4 High-Yield Dividend Stocks Warren Buffett Is Using to Tame Inflation

These High-Yield Dividend Stocks Generated $1.6B in Annual Dividends for Berkshire Hathaway

Berkshire Hathaway Inc (NYSE:BRK.B), which is helmed by Warren Buffett, recently released its quarterly 13F report. It’s one of the most widely followed 13F reports on Wall Street. And for good reason; it shows what the Oracle of Omaha has been investing in. Moreover, the additions, sales, and increased positions provide insight into where Buffett thinks the economy is heading.

One of Buffett’s mantras is to buy shares of companies that he’s happy to own for the rest of his life—and that, if those stocks become cheaper, it makes sense to purchase more shares. That formula has served him well. Since 1965, the returns from Berkshire Hathaway stock have expanded at a compound annual growth rate (CAGR) of roughly 20%, about double the returns from the S&P 500 over the same time frame.

In addition to finding stocks with a long history of high capital appreciation, Buffett likes to pad his investment portfolio with dividend stocks. Berkshire Hathaway stock is famous for not paying dividends, but that doesn’t prevent Buffett from honing in on other stocks that provide reliably growing dividends. Each year, the companies in Berkshire Hathaway’s stock portfolio give Buffett more than $6.0 billion in dividend income. (Source: “Form 13F,” United States Securities and Exchange Commission, last accessed February 24, 2023.)

While U.S. inflation fell for seven consecutive months (from a four-decade high of 9.1% in June 2022 to 6.5% in December), it remains way too high for the average American family and small business. Heck, even high-income earners have been moving back into their childhood homes to make ends meet. (Source: “These High-Income Earners Are Moving Back Into Their Childhood Bedrooms and Putting Off Vacations as Inflation Drags On,” NBC News, February 15, 2023.)

So, a little extra money each month or quarter could certainly help investors fight inflation. Below are four of the biggest high-yield dividend stocks in Berkshire Hathaway Inc’s investment portfolio.

4 High-Yield Dividend Stocks That Warren Buffett Trusts

| Company Name | Stock Ticker | Business Sector | Dividend Yield |

| Ally Financial Inc | NYSE:ALLY | Financial Services | 4.0% |

| Kraft Heinz Co | NASDAQ:KHC | Consumer Defensive | 4.0% |

| Chevron Corporation | NYSE:CVX | Oil & Gas (Integrated) | 3.8% |

| Coca-Cola Co | NYSE:KO | Consumer Defensive | 3.1% |

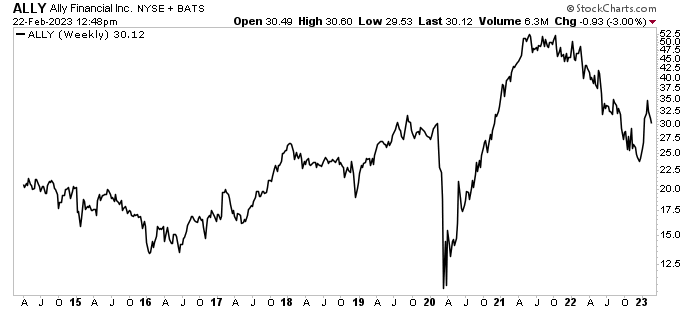

Ally Financial Inc

As of this writing, Berkshire Hathaway Inc owns 30.0 million shares (worth about $902.1 million) of Ally Financial Inc (NYSE:ALLY), making Berkshire Hathaway the company’s second-largest shareholder.

Ally Financial is a digital financial services company with one of the largest full-service automotive finance operations in the U.S., an award-winning digital direct bank (Ally Bank), a consumer credit card business, a corporate finance division, and a securities brokerage and investment advisory service (Ally Invest). (Source: “2021 Annual Report,” Ally Financial Inc, last accessed February 24, 2023.)

The company serves more than 11 million customers through a full range of online banking and financial services, including deposits, mortgages, and point-of-sale personal lending. Ally Bank is one of the largest direct banks in terms of retail deposit balances.

