Earn 7% in Investment Income Outside of the Stock Market?

This Private Stock Market Pays More Investment Income

If you’ve felt a lingering disturbance in the business order—a vague and unsettling sense that there’s a hidden financial world where insiders collect out-sized investment income while you earn mediocre returns from stocks and bonds—I have some bad news.

This place exists.

It’s called private equity. And unless you are an “accredited investor,” they won’t let you in.

The best companies, as you might have suspected, don’t trade on public stock exchanges. Instead, a connected group of financial insiders exchange shares in a world of backdoor deals. And until recently, this private stock market remained the purview of the world’s elite.

But one company has allowed ordinary investors a way in: Main Street Capital Corporation (NYSE:MAIN).

Over the past decade, the firm has earned explosive returns for investors. Its shares have also emerged as a lucrative source of investment income, paying an upfront yield of seven percent.

Let me explain.

The Best Thing About BDCs

Main Street Capital belongs to a unique industry called business development corporations (BDCs).

Simply put, these firms lend money to—or take ownership stakes in—private businesses. In exchange, they collect interest and dividend payments.

Because of how these firms get structured, BDCs pay little in the way of taxes. But, in exchange for this benefit, management must pay out the majority of their profits to investors each year. As a result, it’s not uncommon to see a BDC paying a yield upwards of 12%, 15%, or even 21%.

The best part? These firms trade on public exchanges just like ordinary stocks. So, with a click of a mouse or swipe of a screen, investors can access the returns of the private equity market.

Why Main Street Capital’s a Standout Opportunity

But here’s what sets Main Street Capital Corporation apart.

Over the past decade, management has focused on mid-sized businesses, which generate between $10.0 and $100.0 million in annual earnings. In other words, real companies with real cash coming in.

But, because banks have scaled back lending to this segment, Main Street Capital executives can charge above-average interest rates on loans.

And the company doesn’t just provide funds and collect interest. Like a venture capital firm, it also provides advice, financial support, and other services to its portfolio companies. This generally results in better investment returns and lower default rates.

On top of all that, Main Street Capital also tends to have senior status on any loans. This means it stands first in line to get paid; if anything goes wrong, Main Street gets its money back before anyone else.

For investors, this has resulted in explosive returns.

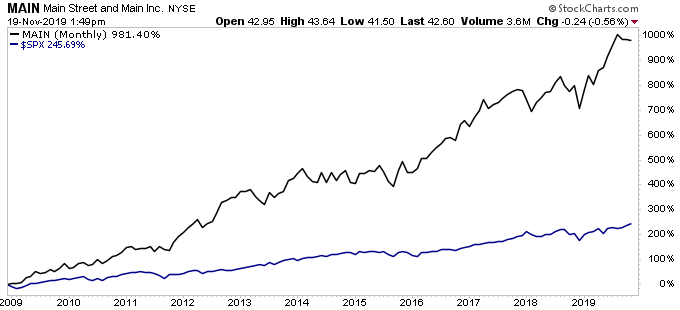

Since 2009, Main Street shares have generated a total return, including dividends, of 981%.

By comparison, the broader S&P 500 has gained only 246% over the same period.

Chart courtesy of StockCharts.com

This has also created a tidy income stream. Like clockwork, Main Street Capital Corporation executives have mailed out checks to shareholders every month since the trust’s initial public offering in 2007.

That’s a payment, it’s worth mentioning, that has more than doubled over the past decade.

The board has supplemented this income stream further through special dividends, which vary depending on the profitability of the business.

It’s a smart policy. By varying the payout, management can conserve cash in recessions and reward shareholders during upswings. Combined with the ordinary dividend, Main Street Capital shares pay a forward yield (at the time of this writing) of seven percent.

Of course, Main Street doesn’t represent a sure thing. But its executives have carved out a lucrative niche in the world of private equity. And that should translate into respectable returns and growing dividends in the years ahead.

That’s the power of investing outside of the stock market.