3M Stock a Contrarian Opportunity With Attractive Dividends

Why MMM Stock Has Immense Upside

Contrarian investors seek opportunities in undervalued assets or sectors that are experiencing temporary setbacks. While conventional investing wisdom calls for following trends, contrarian investing involves buying assets that are priced low and not in favor.

The strategy is risky, but it can be lucrative.

One contrarian opportunity that could be in the making is 3M Co (NYSE:MMM). Headquartered in Saint Paul, Minnesota, the company offers a wide range of products and solutions.

To the average consumer, 3M is known for iconic products like “Post-it” sticky notes and “Scotch” tape, but the company is much more than that.

The full list of the products and services that 3M provides is too long to mention here, but a few of them are abrasives, cleaning products, electrical supplies, insulation, medical products, and signage/markings. (Source: “All 3M Products,” 3M Co, last accessed January 25, 2024.)

Poor Share-Price History, But Fundamentals Are Intact

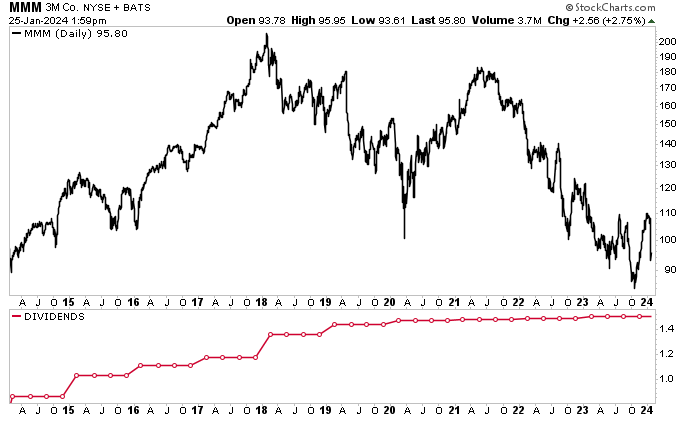

Over the past few years, 3M stock has faced a lot of selling. Around mid-2021, MMM stock traded as high as $184.17. As of this writing, it trades at $95.90. This represents a decline of almost 50%.

The below chart looks scary. Lately, 3M stock has been trading at some of its lowest levels in the past 10 years.

What happened?

There’ve been some very valid reasons for the selling. 3M Co is in the midst of fighting a few major lawsuits, and its business hasn’t been as stellar as it used to be. So, investors are genuinely concerned.

However, could the selling be overkill?

Speaking from experience, stock traders tend to become overly pessimistic on bearish developments and take share prices a lot lower than they should. The opposite is also true: investors sometimes get too excited about bullish developments and take stock prices a lot higher than they should.

Eventually, though, share prices better reflect companies’ fundamentals and come close to their true value.

Chart courtesy of StockCharts.com

Right now, Wall Street analysts see a lot of upside for MMM stock. Of the analysts providing a 12-month share-price forecast for 3M Co, their average estimate is $111.52 and their high estimate is $189.00. This points to potential upside in the range of 20.5% to 97.0% for 3M stock.

Despite the bearishness in the past couple years, 3M remains a fundamentally strong company, and its business is expected to improve.

Take a look at what Wall Street analysts are projecting about the company’s financials. As of this writing, they expect 3M Co to report revenue growth of 1.6% for 2024 and 3.1% for 2025. They estimate that the company’s revenues will be about $31.9 billion in 2024 and $32.9 billion in 2025. (Source: “Analysis,” Yahoo! Finance, last accessed January 25, 2024.)

As for profitability, analysts expect 3M Co to report earnings per share (EPS) of $9.59 for 2024 and increase that to $10.28 for 2024.

Could these estimates get better? It’s possible. As fears of an upcoming recession have faded away, inflation has eased, and interest rates are expected to decline, there’s a real possibility that 3M Co’s business will improve.

Moreover, the company’s balance sheet is solid, as well as strong enough to take the blow that could come from the previously mentioned lawsuits.

On top of that, the products that 3M makes and sells have garnered a lot of attention and brand loyalty over the years. In other words, this company isn’t going anywhere.

3M Co Has Hiked Its Dividends for 64 Years

Now, the fun part: dividends.

3M Co is one of those dividend payers that has a history of making sure long-term investors are happy. It has paid dividends to its shareholders without interruption for more than 100 years, and it has raised its dividend for 64 consecutive years.

This puts it deep in dividend king territory. That is, it’s in the group of companies that have raised their payouts annually for at least 50 years.

That’s pretty impressive. Keep in mind, over the past 64 years, we’ve seen several recessions, stock market crashes, wars, soaring inflation, financial crises, terrorist attacks, and a worldwide pandemic. Yet, through it all, 3M Co continued to give annual pay raises to its shareholders.

Thanks to MMM stock’s recent decline in price, its dividend yield is looking very attractive at 6.44% (as of this writing)

The Lowdown on 3M Stock

3M Co has come under fire from investors because some major lawsuits have been launched against the company, and there’s uncertainty about how those lawsuits will affect 3M. In addition to this, business has slowed down.

However, there’s a chance that investors have become too pessimistic, and that their selling of MMM stock could be overkill.

The company is fundamentally strong, and its financial performance and forecast seem decent. Plus, the company has built brand loyalty over the years, which could generate sustained business over time.

The good news for income investors is that 3M stock’s share-price weakness has made its dividend yield very attractive. As mentioned earlier, 3M Co has a very long track record of paying dividends (and increasing them).

Long-term investors could generate a healthy amount of capital appreciation and income from MMM stock. The stock is certainly down, but it remains compelling for contrarian investors.