Could 16%-Yielding Mach Natural Resources Have 90% Upside Potential?

Analysts Expect Mach Natural Resources Units to Rip Higher

At the start of 2026, West Texas Intermediate (WTI) was trading at its lowest levels since 2020. But, for better or worse, you can’t ignore the inherent volatility of crude. And right now, both WTI and Brent crude prices are being energized by ongoing geopolitical risk.

Crude oil prices are trading at a four-month high on concerns that the U.S. could again attack Iran if it doesn’t negotiate a new nuclear agreement.

The U.S. military has stationed naval vessels and other equipment capable of attacking deep inside Iran over the last week.

“A massive Armada is heading to Iran. It is moving quickly, with great power, enthusiasm, and purpose … Like with Venezuela, it is, ready, willing, and able to rapidly fulfill its mission, with speed and violence, if necessary,” U.S. President Donald Trump wrote in a Truth Social post on Wednesday, January 28. (Source: “@realDonaldTrump,” Truth Social, January 28, 2026.)

Cold weather ravaging huge swaths of the U.S. is another reason why crude oil prices are up roughly 15% over the last month.

One great midstream stock to keep on your radar, even when there is no threat of war and temperatures are hot, is Mach Natural Resources LP (NYSE:MNR).

About Mach Natural Resources

Not only has Mach Natural Resources been reporting solid financial results, revenue is expected to top $1.0 billion for the first time in 2025. (Source: “Mach Natural Resources LP (MNR),” Yahoo! Finance, last accessed January 30, 2026.)

Most investors probably aren’t all that familiar with Mach Natural Resources, but that’s because it only went public in October 2023.

Mach Natural Resources is an exploration and production (E&P) company focused on the acquisition, development, and production of oil, natural gas, and natural gas liquids (NGL) reserves across Oklahoma, Kansas, and the panhandle of Texas. (Source: “Investor Presentation December 2025,” Mach Natural Resources LP, last accessed January 30, 2026.)

In its transformative 2023, Mach successfully completed the largest initial public offering (IPO) for an E&P since 2017. In December of 2023, it closed on the $815.0-million acquisition of Paloma Anadarko Basin Assets in Oklahoma. (Source: “Mach Announces Acquisition of Paloma Assets,” Mach Natural Resources LP, November 13, 2023.)

Mach actually has a long history of exploiting acquisition opportunities. Since its 2017 inception, the company has closed 20+ acquisitions, totaling more than $3.0 billion, giving it approximately 2.8 million net acres, more than 12,600 producing wells, and proved reserves of 653 million barrels of oil equivalent (MMboe).

Most recently, this past September, Mach closed on two previously announced acquisitions: oil and gas assets from Sabinal Energy, LLC, and oil and gas assets managed by IKAV Energy Inc., for a combined $1.3 billion. (Source: “Mach Natural Resources LP Announces Successful Closing of Acquisitions in the Permian Basin and San Juan Basin; Provides Updated Outlook,” Mach Natural Resources LP, September 16, 2025.)

The acquisitions:

- Nearly double the partnership’s production from 81 Mboe/d to 152 Mboe/d;

- Increase pro forma natural gas exposure from 53% to 66%;

- Establish a presence in Permian and San Juan Basins; and

- Increase scale, strengthening Mach’s operational reach and ability to pursue future accretive acquisitions.

Another Solid Quarter

For the third quarter ended September 30, 2025, Mach Natural Resources reported total revenue of $273.0 million and a net loss of $36.0 million. (Source: “Mach Natural Resources LP Reports Third Quarter 2025 Results; Declares Quarterly Cash Distribution of $0.27 Per Common Unit; Provides Recent Well Results and Updated 2026 Outlook,” Mach Natural Resources LP, November 6, 2025.)

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were $124.2 million. It generated net cash provided by operating activities of $106.0 million.