You’d like to think a bank would be good at making money, and Ally Financial Inc is no exception. For 2022, the firm reported full-year net income of $1.7 billion, or $5.03 per share ($6.06 per share on an adjusted basis). It also reported record net interest margin and total revenue. (Source: “Ally Financial Reports Fourth Quarter and Full-Year 2022 Financial Results,” Ally Financial Inc, last accessed February 24, 2023.)

Ally Financial has increased its dividends for six consecutive years. That’s not bad, considering the company only went public in April 2014. In the first quarter of 2023, it declared a dividend of $0.30 per share, for a current yield of four percent. Ally Financial stock currently provides Berkshire Hathaway Inc with $39.0 million in dividends per year.

ALLY stock’s payout ratio is just 23.8%, which gives the company more than enough financial wiggle room to hike its dividend again in 2023.

Chart courtesy of StockCharts.com

Kraft Heinz Co

Berkshire Hathaway Inc is the largest institutional holder of Kraft Heinz Co (NASDAQ:KHZ). It currently owns 325.6 million shares (worth about $13.0 billion) of Kraft Heinz stock, representing 26.6% of the company.

Kraft Heinz is a global food and beverage company that was formed when Kraft merged with Heinz in 2015. It’s the third-largest food and beverage manufacturer in North America.

The company manufactures and markets condiments, sauces, dairy products, packaged meals, meats, “refreshment” beverages, coffees, and other grocery items throughout the world. In addition to its two eponymous brands, the company owns well-known brands including “Jell-O,” “Kool-Aid,” “Lunchables,” “Maxwell House,” “Oscar Mayer,” “Philadelphia,” and “Velveeta.” (Source: “Fact Sheet,” Kraft Heinz Co, last accessed February 22, 2023.)

The company reported more than $26.5 billion in net sales in 2022. It was, in the words of its CEO, Miguel Patricio, “an incredible year for Kraft Heinz, delivering strong results and ending the fourth quarter with solid momentum that positions us well for 2023.” (Source: “Kraft Heinz Reports Fourth Quarter and Full Year 2022 Results,” Kraft Heinz Co,” February 15, 2023.)

As of this writing, Kraft Heinz stock pays quarterly dividends of $0.40 per share, for a current yield of four percent. That means Berkshire Hathaway Inc will pocket about $521.0 million in dividends from KHZ stock this year.

Chart courtesy of StockCharts.com

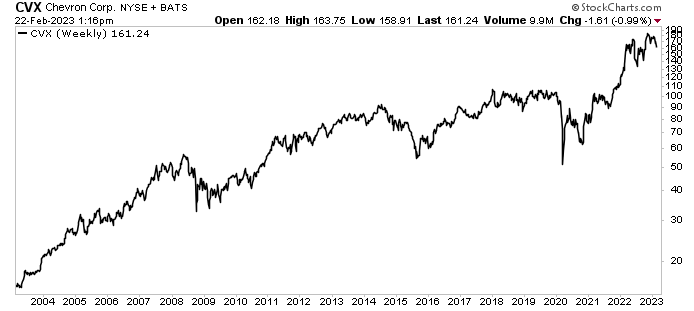

Chevron Corporation

Berkshire Hathaway Inc is the largest institutional shareholder of Chevron Corporation (NYSE:CVX). It currently owns 163.0 million shares (worth about $26.2 billion), amounting to 8.4% of the company.

Chevron is a global energy giant with a market cap of $322.0 billion. Through its various subsidiaries, the company is engaged in integrated energy and chemical operations worldwide. The company operates through two business segments, Upstream and Downstream. (Source: “Chevron 2023 Investor Presentation,” Chevron Corporation, January 31, 2023.)

The Upstream segment primarily consists of exploring for, developing, and producing crude oil and natural gas; processing, liquefying, transporting, and regasifying liquefied natural gas; transporting crude oil via export pipelines; transporting, storing, and marketing natural gas; and operating a gas-to-liquid plant.

The Downstream segment primarily consists of refining crude oil into petroleum products; marketing crude oil, refined products, and lubricants; manufacturing and marketing renewable fuels; transporting crude oil and refined products; and manufacturing and marketing commodity petrochemicals.

