9%-Yielding Western Midstream Stock Hits Record High

Western Midstream Partners LP Reports Record Q3

West Texas Intermediate (WTI) crude might be trading at a multi-year low, but that doesn’t mean all energy plays are in the doldrums. One industry that doesn’t really care about the state of crude oil prices is oil and gas midstream.

As midstream companies, energy limited partnerships (LPs) manage the storage and transportation of oil or natural gas. They don’t need to worry about the price of crude oil, because they don’t need to drill new wells.

They’re essentially toll bridges of the oil patch, moving oil and gas from wellhead to refineries. Pipeline profits aren’t hurt by asset bubbles or stock market crashes. Volatile energy prices have almost no impact on earnings.

Because the company earns a fee for each barrel shipped, this results in reliable cash flow and dividends. On top of that, they don’t have to pay corporate taxes as long as they earn at least 90% of their income from activities involving the transportation of commodities in the U.S. This extra money allows them to pay some of the best dividends on Wall Street.

One great midstream stock reporting strong financial results, with a reliable dividend and units that are at record levels, is Western Midstream Partners LP (NYSE:WES).

About the Company

Western Midstream Partners is involved in gathering, compression, treating, processing, and transporting natural gas. The LP gathers, stabilizes, and transports condensate, natural gas liquids (NGLs), and crude oil and gathers and disposes of produced water. It also buys and sells natural gas, NGLs, and condensate. (Source: “Third-Quarter 2025 Review,” Western Midstream Partners LP, November 4, 2025.)

The LP’s core assets provide midstream services for customers in some of the most active and productive basins in the U.S.: the Delaware Basin in West Texas and New Mexico; the DJ Basin in northeastern Colorado; and the Powder River Basin in Northeast Wyoming. Additional assets and investments are located in South Texas, Utah, and Southwest Wyoming.

In October, Western Midstream Partners completed the $2.0-billion acquisition of Aris Water Solutions. This marks a big step in helping the LP consolidate the water midstream sector in Texas’s Permian Basin.

Aris’ water infrastructure assets include approximately 790 miles of produced-water pipeline, 1,800 thousand barrels per day (MBbls/d) of produced-water handling capacity, 1,400 MBbls/d of water recycling capacity, and 625,000 acres from investment-grade counterparties. (Source: “Western Midstream To Acquire Aris Solutions,” Western Midstream Partners LP, August 6, 2025.)

Western Midstream’s produced-water business is supported by long-term contracts with significant minimum-volume commitments. Water is a strategic, essential infrastructure for the development and transportation of unconventional oil land gas production.

The company’s current infrastructure currently includes:

- 21 gathering systems

- 77 processing and treating facilities

- 7 natural gas pipelines

- 11 crude oil/NGL pipelines

- 14,000+ pipeline miles

While energy prices can be volatile, 95% of Western Midstream’s gas contracts and 100% of its liquids contracts are fee-based. This provides it with direct commodity exposure protection.

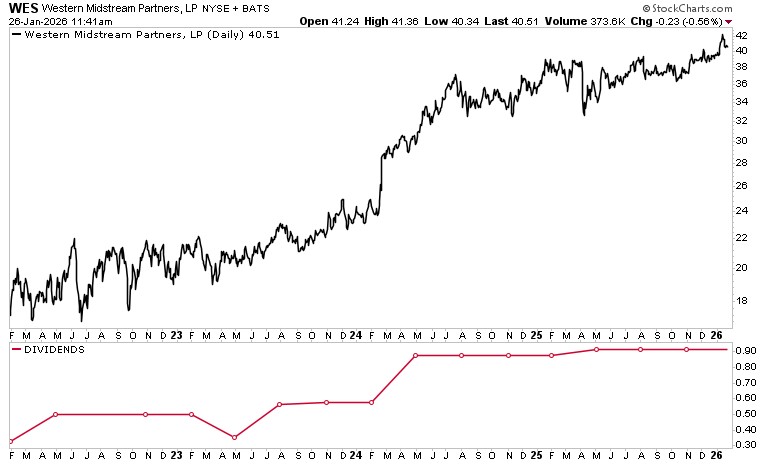

Chart courtesy of StockCharts.com

Record Third-Quarter Results

Western Midstream reported record third-quarter financial results. This included third-quarter net income attributable to limited partners of $331.7 million, or $0.87 per unit, which resulted in record third-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $633.8 million. (Source: “Western Midstream Announced Record Third-Quarter 2025 Results,” Western Midstream Partners LP, November 4, 2025.)

Third-quarter 2025 cash flows provided by operating activities climbed to $570.2 million, and third-quarter 2025 free cash flow increased to $397.4 million.

Third-quarter 2025 natural gas throughput increased two percent on a sequential basis to an average 5.4 billion cubic feet per day (Bcf/d). Crude oil and NGLs throughput climbed four percent on a sequential basis to an average 510 thousand barrels per day (MBbls/d).

Commenting on the results, Oscar Brown, president and chief executive officer, said, “I am pleased to report another strong operational and financial quarter for WES as we generated our second consecutive quarter of record Adjusted EBITDA.”

“Lower operational costs, inclusive of efficiency improvements and cost management efforts, drove a sequential-quarter increase in Adjusted EBITDA, even though volumes remained relatively in line with the second-quarter.”

Q4 Distribution of $0.91/Unit Announced

Dating back to 2008, Western Midstream has a long history of paying a reliable distribution. More recently, it has also been increasing its annual payout, for five years and counting.

Back in April, the LP increased its first-quarter 2025 distribution to $0.910 per WES unit. It has held it there since then. This works out to an annual payout of $3.64 per unit for a forward dividend yield of approximately nine percent. (Source: “Western Midtream Announces Fourth-Quarter Distribution And Earnings Conference Call,” Western Midstream Partners LP, January 23, 2026.)

Western Midstream’s reliably growing dividend is due to a steady stream of income that includes 95% fee-based gas contracts and 100% fee-based liquids contracts, which provides it with both direct exposure protection and predictable income.

WES Hits Record High

Record financial results have been helping juice WES units. On January 14, WES reached a record high of $42.80. The units continue to trade near that level. This puts WES up 8.5% over the last three months and five percent on an annual basis.

WES units may be trading at record levels, but Wall Street thinks the stock will hit further record highs over the coming quarters. Analysts have provided a 12-month share price forecast range of $41.00 to $46.00 per share. This points to potential upside of up to 13.4%.

The Lowdown on Western Midstream Partners LP

Western Midstream Partners LP is a great energy company with a strong balance sheet, reporting record financial results. The recent Aris acquisition coupled with numerous organic projects provide it with a strong growth platform for 2026 and beyond.

Taken together, Western Midstream Partners is on track to be at the high end of its 2025 adjusted EBITDA guidance range for the year.

On the passive income front, Western Midstream has paid a reliable dividend since 2008, and it recently increased its annual payout by four percent. While WES units recently reached a record high, Wall Street remains bullish on WES units and expects them to hit fresh highs over the next 12 months.

That’s good news for common unitholders and the 347 institutions that hold 36.2% of all outstanding WES shares. Some of the biggest holders include Alps Advisors Inc., Invesco Ltd, Blackstone Inc, and Goldman Sachs Group Inc. (Source: “Western Midstream Partners, LP (WES),” Yahoo! Finance, last accessed January 26, 2026.)

Insiders hold an impressive 40.01% of all shares, which should incentivize them to see WES units perform well.