The two recently closed acquisitions in the Permian and San Juan Basins contributed approximately two weeks to the company’s financial results.

During the third quarter, Mach achieved average oil equivalent production of 94 thousand barrels of oil equivalent per day (Mboe/d), which consisted of 21% oil, 56% natural gas, and 23% (NGLs).

It also reduced its 2026 drilling and completion capital program by 18% while maintaining prior production guidance.

Commenting on the results, Tom L. Ward, the company’s chief executive officer, said, “The third quarter was a defining period for Mach with the closing of our Permian and San Juan acquisitions. These transactions have transformed our scale and operating footprint while remaining fully aligned with the disciplined strategy that has guided Mach since inception.”

Q3 Distribution of $0.27/Share Declared

Mach Natural Resources has only paid eight distributions since going public in October 2023, so it doesn’t exactly have a rich history of payouts. And because its payout depends on earnings, it will fluctuate.

That said, the company has a disciplined business plan that puts distributions on the front burner. This includes maintaining a reinvestment rate of less than 50% of operating cash flow to optimize distributions to unitholders.

This allows Mach to target a peer-leading distribution to unitholders. Since 2024 alone, MNR stock had paid out $4.87 per unit. In December, the company paid a third-quarter distribution of $0.27 per unit, or $1.94 per unit on an annual basis, for a forward distribution yield of 16.5%.

For comparison’s sake, SPDR S&P Oil & Gas Exploration & Production ETF (NYSE:XOP) has a forward dividend yield of just 2.65%.

MNR Units Have 90% Upside Potential

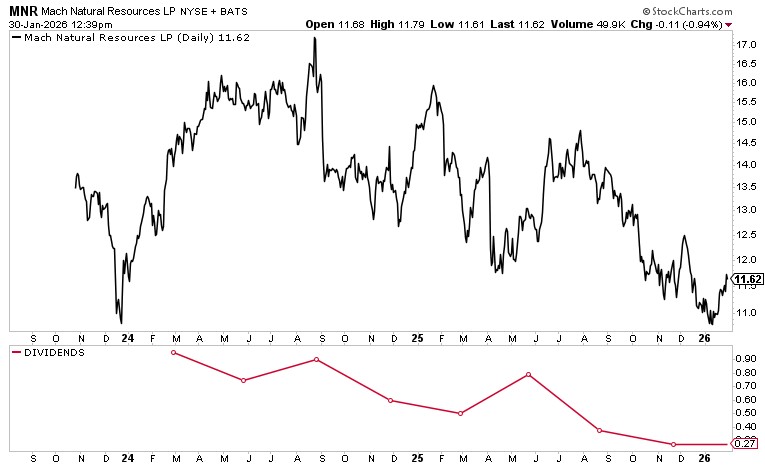

Despite posting solid financial results and announcing additional transformative acquisitions, MNR units’ performance has been underwhelming, trading down 25% on an annual basis. On the plus side, MNR is up five percent year to date.

Currently trading hands at $11.62, MNR units need to climb 58% to hit their all-time record high of $18.40.

Wall Street is confident that MNR will get there, with analysts providing a 12-month share price target range of $20.00 to $22.00. This points to potential upside of approximately 72% to 90%.

Hitting either target would put MNR units in record territory.

Chart courtesy of StockCharts.com

The Lowdown on Mach Natural Resources

Mach Natural Resources is an E&P company with a growing position across Oklahoma, Kansas, and Texas. It recently completed billion-dollar acquisitions that are expected to significantly increase production and cash available for distribution, which should help it maximize distributions to unitholders.

To that end, 70 institutions hold 62.7% of all outstanding MNR shares, with insiders accounting for an impressive 26.6%. Three of the biggest institutional holders include Kayne Anderson Capital Advisors, L.P., American Century Companies Inc, and Morgan Stanley. (Source: “Mach Natural Resources LP (MNR),” Yahoo! Finance, last accessed January 30, 2026.)