, my connections in the energy business tell me that Exxon was so well managed, the company could make money on $35.00 oil.

Of course, the energy market has since bounced back. And at today’s prices, management has no problem making buckets of money for shareholders. In the oil business, analysts use a metric called return on capital employed (ROCE) to determine profitability. This number measures how much money a company made in relation to how much capital executives actually invested into the business to generate that income.

Over the past decade, Exxon Mobil Corporation has generated an average annual ROCE of 18%. By comparison, the company’s “Big Oil” peers (BP plc [NYSE:BP], Total SA [NYSE:TOT], Chevron Corporation [NYSE:CVX], and Royal Dutch Shell plc [NYSE:RDS.A, NYSE:RDS.B]) as a group have only earned an average return of 12% per year. Smaller companies have done even worse.

In other words, Exxon stands in a league of its own (one of the reasons why XOM stock is the only energy stock in the Automated Income Core Portfolio). That’s the power of an integrated business model and sheer size in action. (Source: Ibid.)

Exxon Stock’s Dividend

As you can imagine, high profitability multiplied over such a large business translates into a lot of income. Last year, Exxon Mobil Corporation generated $16.4 billion in free cash flow. So what does management do with all of that money? It gives most of it back to shareholders.

Over the past decade, executives have spent nearly $180.0 billion on stock repurchases. Over that time, the number of outstanding shares has dropped from almost 5.6 billion shares to less than 4.2 billion. In effect, this has allowed investors to increase their claim on future cash flows by more than a third.

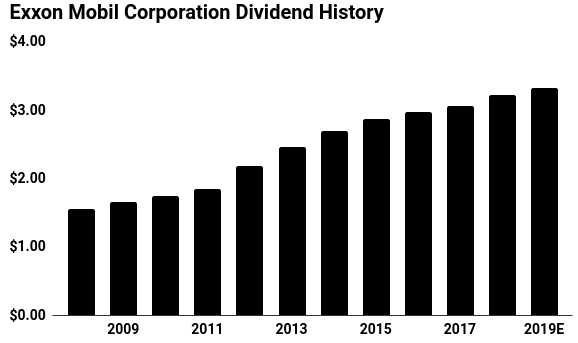

Exxon pays cash dividends as well, of course. As mentioned above, the company has mailed out checks to shareholders every year since 1882. Executives have also boosted that payout annually since 1983, earning Exxon Mobil Corporation a place on the elite list of “Dividend Aristocrats”

The total amount paid out to shareholders in combined dividends and buybacks has moderated in recent years. While the company has held up better than most, lower oil prices have taken a bite out of cash flows. But until oil becomes completely obsolete (a distant proposition even assuming an optimistic rollout of alternative energies), nothing will stop this lucrative income stream.

(Source: “Dividend Information,” Exxon Mobil Corporation, last accessed March 25, 2019.)

Exxon’s management also has another hidden way to reward shareholders: debt reduction. In 2012, Exxon had over $170.0 billion in outstanding liabilities. Today, that figure has dropped to $147.7 billion.

Sure, this program has the excitement factor of doing your taxes and investors would probably prefer bigger dividends, but it’s the smart, responsible thing to do.

By paying down debt, Exxon saves billions of dollars in interest payments each year. This frees up more money for shareholder distributions or new growth projects down the road. It also leaves the business on a sounder financial footing. So when the next downturn in the oil patch arrives, Exxon will be in the position to scoop up wonderful assets on the cheap.

The Opportunity

Now you might expect to pay a premium such a wonderful business. But for the most part, investors have decided to chase faster returns in tech stocks and cryptocurrencies, leaving blue-chip stocks like XOM stock in the dust. A decade ago, the company represented the most valuable business on earth. Since then, Exxon stock has remained range bound, lagging the S&P 500 by 230%.

Here’s how cheap Exxon stock looks today. In 2008, a single share bought you 4.1 barrels of proven oil reserves. Right now, that same share will buy you 5.8 barrels of proved reserves. In a normal world, you would think that would result in a higher price for XOM stock. That’s especially true when you consider Exxon makes a wider profit margin on each barrel sold than it did a decade ago. Yet today, shares trade hands for the same prices as they did at the start of the Obama presidency.

Maybe traders see problems down the road. That, however, doesn’t seem to be the case at Exxon Mobil Corporation. In fact, the company’s reserves-per-share figure will likely grow substantially in the years ahead.

In previous Income Investor columns, I’ve highlighted the impact of shale drilling on the oil and gas industry. New technologies, like horizontal drilling and hydraulic fracturing, have allowed Exxon to unlock vast swaths of energy across North America. The company also recently announced huge discoveries off the coasts of Brazil, Guyana, and Papua New Guinea.

Chart courtesy of StockCharts.com

How big is the potential here? In the energy business, I look at a number called the total resource base. This includes every single barrel the company has underground, but not commercially extractable with existing technology or at today’s energy prices.

In total, Exxon’s resource base totals 97 billion barrels of oil equivalent. Given the rapid advances we’ve seen in drilling technology, a lot of those barrels will become proved reserves in the next decade or so. Higher oil prices, not something I’m necessarily counting on to make this a profitable investment, could boost that reserve figure even more. (Source: “ExxonMobil Adds 2.7 Billion Barrels to Reserves; Replaces 183 Percent of 2017 Production,” Exxon Mobil Corporation, February 8, 2018.)

The Risks

Oil prices present the biggest risk for Exxon stockholders. If the price of the commodity you sell drops, so will your profits. It doesn’t take a Ph.D. to figure that out. But as I mentioned above, Exxon’s integrated business hedges some of that downside. When oil production earnings drop, the refining business usually picks up the slack and vice versa. This protects against some of the downside risks, much like owning bonds in a balanced portfolio.

Second, investors also have to keep an eye on reserve replacement. Operating an oil company is a bit like running on a treadmill; you have to keep moving just to stand in place. Every time Exxon pulls a barrel of crude out of the ground, it has to find another barrel somewhere else. Otherwise, the company will eventually run out of reserves. At the moment, this doesn’t appear to be a problem. Last year, Exxon Mobil Corporation added 4.5 billion in new reserves, replacing 313% of its annual production. Eventually, however, the pace of new discoveries will slow down. (Source: “ExxonMobil Adds 4.5 Billion Barrels to Reserves,” Exxon Mobil Corporation, February 26, 2019.)

Finally, shareholders also have to worry about international headlines. Because Exxon has operations around the world, management sometimes does business in places others fear to tread. And for good reason; past events in Russia, Nigeria, and Venezuela underscore the risks that come with doing business in some regions.

Exxon’s global portfolio mitigates some of these uncertainties. A problem in one country doesn’t spell doom for the entire company. But from time to time, investors will see the value of their shares drop on rumors of a coup or other types of uncertainty in some far off nation.

The Bottom Line on XOM Stock

“Forever assets” amounts to a lot of common sense: buy timeless businesses with entrenched market positions that reward their shareholders through ongoing dividend payments. Over the long haul, you’ll probably do pretty well.

Exxon stock constitutes a classic example. The company’s raw size endows the business with a permanent competitive advantage. That edge has allowed management to pay out distributions for over a century.

And because the energy patch has fallen out of favor on Wall Street, investors have a chance to scoop up shares at a rare bargain. My approach would be to consider owning XOM stock, stashing the certificates in a drawer, and collecting the dividends for decades to come.