3 Ultra-High-Yield Dividend Stocks for 2026

How Will Dividend Stocks Do in 2026?

It would be great to have a crystal ball and see what 2026 will bring, especially after a strong 2025. At the time of writing, the S&P 500 was up 15.8% year to date, the Nasdaq has rallied 19.5%, and the Dow Jones Industrial Average has advanced 13.5%. Not do be outdone, the Toronto Stock Exchange (TSE), the largest exchange in Canada, has climbed an impressive 27.5%.

Will 2026 be another year of double-digit growth or a year of reflection?

Thanks to the Federal Reserve announcing 175-basis-point cuts since September 2022, burgeoning artificial intelligence tailwinds, strong earnings, and a resilient U.S. economy, the outlook for stocks in 2026 is bullish, with big Wall Street brokerages calling for the S&P 500 to hit fresh highs over the coming quarters.

Deutsche Bank is, so far, the most bullish on the S&P 500, projecting the index to finish 2026 at 8,000. This represents upside of approximately 17% from current levels. (Source: “The world outlook 2026 – never a dull moment,” Deutsche Bank, December 2, 2025.)

Morgan Stanley remains bullish on U.S. stocks and expects the index to hit 7,800 by the end of 2026. Britain’s HSBC sees the S&P 500 ending the year at 7,500, with strength coming from artificial intelligence (AI). (Source: “Deutsche Bank sees S&P 500 rising to 8,000 by end of 2026,” The Globe and Mail, November 24, 2025.)

Obviously, there will be winners and losers in 2026. Our goal at Income Investors is to find winning stocks that provide shareholders with both solid capital appreciation and a reliable, high-yield dividend.

What constitutes “high yield” is a matter of opinion. You certainly can’t look to the S&P 500 for guidance. The dividend yield on the S&P 500 is a paltry 1.2%, which is near its all-time low.

For income hogs, you’ll most likely need to look outside the S&P 500 for more interesting dividend plays. Below are three great ultra-high-yield dividend stocks to consider for 2026.

They’re not the stocks with the highest dividend yield, and we don’t encourage chasing yield. Instead, these are three great stocks with yields over 10% and robust operations and cash flow, allowing them to provide shareholders with a reliable payout. Thanks to industry tailwinds, these stocks have great upside potential, too.

Ultra-High-Yield Dividend Stock List

| Company | Ticker |

| Dynex Capital Inc | NYSE:DX |

| ARMOUR Residential REIT, Inc. | NYSE:ARR |

| ZIM Integrated Shipping Services Ltd | NYSE:ZIM |

Dynex Capital Inc

Dynex Capital Inc (NYSE:DX), which operates as a mortgage real estate investment trust (mREIT) is in a sweet spot right now: DX shares are crushing the broader market and shareholders get paid monthly.

There have been concerns that interest-rate cuts would harm mREITs. But the Fed isn’t slashing interest rates as quickly as many expected. On top of that, the U.S. housing market remains strong, with the average 30-year fixed mortgage rate remaining above six percent. That’s all good news for Dynex Capital.

In the just-completed third quarter, Dynex reported total economic return of $1.23 per common share. Third-quarter net income was $147.5 million, or $1.08 per share, up from a net loss of $16.2 million, or a loss of $0.14 per share, in the same prior-year period. (Source: “Dynex Capital, Inc. Announces Third Quarter 2025 Results,” Dynex Capital Inc, October 20, 2025.)

During the quarter, the mREIT raised equity capital of $254.0 million and purchased $2.4 billion in agency residential mortgage-backed securities (RMBS) and $464.0 million in agency commercial mortgage-backed securities (CMBS).

On the dividend front, mREITs like Dynex have to legally distribute at least 90% of their taxable earnings to shareholders as dividends. This allows mREITs to pay out some of the most reliable high-yield dividends on Wall Street.

In November 2024, Dynex increased its monthly distribution from $0.13 per share to $0.15 per share. For March 2025, the mREIT’s board increased the monthly distribution again to $0.17 per share. It has held it there since then. This works out to an annual distribution of $2.04 per share, for a massive dividend yield of 15.1%. (Source: “Dynex Capital, Inc. Declares Monthly Common Stock Dividend of $0.17 Per Common Share for November 2025,” Dynex Capital Inc, November 10, 2025.)

A growing high-yield dividend is great, but it’s even better when it’s tied to a stock that’s thumping the broader market. Currently near their highest levels in more than 25 years, DX shares are currently trading up:

- 25.5% year to date

- 25% year over year

Chart courtesy of StockCharts.com

ARMOUR Residential REIT, Inc.

Real estate investment trusts (REITs) are a fabulous option for passive income investors, because they legally have to distribute at least 90% of their taxable earnings to shareholders in the form of a dividend.

It’s certainly easier to find a well-run REIT that has to provide a dividend than a well run company that you have to trust will maintain a dividend.

And that’s where ARMOUR Residential REIT, Inc. (NYSE:ARR) comes in. The Vero-Beach-Florida-based company invests primarily in RMBS issued or guaranteed by a U.S.-government-sponsored entity, including the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), or guaranteed by the Government National Mortgage Administration (Ginnie Mae). (Source: “Corporate Profile,” ARMOUR Residential REIT, Inc., last accessed December 15, 2025.)

ARMOUR Residential REIT’s investments are made up primarily of fixed-rate loans. The rest are either backed by hybrid adjustable-rate or adjustable-rate loans.

It’s good at what it does. ARMOUR’s third-quarter net income improved to $156.3 million, or $1.49 per share. The all-important distributable earnings came in at $78.3 million, or $0.72 per share. (Source: “ARMOUR Residential REIT, Inc. Announces Q3 Results and September 30, 2025 Financial Position,” ARMOUR Residential REIT, Inc., October 22, 2025.)

