Outlook for 8.4%-Yielding Omega Healthcare Investors Stock Is Bullish

OHI Stock Pays Reliable Dividends

Omega Healthcare Investors Inc (NYSE:OHI) isn’t the healthiest real estate investment trust (REIT), but it’s getting there. The company is a triple-net equity REIT with a property portfolio of senior care centers, skilled nursing facilities, and assisted living homes. The REIT owns 921 facilities in 42 U.S. states and the U.K., and it has partnered with 63 operators. (Source: “Map of Our Locations,” Omega Healthcare Investors Inc, last accessed September 27, 2022.)

The health-care industry, especially nursing homes and care facilities, took a hit during COVID-19. Omega Healthcare Investors was no exception. The company has mostly recovered from the economic downturn, but a few of its tenants are in arrears. Some of the REIT’s tenants have still not resumed paying their contractually required rent and interest. Omega Healthcare Investors Inc has amended some of its contracts to ensure it will eventually receive all of its owed rent and interest.

Because of the nonpayment of rent by a few tenants, the company’s profitability is below its pre-pandemic level. That said, the company’s second-quarter financial results experienced sequential improvements as some of its restructured tenants resumed paying their rents.

Moreover, Omega Healthcare Investors Inc’s property portfolio has been seeing steady occupancy growth, with the labor market showing signs of improving. The REIT has also been seeing a continued high demand for its real estate assets. During the second quarter, the company sold 13 facilities for $54.0 million, generating a gain of $25.0 million.

Looking forward, Omega Healthcare Investors Inc believes that the long-term impact of its tenants being behind in rent “should be relatively modest.”

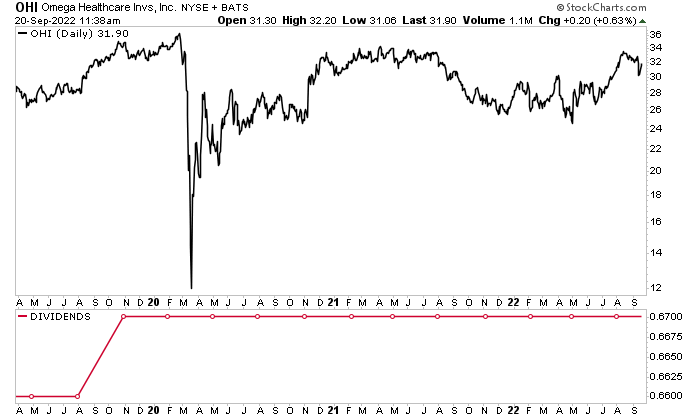

All this bodes well for the future of Omega Healthcare Investors stock, which is still trading down by 14% from its record pre-pandemic level. OHI stock, however, is resilient; it’s up by 196% over its March 2020 low. Furthermore, the stock has been significantly outperforming the broader market, up by:

- 20% over the last three months

- 16% year-to-date

- 10% year-over-year

Omega Healthcare Investors stock has made solid gains over the last few months, so profit-taking might be in order for some investors. OHI stock has found support at $28.45 and resistance at $37.09.

Throughout the COVID-19 pandemic, Omega Healthcare Investors Inc has been able to maintain its dividend at $0.67 per quarter, for a yield of 8.4% (as of this writing). While some dividend hogs might wish the company would raise its payout, it’s important to remember that Omega Healthcare Investors didn’t cut or suspend its payout during the pandemic like many companies did. Dividends during the pandemic, especially from health-care stocks, weren’t a sure thing.

Chart courtesy of StockCharts.com

Solid Q2 Results & $73 Million in New Investments

For the second quarter ended June 30, Omega Healthcare Investors announced that its revenue went down by five percent year-over-year to $244.6 million. The revenue decrease was primarily a result of property sales completed in 2021, tenant restructuring, and no rental or interest income from one of its tenants. (Source: “Omega Reports Second Quarter 2022 Results and Recent Developments,” Omega Healthcare Investors Inc, August 1, 2022.)

The company’s second-quarter net income increased 5.7% year-over-year to $92.0 million, or $0.38 per share. Its funds from operations (FFO) went down by 11% to $161.0 million, or $0.66 per share. Its adjusted FFO (AFFO) were $185.4 million, or $0.76 per share, compared to $207.0 million, or $0.85 per share, in the same period of last year.

Omega Healthcare Investors Inc’s second-quarter 2022 funds available for distribution (FAD) were $172.0 million, compared to $197.0 million in the second quarter of 2021.

During the second quarter of 2022, the company completed $73.0 million in new investments, funded $17.0 million in capital renovation and construction-in-progress projects, and sold 13 facilities for a gain of $25.0 million. It also repurchased 4.2 million of its own shares for $115.0 million.

The Lowdown on Omega Healthcare Investors Inc

Omega Healthcare Investors Inc is one of the largest health-care REITs. Omega Healthcare Investors stock has mostly recovered from the pandemic, but the company’s earnings haven’t. Therefore, management has taken steps to ensure that the company returns to its former glory. This has helped the REIT report better-than-expected second-quarter results.

In addition to its market-beating share price, Omega Healthcare Investors stock provides high-yield dividends and a healthy share repurchase program.