Suffice it to say, with the energy industry being the biggest winner of 2022, Chevron has been making lots of money. For 2022, it reported record annual cash flow from operations of $49.6 billion and free cash flow of $37.6 billion. It also reported record annual U.S. oil and gas production. (Source: “Chevron Announces Fourth Quarter Results,” Chevron Corporation, January 27, 2023.)

“We delivered record earnings and cash flow in 2022, while increasing investments and growing U.S. production to a company record,” said Mike Wirth, Chevron’s chairman and CEO. (Source: Ibid.)

He continued, “The company’s investments increased by more than 75 percent from 2021, and annual U.S. production increased to 1.2 million barrels of oil equivalent per day, led by 16 percent growth in Permian Basin unconventional production.”

In 2022, Chevron increased its quarterly dividend by six percent, paying out $11.0 billion to its shareholders. The company also returned $11.3 billion to CVX stockholders by purchasing nearly 70 million of its own shares for $15.0 billion.

Chevron Corporation has raised its dividend annually for the last 36 years. In January 2023, the company’s board declared a quarterly dividend of $1.51 per share, for a current yield of 3.8%. For Berkshire Hathaway Inc, that dividend increase will result in a tidy $984.3 billion payday.

Chevron’s board also authorized a new share-repurchase program, for an aggregate amount of $75.0 billion. That authorization takes effect on April 1 and doesn’t have a fixed expiration date.

Chart courtesy of StockCharts.com

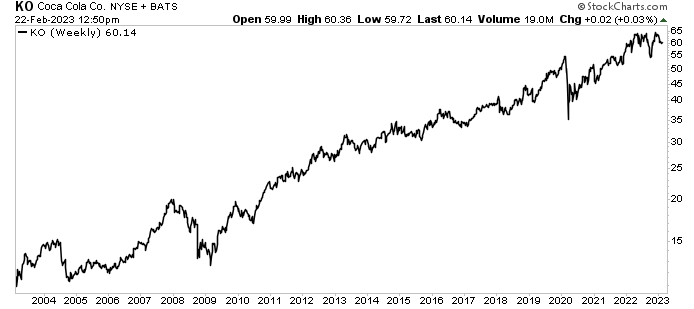

Coca-Cola Co

Berkshire Hathaway Inc owns 400.0 million shares of Coca-Cola Co (NYSE:KO), which is 9.3% of the outstanding shares of Coca-Cola stock.

Coca-Cola Co is the world’s largest non-alcoholic beverage company, home to about 200 master brands that are sold in more than 200 countries and territories. Some of the company’s most popular brands are “Coca-Cola,” “Dasani,” “fairlife,” “Fanta,” “Minute Maid,” “Powerade,” “Sprite,” and “vitaminwater.”

The company distributes its products through unmatched infrastructure, which includes about 225 bottling partners, 900 bottling plants, and 30 million retail outlets. (Source: “Company Profile,” Coca-Cola Co, last accessed February 24, 2023.)

Even when times are tough, most people can afford a soft drink. This helps explain why Coca-Cola Co has a long history of wonderful financial results and frothy dividends.

On February 16, the company’s board approved its 61st consecutive annual dividend increase, lifting KO stock’s quarterly dividend by 4.6% from $0.44 to $0.46 per share, for a current yield of 3.1%. (Source: “The Coca-Cola Company Announces Nomination of New Director and Approves 61st Consecutive Annual Dividend Increase,” Coca-Cola Co, February 16, 2023.)

This will provide Berkshire Hathaway Inc with about $736.0 million in dividends.

Chart courtesy of StockCharts.com

The Lowdown on High-Yield Dividend Stocks

As mentioned earlier, Berkshire Hathaway Inc doesn’t pay dividends, but its CEO knows the value of stocks that do. Not just any dividend stock earns a place in Berkshire Hathaway’s investment portfolio; Buffett looks for shares of great companies with solid fundamentals, ones that provide products and services that people need no matter what.

Buffett also likes to take advantage of companies that reward buy-and-hold investors with stock buybacks and reliable, growing, high-yield dividends. There’s no reason why everyday investors can’t do the same. Four of the top high-yield dividend stocks in Berkshire Hathaway’s portfolio are Ally Financial Inc, Kraft Heinz Co, Chevron Corporation, and Coca-Cola Co.