Distributable earnings are important, because that’s where the REIT’s dividend payouts come from. In December, ARMOUR paid a monthly dividend of $0.24 per share, or $2.88 per share, for a current annual dividend of 17.03%. (Source: “ARMOUR Residential REIT, Inc. Announces December 2025 Dividend Rate Per Common Share,” ARMOUR Residential REIT, Inc., November 26, 2025.)

The REIT’s third-quarter distributable earnings of $0.72 are sufficient enough to pay for its monthly dividends. On a quarterly basis, ARMOUR pays out $0.72 per share. Where most stocks like to have a buffer when it comes to their payout ratios, REITs legally have to pay out the vast majority of their earnings to shareholders.

And ARMOUR has paid out a lot over the years. Since it’s inception in November 2009, ARMOUR has paid out $2.6 billion in dividends. It’s also good at repurchasing shares—more than 275% million since 2013.

ARR stock has continued to have a good year in 2025, too. Like Dynex, the stock took a big hit in early April after President Donald Trump unveiled his global tariffs. This spooked investors, and the entire market took a dive. ARR has rebounded since then; it’s currently trading up 6.8% year to date and 5.3% on an annual basis.

Chart courtesy of StockCharts.com

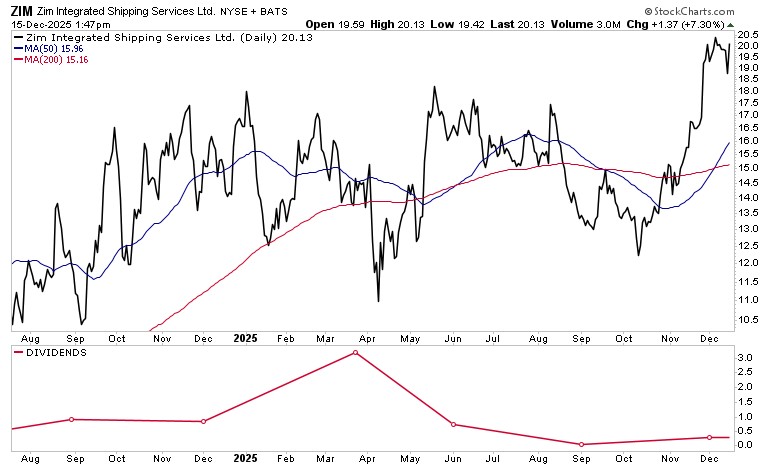

ZIM Integrated Shipping Services Ltd

The fortunes or misfortunes of marine shipping stocks like ZIM Integrated Shipping Services Ltd (NYSE:ZIM) are closely aligned with the global economy. When the economy is chugging along, more goods get shipped. Of course, the opposite is true when the economic outlook is a little foggy.

Right now, things are ship-shape for ZIM, with 2025 having been a good year for the company. It just reported solid third-quarter results and increased the midpoint of its 2025 guidance. ZIM stock has also done well of late, trading up:

- 27% over the last month

- 40% over the last three months

- 21% year to date

- 31% year over year

Founded in 1945, ZIM Integrated Shipping is a global container shipping company operating 129 vessels, all of which are currently chartered. (Source: “Q3 & 9M 2025 Financial Highlights,” ZIM Integrated Shipping Services Ltd., November 20, 2025.)

ZIM Integrated Shipping has operations in over 90 countries, serving approximately 32,000 customers in 300 ports. Core routes include Pacific, Latin America, Atlantic, Cross-Suez and Intra-Asia. (Source: “Corporate Overview,” ZIM Integrated Shipping Services Ltd, last accessed December 15, 2025.)

Despite a volatile rate environment and complex geopolitical landscape, the company reported “solid” third-quarter results. (Source: “ZIM Reports Financial Results for the Third Quarter of 2025,” ZIM Integrated Shipping Services Ltd, November 20, 2025.)

This includes revenue of $1.78 billion, net income of $123.0 million, or $1.02 per share, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $593.0 million, and operating income of $259.0 million.

Looking ahead to the fourth quarter, management expects the company to report adjusted EBITDA of between $2.0 billion and $2.2 billion and adjusted operating income of between $700.0 million and $900.0 million. Previously, the company expected to generate adjusted EBITDA of $1.8 billion to $2.2 billion and adjusted operating income of $550.0 million to $950.0 million.

As for dividends, ZIM Integrated Shipping’s payout is contingent on profitability, which means it will fluctuate. And frankly, ZIM stock doesn’t have a long dividend history, having only paid out its first dividend in August 2021. The company suspended its dividend in the back half of 2023 and reinstated it in June 2024.

ZIM Integrated Shipping’s dividend policy provides for a quarterly dividend equal to 30% of quarterly net income, with the full-year dividend payout totaling up to 50% of annual net income.

To that end, the company recently declared a quarterly dividend of $0.31 per share, or a total of $37.0 million. This works out to an annual payout of $4.28 per share, for a forward annual dividend yield of 22.8%.

Since its IPO in early 2021, ZIM Integrated Shipping has distributed approximately $5.7 billion to its shareholders; more than 25 times what the company raised in its IPO in January 2021.

Chart courtesy of StockCharts.com

The Lowdown on High-Yielding Dividend Stocks in 2026

No one knows what kind of year 2026 will be for investors. What we do know is that there will be winners and losers. When it comes to ultra-high-yield dividend stocks, an income investor must look for those with a strong balance sheet, which allows it to provide a reliable, growing dividend; a dominant position in a stable sector; a strong footprint; and a long-term business strategy.

That might sound like a tall order, but there are many excellent ultra-high-dividend-yielding stocks that reward investors with long-term dividend growth and capital appreciation.